Forefront’s Market Notes:

May 6th, 2024

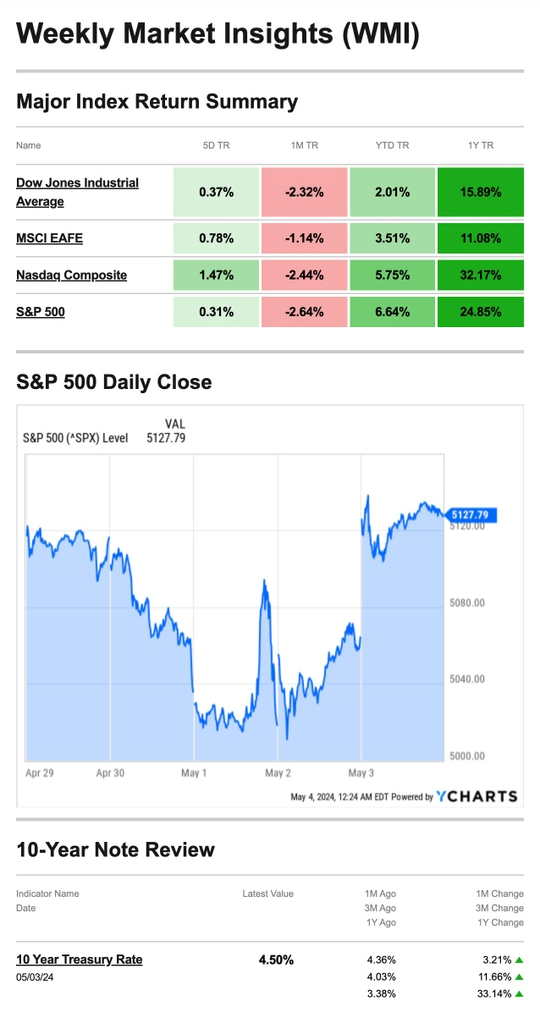

Stocks notched a solid gain last week, rallying behind upbeat earnings, a dovish Fed, and mixed economic data.

Stocks Pop, Drop, Then Rally

Markets began the week with an upward bump as positive news from some mega-cap tech companies outweighed disappointing updates from other tech names.

The tone quickly changed on Tuesday as higher-than-expected Q1 wage growth triggered inflation and interest-rate anxiety—just as the Federal Open Market Committee kicked off its third meeting of the year. Each of the three major averages dropped more than 1.5 percent on the last trading day of April.1

When the Fed announced it was holding rates steady on Wednesday, stocks initially rallied on the news, but sellers got the upper hand late in the trading session, and prices ended the day slightly down.2

On Thursday, stocks trended higher as more companies reported upbeat Q1 results. Then, on Friday, stocks pushed higher after the April jobs report indicated that unemployment ticked up and the economy slowed. The 175,000 jobs created in April represented slower growth than the over 300,000 added in March and less than the 240,000 economists expected. Some Fed watchers believe that the news bolstered chances that the Fed may adjust rates sooner rather than later.3

Source: YCharts.com, May 4, 2024. Weekly performance is measured from Monday, April 29, to Friday, May 3.

ROC 5 = the rate of change in the index for the previous 5 trading days.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Uncertain Hurtin’

Markets hate uncertainty, so Fed Chair Jerome Powell attempted to clarify the Fed’s stance on the outlook for interest rates at the close of its two-day meeting. Determining what’s next for interest rates in the context of stubborn inflation is no simple task. But Powell was as straightforward as possible at the press conference. “I think it’s unlikely that the next policy rate move will be a hike,” he said. “I’d say it’s unlikely.”4,5

Do You Need to Report Cash Payments?

If you receive a cash payment of over $10,000, you may be required to report it to the IRS. In this case, a cash payment includes U.S. or foreign currency and can also include cashier’s checks, bank drafts, traveler’s checks, or money orders.

In addition, cash payments to individuals can also include payments from companies, corporations, partnerships, or associations. For example, these could consist of payments from the following parties:

- Dealers of jewelry, furniture, boats, aircraft, automobiles, art, rugs, and antiques

- Pawnbrokers

- Attorneys

- Real estate brokers

- Insurance companies

- Travel agencies

This requirement refers to cash payments received as one lump sum, in two or more payments within 24 hours, as a single transaction within 12 months, or as part of two or more transactions within 12 months.

So, how do you report cash payments? Taxpayers should complete Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. You can file this form electronically or mail a copy to the IRS. You must submit Form 8300 within 15 days after receiving the cash payment.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Footnotes and Sources

1. The Wall Street Journal, May 3, 2024

2. CNBC.com, May 1, 2024

3. The Wall Street Journal, May 3, 2024

4. The Wall Street Journal, May 3, 2024

5. CNBC.com, May 1, 2024

6 IRS.gov, July 26, 2023

8. Healthline, January 24, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, May 6 | |

| 12:50 PM | Richmond Fed President Tom Barkin speaks |

| 1:00 PM | New York Fed President Williams speaks |

| TUESDAY, MAY 7 | |

| 11:30 AM | Minneapolis Fed President Kashkari speaks |

| 3:00 PM | Consumer credit |

| WEDNESDAY, MAY 8 | |

| 10:00 AM | Wholesale inventories |

| 11:00 AM | Fed Vice Chair Philip Jefferson speaks |

| 11:45 AM | Boston Fed President Susan Collins speaks |

| 1:30 PM | Fed Gov. Cook speaks |

| THURSDAY, MAY 9 | |

| 8:30 AM | Initial jobless claims |

| 2:00 PM | San Francisco Fed President Mary Daly speaks |

| FRIDAY, MAY 10 | |

| 9:00 AM | Fed Governor Michelle Bowman speaks |

| 10:00 AM | Consumer sentiment (prelim) |

| 12:45 PM | Chicago Fed President Austan Goolsbee speaks |

| 1:30 PM | Fed Vice Chair for Supervision Michael Barr speaks |

| 2:00 PM | Monthly U.S. federal budget |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes April 29th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.