Forefront’s Market Notes:

April 1st, 2024

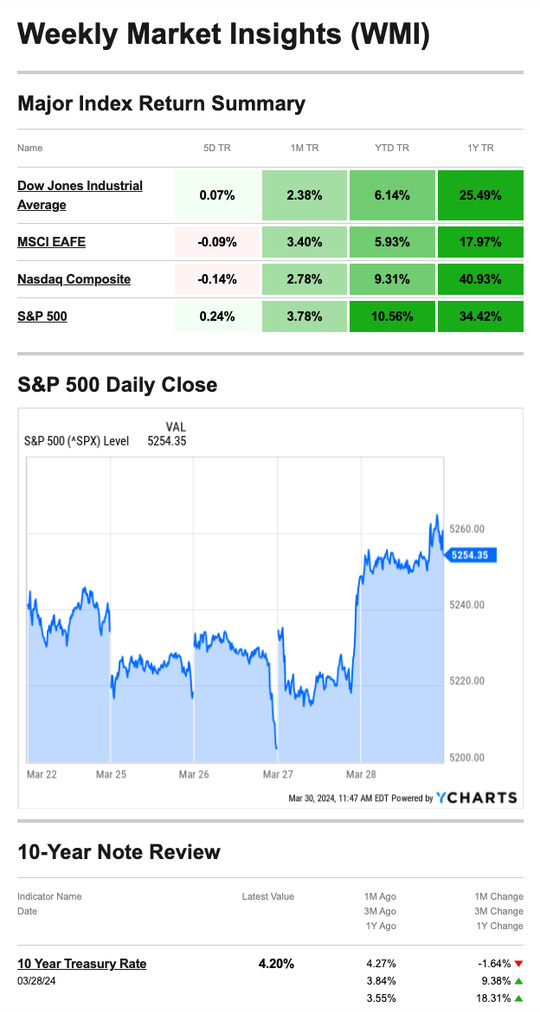

Stocks were narrowly higher for the week as investors digested mixed economic news about consumer confidence. All three of the major averages posted gains for Q1 2024.

Stocks Finish Strong

Markets slipped for the first half of the four-day week as investors took a breather after the prior week’s gain. Conflicting economic news on Monday and Tuesday contributed to the slide. New home sales in February slipped 0.3 percent over the prior month but increased by 5.9 percent from the prior year. Durable goods orders—everything from washing machines to helicopters—rebounded 1.4 percent in February, beating expectations and recouping some of January’s 6.9 percent drop.1,2,3

Stocks rallied on Wednesday, including a fresh record close for the Standard & Poor’s 500. An upward revision to consumer sentiment on Thursday helped the rally along. The markets are closed on Friday when the much-anticipated inflation report called the Personal Consumption and Expenditures (PCE) is released, which could set up a volatile Monday.4

Source: YCharts.com, March 30, 2024. Weekly performance is measured from Friday, March 22, to Thursday, March 28.

ROC 5 = the rate of change in the index for the previous 5 trading days.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Doubters & Believers

Getting a straightforward read on consumers this week was challenging. The Conference Board reported on Tuesday that its Consumer Confidence Index remained essentially unchanged—as it has for the past six months—showing consumers were generally pessimistic about the future.

But on Thursday, the University of Michigan’s consumer-sentiment survey showed consumer confidence hit a 2½-year high in March. It suggested that consumers had gained more confidence that inflation would drop and alleviate some pressure on household finances. Friday’s PCE report may give some additional insights into consumer confidence.5,6,7

IRS Offers Free Tax Prep Option for Military Personnel

Each year, the Internal Revenue Service takes a moment to remind active duty military personnel that the “IRS Free File” offers them multiple choices for free federal tax preparation.

“The IRS takes special steps to help military members and their families with their taxes, and the Free File program is part of that effort,” said IRS Commissioner Chuck Rettig. “Almost 10% of the IRS workforce are veterans. We greatly appreciate the service to the nation of every veteran and their supportive families, and we will do all we can to assist them.”

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov7

Footnotes and Sources

1. The Wall Street Journal, March 28, 2024

2. CNBC.com, March 25, 2024

3. Reuters, March 26, 2024

4. CNBC.com, March 26, 2024

5. MarketWatch.com, March 28, 2024

6. The Conference Board, March 26, 2024

7. IRS.gov, October 23, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, APRIL 1 | |

| 9:45 AM | S&P U.S. manufacturing PMI (final) |

| 10:00 AM | Construction spending |

| 10:00 AM | ISM manufacturing |

| 6:50 PM | Fed Governor Lisa Cook speaks |

| TUESDAY, APRIL 2 | |

| 10:00 AM | Factory orders |

| 10:00 AM | Job openings |

| 10:10 AM | Fed Governor Michelle Bowman speaks |

| 12:05 PM | Cleveland Fed President Loretta Mester speaks |

| 1:30 PM | San Francisco Fed President Mary Daly speaks |

| TBA | U.S. auto sales |

| WEDNESDAY, APRIL 3 | |

| 8:15 AM | ADP employment |

| 9:45 AM | S&P U.S. services PMI (final) |

| 9:45 AM | Fed Governor Michelle Bowman speaks |

| 10:00 AM | ISM services |

| 12:00 PM | New York Fed President John Williams moderates discussion |

| 12:10 PM | Fed Chair Jerome Powell speaks |

| 1:10 PM | Fed Vice Chair for Supervisions Michael Barr speaks |

| 4:30 PM | Fed Governor Adriana Kugler speaks |

| THURSDAY, APRIL 4 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. trade balance |

| 10:00 AM | Philadelphia Fed President Patrick Harker speaks |

| 12:15 PM | Richmond Fed President Tom Barkin speaks |

| 12:45 PM | Chicago Fed President Austan Goolsbee speaks |

| 2:00 PM | Cleveland Fed President Loretta Mester speaks |

| 2:00 PM | Minneapolis Fed President Neel Kashkari speaks |

| 7:30 PM | Fed Governor Adriana Kugler speaks |

| FRIDAY, APRIL 5 | |

| 8:30 AM | U.S. nonfarm payrolls |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

| 9:15 AM | Richmond Fed President Tom Barkin speaks |

| 11:00 AM | Dallas Fed President Lorie Logan speaks |

| 12:15 PM | Fed Governor Michelle Bowman speaks |

| 3:00 PM | Consumer credit |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: March 25th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.