Forefront’s Market Notes:

April 29th, 2024

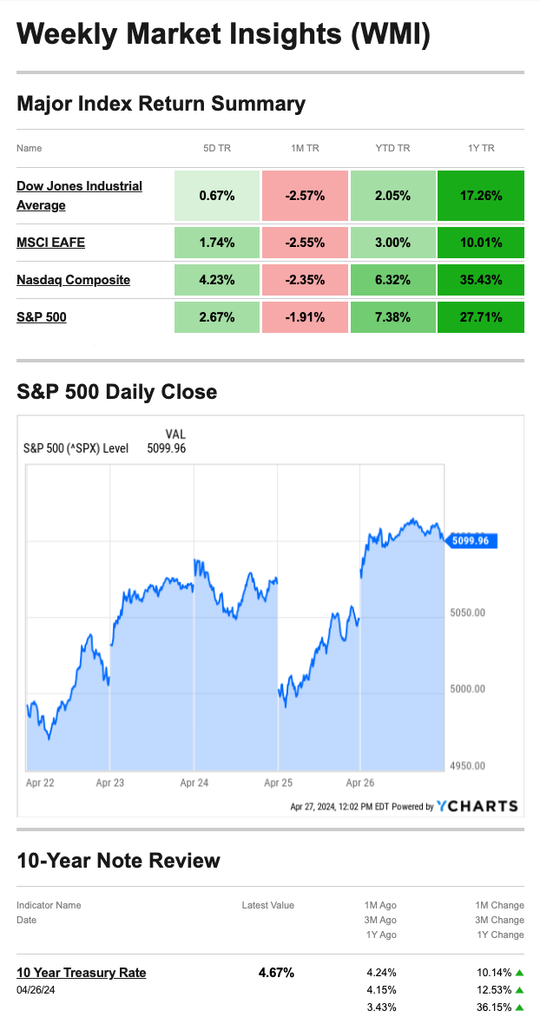

Stocks staged a choppy comeback last week as investors cheered positive earnings, led by mega-cap tech stocks. The rally came to pass despite fresh data showing a slowing economy and increasing inflationary pressures.

Stocks Bounce Back. Twice.

Last week opened with a rebound rally as investors breathed a sigh of relief that Middle East tensions had eased. The market rally extended into Tuesday, with investors cheering positive corporate earnings reports. By Tuesday’s market close, the S&P 500 had gained 2% for the week.1,2,3

But investor enthusiasm didn’t last, as midweek saw profit taking in all three averages. Rising bond yields threw a wet blanket on market momentum; at one point, the yield on the 10-year Treasury note rose more than 40 basis points from its low earlier in the week.4

On Thursday, markets slipped on two fresh pieces of economic data: a Gross Domestic Product (GDP) slowdown and higher consumer prices. But by midday, selling pressure slowed. Stocks pushed higher on Friday behind upbeat Q1 reports from two mega-cap tech stocks, helping the S&P 500 and the Nasdaq post their best week since November.5

Source: YCharts.com, April 27, 2024. Weekly performance is measured from Monday, April 22, to Friday, April 26.

ROC 5 = the rate of change in the index for the previous 5 trading days.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Earnings vs. Inflation

Corporate earnings and economic reports battled it out last week. In the end, earnings won, at least for this week.

The big economic news was that Q1 GDP grew at a 1.6 percent annualized rate—slower than the 2.4 percent economists expected and less than Q4 2023. The GDP report seemed to support the Goldilocks economy theory—not too hot, but not too cool—a story investors have favored this year.

The PCE (personal consumption expenditures) Index, the Fed’s preferred inflation gauge, was embedded within the GDP report. Excluding food and energy, it increased 2.8% from a year ago. It was unchanged from February and slightly higher than expected. It joined a growing list of factors pointing to an uptick in inflation, complicating the Fed’s interest rate decision.5

IRS Program Helps Seniors Prepare Taxes

-

- IRS Free File is at IRS.gov and features some significant names in the tax software provider world.

- To use the tool, taxpayers can browse multiple offers.

- The eligibility standards for Free File depend on the tax partner but are typically based on income, age, and state residency.

- Free File has most of the necessary forms when filing your taxes. Even if you have a unique tax situation, you may still be able to use Free File.

- Some Free File products are available in Spanish.

- You can also search for credits and deductions in Free File.

- Some providers in Free File also offer state return preparation. You can use the lookup tool in Free File to find the tax partner that might be appropriate for your state requirements.

- Taxpayers can access Free File through computers, smartphones, or tablets.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Footnotes and Sources

The Wall Street Journal, April 26, 2024

2. CNBC.com, April 22, 2024

3. CNBC.com, April 23, 2024

4. CNBC.com, April 24, 2024

5. The Wall Street Journal, April 25, 2024

6 IRS.gov, October 23, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, APRIL 29 | |

| None scheduled | |

| TUESDAY, APRIL 30 | |

| 8:30 AM | Employment cost index |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 9:45 AM | Chicago Business Barometer (PMI) |

| 10:00 AM | Consumer confidence |

| WEDNESDAY, MAY 1 | |

| 8:15 AM | ADP employment |

| 10:00 AM | Construction spending |

| 10:00 AM | ISM manufacturing |

| 10:00 AM | Job openings |

| 2:00 PM | FOMC interest-rate decision |

| 2:30 PM | Fed Chair Powell press conference |

| 5:30 PM | Auto sales |

| THURSDAY, MAY 2 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. trade deficit |

| 8:30 AM | U.S. productivity |

| 8:30 AM | U.S. unit-labor costs |

| 10:00 AM | Factory orders |

| FRIDAY, MAY 3 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

| 10:00 AM | ISM services |

| 7:45 PM | Chicago Fed President Austan Goolsbee speech |

| 8:15 PM | New York Fed President John Williams speech |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes April 22nd

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.