Forefront’s Market Notes:

April 8th, 2024

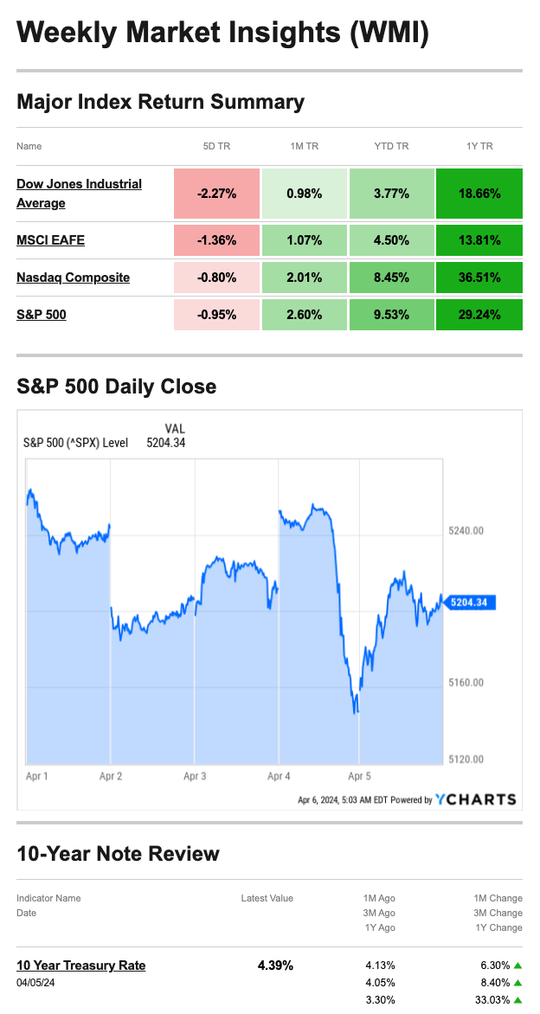

Stocks dropped last week as investors focused on “what’s next” for interest rates after mixed comments from multiple Fed officials.

Fed Officials Weigh In

Stocks struggled out of the gate again last week, ending Monday and Tuesday in the red on concerns that recent economic data could derail the Fed’s plan for short-term rates.

The markets recovered Wednesday through Thursday morning when weekly jobless claims were better than expected. But stocks fell broadly Thursday afternoon following mixed comments from multiple Fed officials. All three averages ended the day down more than 1 percent for the first time in a month.1,2

On Friday, a strong jobs report gave investors much-needed confidence. The U.S. economy created 303,000 jobs in March—higher than economists’ expectations—while unemployment dropped slightly to 3.8 percent. Markets rallied after the news, but not enough to recoup all weekly losses.3

Source: YCharts.com, April 6, 2024. Weekly performance is measured from Monday, April 1, to Friday, April 5.

ROC 5 = the rate of change in the index for the previous 5 trading days.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

What’s the Scoop?

Several Fed officials made speeches last week, including Chair Jerome Powell. In a Wednesday speech at Stanford University, Powell said it was a “bumpy” path to a soft landing, but Fed officials are continuing to look at the long-term trends.4

Last week, Atlanta Fed President Raphael Bostic suggested one cut. San Francisco Fed President Mary Daly noted no guarantees, and Cleveland’s President Loretta Mester said rate cuts may come later this year. Minneapolis President Neel Kashkari rattled markets by suggesting that no cuts may be on the table, followed by Fed Governor Michelle Bowman, who said on Friday that it’s possible rates may have to move higher to control inflation.5,6

The flurry of comments comes following the end of the Fed’s blackout period. Fed officials are not allowed to make public comments except for very narrow windows during the year.

Reporting Cash Payments

Are you expecting a little extra cash from a gift or sale? The IRS would like to know. Individuals, corporations, and partnerships must report cash transactions of more than $10,000.

These cash payments can include jewelry sales, a gift from a family member, an overseas purchase, or any other cash transaction. You also need to report cash payments received in one lump sum, in two or more related payments within 24 hours, or as part of a single transaction or two or more transactions in the last year.

File Form 8300, titled Report of Cash Payments Over $10,000 Received in a Trade or Business. This form requires information about the benefactor and the recipient of the cash, a description of the transaction, and information about any other parties involved.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov7

Footnotes and Sources

1. The Wall Street Journal, April 5, 2024

2. The Wall Street Journal, April 4, 2024

3. The Wall Street Journal, April 5, 2024

4. CNBC.com, April 3, 2024

5. CNBC.com, April 5, 2024

6. CNBC.com, April 5, 2024

7. IRS.gov, May 17, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, APRIL 8 | |

| 1:00 PM | Chicago Fed President Austan Goolsbee radio interview |

| 7:00 PM | Minneapolis Fed President Neel Kashkari speaks |

| TUESDAY, APRIL 9 | |

| 6:00 AM | NFIB optimism index |

| WEDNESDAY, APRIL 10 | |

| 8:30 AM | Consumer price index |

| 8:30 AM | Core CPI |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI year over year |

| 8:45 AM | Fed Gov. Michelle Bowman speaks |

| 10:00 AM | Wholesale inventories |

| 12:45 PM | Chicago Fed President Austan Goolsbee speaks |

| 2:00 PM | Minutes of Fed’s March FOMC meeting |

| 2:00 PM | Monthly U.S. federal budget |

| THURSDAY, APRIL 11 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| 8:45 AM | Fed Gov. Michelle Bowman speaks |

| 12:00 PM | Boston Fed President Susan Collins speaks |

| 12:45 PM | Chicago Fed President Austan Goolsbee speaks |

| 1:30 PM | Atlanta Fed President Raphael Bostic speaks |

| FRIDAY, APRIL 12 | |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 10:00 AM | Consumer sentiment (prelim) |

| 2:30 PM | Atlanta Fed President Raphael Bostic speaks |

| 3:30 PM | San Francisco Fed President Mary Daly speaks |

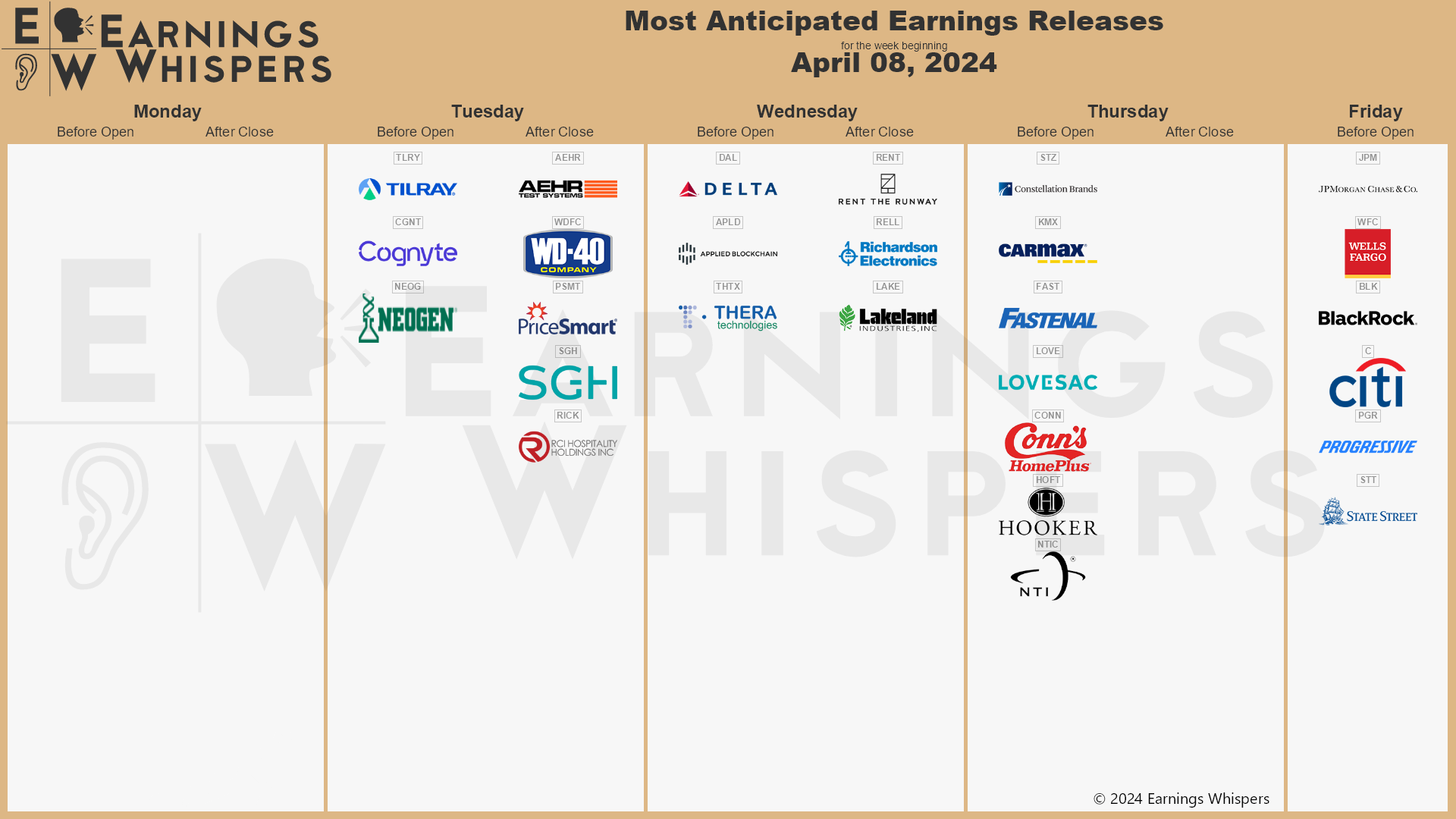

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: April 1st

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.