by David Lieberman

Managing Partner, Portfolio Manager

I am a fantasy baseball geek. And, as a fantasy baseball geek, I get together with 10 friends from all over the country each year for a 7-hour fantasy baseball draft. The methods that we use to evaluate the skills of a player have changed a lot and have advanced far beyond ERA and batting average. These advanced metrics are often referred to as Sabermetrics. New tools have been introduced, including Statcast, which help to more precisely measure player movements and abilities. The data that originates from all of these tools and advanced metrics is extensive and from this information, we can more accurately predict whether a hitter who hit 30 home runs really got unlucky and should have hit 38, or perhaps was lucky and really should have hit 22. Often, economic data is the same way and we need to look more deeply at the data to make a better judgment about what is really happening.

Last Friday, the U.S. employment report came out and, between the results from September and the upward revisions from the two prior months, total employment rose by 181,000. The unemployment rate also fell to 3.5%, the lowest level in 50 years!

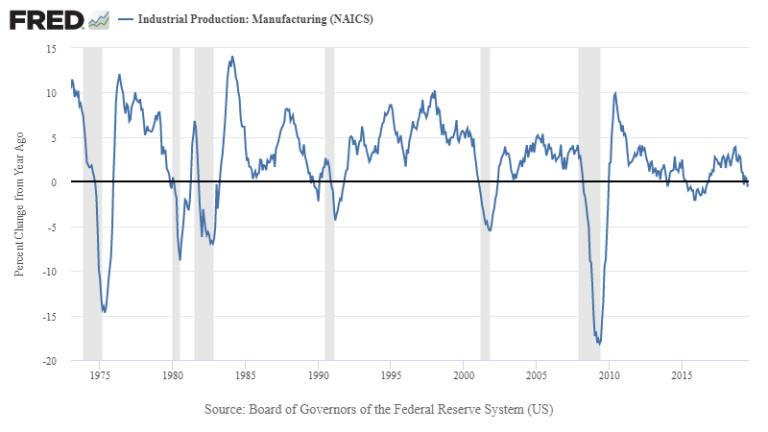

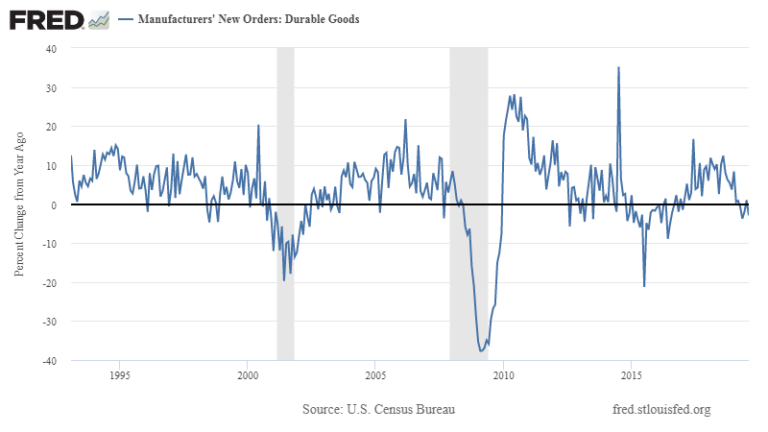

In contrast, durable goods, Industrial Production, and the ISM Manufacturing survey paint a much bleaker picture of the economy. No doubt, the dispute with China is a major contributing factor to the broader weakness in manufacturing. But GM’s auto strike and Boeing’s reduced deliveries may also be having a negative impact, although there was nothing in the language of these economic reports that suggested as much. With no imminent resolution with China and additional tariffs on the docket, there’s unlikely to be a near term reprieve so the weakness is likely to persist and may even weaken further. Historically, weakness in both Industrial Production and durable goods can precede and accompany a recession and some are suggesting that this will be the case today.

Indeed, if you look at the Industrial Production chart you can see that recessions, shown as shaded in gray, often coincide with weak Industrial Production. But manufacturing is only about 10% of U.S. GDP today and is half the weight it was in 1980. So it is far more difficult for weakness that is focused largely in manufacturing to have a profound impact on the overall economy and manufacturing alone isn’t likely to drive the U.S. into a recession. The service sector, on the other hand, remains reasonably strong even though its pace of expansion slowed slightly in the September report.

Looking at individual pieces of economic data can be misleading when trying to paint the full picture of a complex economy, just as looking at a few individual baseball statistics never paints a complete picture of the overall value or skill of a player. For now, and the foreseeable immediate future, there remains underlying strength with an elevated level of mixed and conflicting data, which suggests that the stock market will continue to slowly grind higher but with bumps along the way.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth