Forefront’s Market Notes:

April 22nd, 2024

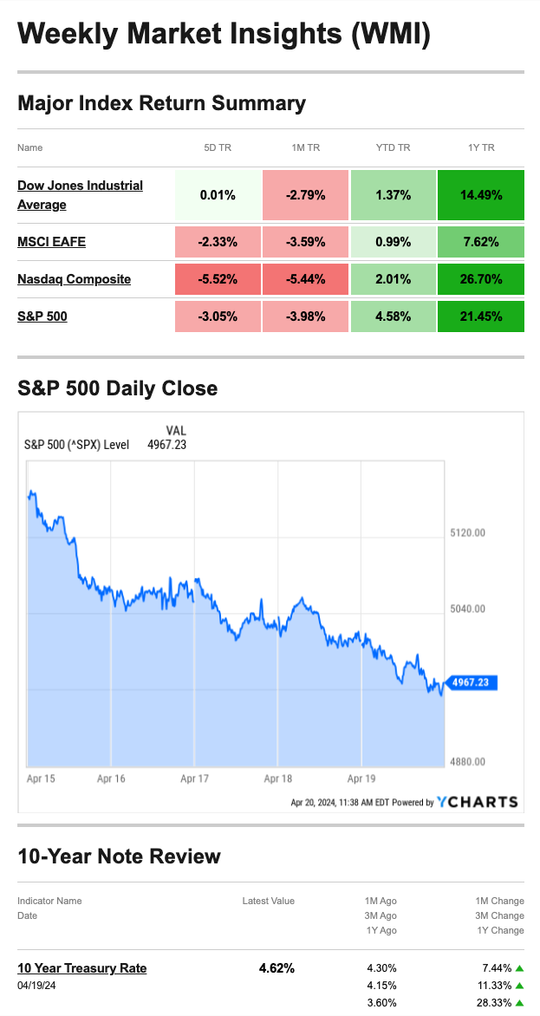

Stocks fell for a third straight week, as Fed Chair Jerome Powell’s mixed but upbeat message could not offset the anxiety caused by the Middle East conflict.

Stocks Retreat

Markets began the week rattled by further escalation in the Middle East over the weekend. A bit of good news punctuated an otherwise sour Monday, as a stronger-than-expected retail sales report showed consumers were spending despite rising inflation.1,2

On Tuesday, remarks from Fed Chair Jerome Powell indicated a shift in thinking—from being confident to not-so-confident about interest rate cuts in 2024. He said rates might need to stay higher until the Fed meets their 2% inflation target.3,4

On Friday, the markets saw further declines, but investors were somewhat reassured by the perception that Thursday’s retaliatory actions in the Middle East were restricted in scope.5

Source: YCharts.com, April 20, 2024. Weekly performance is measured from Monday, April 15, to Friday, April 19.

ROC 5 = the rate of change in the index for the previous 5 trading days.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Silver Linings

When stocks are in a downtrend, it’s important to keep perspective and realize that markets move in cycles. Here are a couple of bright spots from last week and perhaps some good news that may influence trading in the week ahead:

-

- While Chair Powell said last week that the Fed may keep rates higher for longer, he also said the Fed does not intend to raise rates for now.

- Despite inflation concerns, individuals were in a spending mood in March. Retail sales increased 0.7% for the month, more than twice the consensus forecast.

- “Earning season” picks up during the next four weeks. For the week ending April 26, more than 800 companies will give updates on business conditions in Q1.6

Can you Claim the Child Tax Credit for Other Dependents?

Even if you cannot claim the child tax credit, you may be able to claim the credit for other dependents under your care. The IRS issues a maximum of $500 for each dependent who meets specific conditions.

These conditions include the following:

-

- Dependents who are age 17 or older.

- Dependents who have individual taxpayer identification numbers.

- Dependent parents or other qualifying relatives supported by the taxpayer.

- Dependents living with the taxpayer who are not related to the taxpayer.

The credit begins to phase out when the taxpayer’s income exceeds $200,000. This phaseout begins for married couples filing a joint tax return at $400,000.

Taxpayers may be able to claim this credit if the following are applicable:

-

- They claim the person as a dependent on the taxpayer’s return.

- They cannot use the dependent to claim the child tax credit or additional child tax credit.

- The dependent is a U.S. citizen, national, or resident alien.

This dependent credit may also combine with the child and dependent care credit and the earned income credit.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov7

Footnotes and Sources

1. The Wall Street Journal, April 19, 2024

2. CNBC.com, April 15, 2024

3. The Wall Street Journal, April 16, 2024

4. CNBC.com, April 16, 2024

5. CNBC.com, April 19, 2024

6. MarketWatch, April 19, 2024

7. IRS.gov, October 23, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, APRIL 15 | |

| 2:30 AM | Dallas Fed President Lorie Logan speaks in Tokyo |

| 8:30 AM | Empire State manufacturing survey |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 8:30 AM | New York Fed President John Williams TV appearance |

| 10:00 AM | Business inventories |

| 10:00 AM | Home builder confidence index |

| 8:00 PM | San Francisco Fed President Mary Daly speaks |

| TUESDAY, APRIL 16 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 9:00 AM | Fed Vice Chair Philip Jefferson speaks |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 1:15 PM | Fed Chair Jerome Powell speaks |

| WEDNESDAY, APRIL 17 | |

| 2:00 PM | Fed Beige Book |

| 5:30 PM | Cleveland Fed President Loretta Mester speaks |

| 7:15 PM | Fed Governor Michelle Bowman speaks |

| THURSDAY, APRIL 18 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 9:05 AM | Fed Governor Michelle Bowman speaks |

| 9:15 AM | New York Fed President John Williams speaks |

| 10:00 AM | Existing home sales |

| 10:00 AM | U.S. leading economic indicators |

| 11:00 AM | Atlanta Fed President Raphael Bostic speaks |

| 5:45 PM | Atlanta Fed President Raphael Bostic speaks |

| FRIDAY, APRIL 19 | |

| 10:30 AM | Chicago Fed President Austan Goolsbee speaks |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes April 15th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.