by Dr. JoAnne Feeney

Portfolio Manager

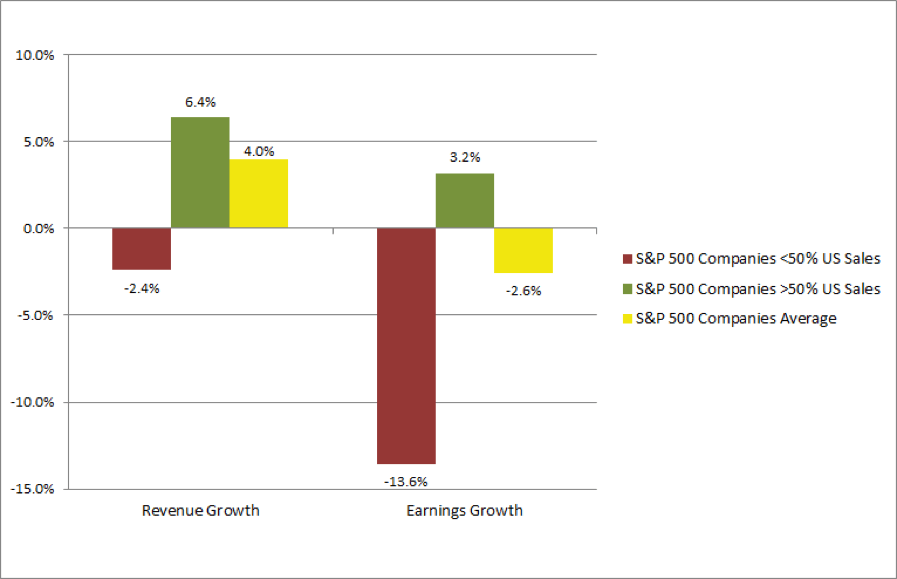

Nearly half of the S&P 500 companies have now reported results for last quarter and the vast majority of them are beating expectations. This is not as good as it sounds. Expectations were low to begin with and those “beats” continue to point to another quarter of lower earnings, relative to last year’s second quarter. Moreover, research by FactSet showed that while average earnings are tracking to a small 2.6% decline for all companies in the S&P 500 last quarter, more global companies are seeing a much steeper drop off in earnings, even as more domestically oriented companies are seeing healthy year-over-year earnings growth. Does this disparity mean that investors should shift holdings away from companies with a majority of sales outside the U.S.? Not necessarily.

2Q Results: Companies with More Global Exposure Suffering

Source: FactSet.

The slowdown in Europe and the trade war are mostly to blame for the relatively poor performance of more global companies (those with at least 50% of sales outside the U.S.). Europe is only growing modestly, in large part because of the slowdown in China—and especially the drop in auto sales. That drop in demand and the ongoing uncertainty surrounding the rules of global trade have reduced capital investment activity in Germany, for example. Business leaders become cautious when the future becomes harder to see. Germany’s purchasing manager’s index for manufacturing has been signaling contraction since January and the latest reading came in at 43.1, well below the 50 mark used to separate expansion from contraction. While this is merely a survey, as opposed to an actual measure of production or capital spending, it does confirm that managers believe economic activity is slowing. And if they think so, why would they hire or build more capacity? U.S. companies that sell in Europe are likely suffering the consequences.

The U.S.-China trade war is clearly another headwind for U.S. companies. The most recent report shows that U.S. exports to China were down over 12% year-over-year in May and have been in negative territory every month since last August. U.S. imports from China—think about inputs to U.S. manufacturing in addition to consumer goods—dropped nearly 12% in January versus 2018 and have been negative in each month since, including May’s decline of nearly 10%. Not only is the trade war hurting sales to China from multinational companies here in the U.S., but also the U.S. tariffs are raising the costs of imported equipment for U.S. manufacturers and making final goods more expensive for U.S. consumers (so they buy fewer of them). Companies with more than 50% of sales abroad are bearing the brunt of the trade war, as the recent earnings and revenue results show. No one knows how long the trade war will last, but the latest comments from the administration suggest a deal may not be reached before the 2020 election.

The relative strength of companies with less than 50% of sales outside the U.S. reflects the ongoing U.S. economic expansion—particularly strength in the U.S. consumer. Consumer spending continues to grow and was most recently reported up 4.2% in May versus last year. And while the housing market is mixed, new home sales are arguably the more important signal since new construction adds considerably to domestic company sales. While existing home sales declined 2.2% year-over-year in June, new home sales climbed 7%. Mortgage rates remain low, household income is rising, and the leading edge of millennials is entering the housing market, so we expect new home sales to continue to grow, especially for entry-level homes. Existing home sales are likely to face ongoing challenges, however, as homeowners remain reluctant to cut prices enough to absorb the new reality of limited interest and local real estate tax deductions. In addition, ongoing technology and demographic trends offer tailwinds to companies in several different sectors, including Health Care, where 100% of companies beat earnings estimates.

The U.S. economy is likely to continue to provide a solid growth environment for U.S.-centric companies, but that does not imply that portfolios should be shifted entirely in that direction, despite recent results. Companies which rely more heavily on international sales are exposed to some of the strongest secular drivers of this era. These include U.S. technology companies, pharmaceuticals, medical device companies, defense companies, and many others. By avoiding companies with a majority of sales outside the U.S., investors will miss out on owning companies with some of the strongest growth prospects available.

The difficulty for investors lies in positioning for the upside which would follow the alleviation of trade tensions while at the same time protecting against headwinds from possible trade-derived weakness in earnings. We added more U.S.-centric companies to the Balanced Strategy, for example, at the beginning of the Trump Administration, but we have also maintained exposure to more global companies where secular drivers are likely to overwhelm the trade war costs—even if that takes time to play out. No one really knows when a trade deal will arrive, irrespective of ongoing public announcements. Trying to time politics is akin to trying to time the market – it’s usually fruitless and often counterproductive.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth