by Jeff Deiss

CFP, AEP, Wealth Advisor

There have been several “head fakes” over the past few years where the consensus indicated an economic recession was imminent and yet here we are.

We waste precious time and energy worrying about seemingly serious issues (quantitative easing (“QE”) after the financial crisis was going to be massively inflationary, the Affordable Care Act was going to cripple job creation for companies with 50 or more employees, far-left elections in Greece were going to cause the Eurozone to break up, etc., etc., etc.), but how many of us have ever looked back to see if the things we worried about ever occurred?

Mark Twain once quipped, “I have been through terrible things in my life, some of which actually happened”. The same can be said of investors who seem to worry about everything and anything even though most of these terrible things were, in hindsight, either imagined or manageable.

Just this year, we’ve encountered several walls of worry: we started the year worried about the Fed tightening rates, then there were the tariffs on Mexican goods, then spread between the 10-year treasury rate and the 1-month treasury rate inverted and they all have come and gone.

I even read this week that a well known economic forecaster with a good track record of calling these things said that the U.S. is already in a recession. It’s hard to figure when I look around our office, as I’m driving around town and certainly when I look at recent economic data.

Even if he’s right and I’m wrong, then my advice is to do nothing and not to worry. If you already have an appropriate financial plan in place, then you have already planned for a possible recession. There’s nothing more that you need to do. Like the “normal” stock market volatility we’ve been writing about this past summer, recessions are a normal part of the business cycle and they also come and go. Over the course of a normal retirement today, you’re like to experience several recessions and bear markets, as well as lots of stock market volatility. The good times outweigh the bad by a lot over time so just stick with your plan.

If you don’t have such a plan, then you should definitely construct one right away and start following it. I’m not recommending to get a plan in place is because I think a recession is about to happen (though of course, one could begin at any time). Instead, the reason to start following a good financial plan is precisely that it enables you not to worry about a recession.

I know it seems counterintuitive to recommend doing nothing in the face of a possible recession. But a recession doesn’t automatically lead to losses in your portfolio.

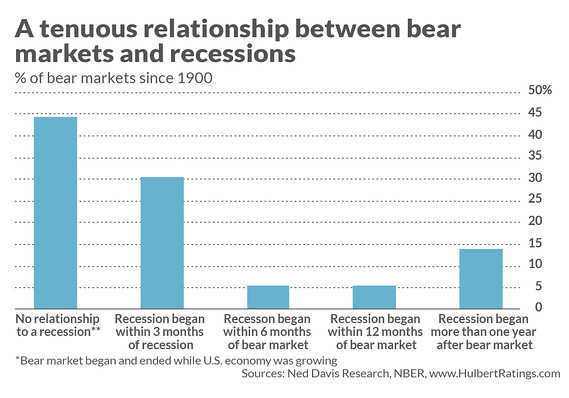

Recessions do not always coincide with stock bear markets and vice versa. Of the 36 bear markets since 1900 in the calendar maintained by Ned Davis Research, no fewer than 16 were not associated with a recession in the calendar maintained by the National Bureau of Economic Research (NBER). Throughout those bear markets, from beginning to end, the U.S. economy was growing. Of those bear markets that were correlated with a recession, some began the same month as the recession while, in some other cases, as much as 16 months in advance.

Slowing economic growth, which we appear to be experiencing, is not necessarily bad. In fact, it worked pretty well up until tax cuts were passed a year or so ago, which increased GDP and corporate earnings temporarily. The subsequent reversion to slower growth has resulted in less certainty, more volatility, and investor consternation.

On the other hand, faster economic growth does not necessarily correlate to better stock market returns. In fact, there is evidence that suggests just the opposite. Jay Ritter, a finance professor at the University of Florida did a study entitled “Is Economic Growth Good for Investors?” where he found that there has been a negative correlation between inflation-adjusted per-capita GDP growth and countries’ stock market returns: “Investors would have been better off investing in countries with lower per capita GDP growth than in countries experiencing the highest growth rates.”

In the U.S., the S&P 500 historically has done the best in those quarters in which earnings per share (EPS) on a year-over-year basis were between 10% and 25% lower. In such quarters, according to Ned Davis Research, the S&P 500 has produced an annualized average return of 25.0%. When year-over-year EPS growth was above 20%, in contrast, the S&P 500 gained an average of just 2.6% annualized.

With all of this said, recessions are certainly not preferable to economic growth. The point is that the relationship between recessions and bear markets is so tenuous that it does you no good to worry about when the next recession begins.

If you’re now a believer and I’ve cured you of your recession worry, but you’re nevertheless the worrying sort and need something else to worry about, then what should you worry about? I would argue that the valuation of the market remains relevant. You’d certainly want to be cautious of buying into an expensive stock market and it’s understandable to be worried about this with stock market indexes near all-time highs. But the absolute level of the index should not be a cause worry by itself. Indexes over time always hit new highs, correct, and go on to hit new highs again. And, as we pointed out last week and earlier this month, the price/earnings ratio (P/E) of the S&P 500 Index was trading near to the average of the past 50 years. Excluding a handful of more expensive stocks, then most of the market is arguably cheap and ACM’s portfolios are all trading at P/E’s below the market.

There are certain things we can control, like how long we work, how much we spend, and how we allocate our assets. What we can’t control is the market or the economic cycle and so it’s somewhat fruitless to waste time and energy worrying about it. My trick to reduce worrying is to study market history (long term trends vs short term blips) and remind myself of all of the terrible things that never did happen. I suggest focusing on your plan when volatility occurs, as best as you can with an unending 24/7 news cycle, knowing that the more you overreact to seemingly immediate dangers, the less likely you are to meet your long term goals.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth