Forefront’s Market Notes:

March 18th, 2024

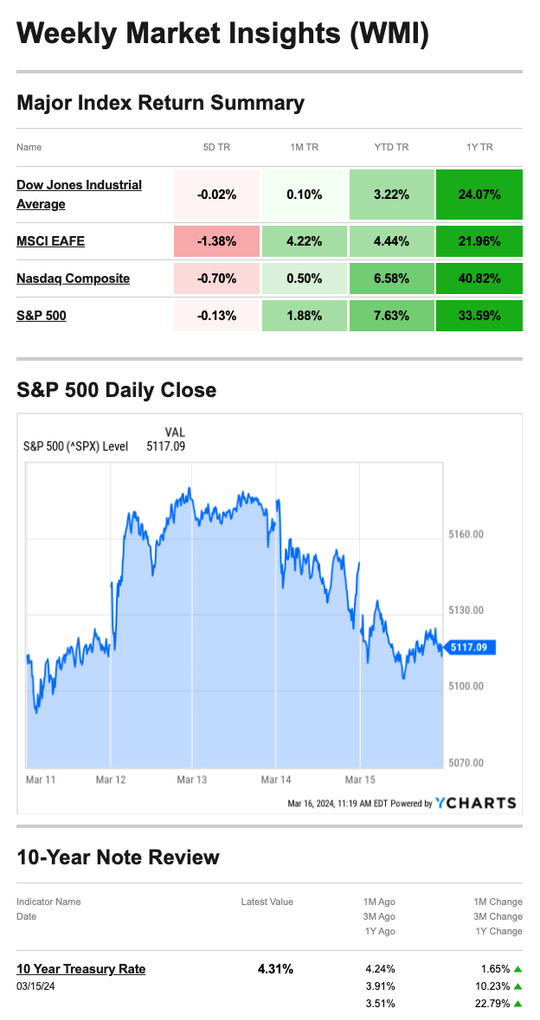

Stocks fell for the second straight week on inflation concerns despite a report on consumer prices that was initially well received by investors.

Stocks Slide

Tuesday was the only bright spot during the week as stock prices rose after the Labor Department report showed the Consumer Price Index rose 3.2% in February compared with a year earlier. It was a bit warmer than economists expected but cooler than investors feared. The news sparked a day-long rally, with the Standard & Poor’s 500 stock index setting its 17th record high of the year.1,2

Following Tuesday, caution lingered as investors parsed the underlying data behind headline consumer inflation numbers. Thursday’s fresh producer price index (PPI) report showed that wholesale prices increased by 0.6% in February, more than the expected 0.3% increase. Additionally, core PPI (excluding food and energy) was hotter than expected.

Retail sales, also reported on Thursday, were disappointing, rising less than expected and adding to the inflation angst. The news rattled investors and contributed to stocks closing lower for three consecutive days to end the week.3,4

Source: YCharts.com, March 16, 2024. Weekly performance is measured from Monday, March 11, to Friday, March 15.

ROC 5 = the rate of change in the index for the previous 5 trading days.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Broadening Leadership

Unlike the prior week when the S&P 500 fell the least, last week it lost slightly more than the Dow but less than the Nasdaq. That performance pattern suggests market leadership may be broadening. Also, the energy, financials, and materials sectors all posted gains last week, showing that other groups may join the tech-led rally.5

4 Facts About Capital Gains

When you sell a capital asset, such as an investment or a piece of property, the sale can result in a capital gain or loss. The IRS defines a capital asset as “most property you own for personal use or own as an investment.” Here are four facts you should keep in mind:

- A capital gain or loss is the difference between what you originally paid for the asset (your basis) and the amount you get when you sell the asset.

- You must include all capital gains in your income, and you may be subject to the Net Investment Income Tax if your income is above certain amounts. Consult a qualified tax expert for help.

- The IRS allows you to deduct capital losses on the sale of investment property. You cannot deduct losses on the sale of property that you hold for personal use.

- If your total net capital loss is more than the limit you can deduct, you can carry it over to next year’s tax return.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Footnotes and Sources

1. The Wall Street Journal, March 15, 2024

2. The Wall Street Journal, March 12, 2024

3. CNBC, March 15, 2024

4. CNBC, March 15, 2024

5. Sector SPDRs, March 15, 2024

6. IRS.gov, October 17, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, MARCH 18 | |

| 10:00 AM | Home builder confidence index |

| TUESDAY, MARCH 19 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| WEDNESDAY, MARCH 20 | |

| 2:00 PM | FOMC interest-rate decision |

| 2:30 PM | Fed Chair Powell press conference |

| THURSDAY, MARCH 21 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:00 AM | U.S. leading economic indicators |

| 10:00 AM | Existing home sales |

| 12:00 PM | Fed Vice Chair for Supervision Michael Barr speaks |

| FRIDAY, MARCH 22 | |

| 9:00 AM | Fed Chair Powell takes part in Fed listens event |

| 12:00 PM | Fed Vice Chair for Supervision Michael Barr speaks |

| 4:00 PM | Atlanta Fed President Raphael Bostic speaks |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.