This Is What Happens When You Bet on Yourself

Seven years ago, I walked out the doors of the financial advisory firm I had once called home for over 12 years. I left behind a steady paycheck, a comfortable book of business, and a lot of people who thought I was out of my mind.

“It will take you five years just to get back to where you are now,” they said.

Well…it’s year seven. And not only am I back, but I’ve doubled my previous level. And the scary part? This is just the beginning.

Since launching Forefront Wealth Planning in June 2018, we’ve ridden every rollercoaster the markets could throw at us:

- December 2018: That fun little -20% nosedive to close out the year

- March 2020: Ah, yes, the “what even is the stock market anymore?” phase

- 2022: Bonds and stocks decided to go on a double date… straight down

- And let’s not forget the “will-they-won’t-they” inflation and rate hike drama of 2023–2024

Through it all, we kept our heads down, continued planning, and guided clients through the noise. No flashy predictions. No panic pivots. Just real financial planning. The kind that works because it’s grounded in logic, not vibes.

Today, Forefront is more than just a financial planning firm. It’s also Forefront Advisory, our full-service CPA practice that helps individuals and small businesses stay ahead of the IRS curve, not just catch up during tax season. We’ve grown, expanded, added services, built a team, and somehow managed to keep the coffee machine working through tax season. Miracles happen.

But none of this happens without my people.

To my wife, Christina, thank you for riding shotgun through the chaos. For putting up with my 11 PM “what if we just launched a tax firm too?” brainstorms and my 6 AM pep talks to myself. You’ve supported me in ways I’ll never be able to articulate fully.

To AJ and Priya, you two didn’t ask for any of this. You sacrificed a lifestyle you didn’t even realize we had built, while I was figuring it out.

You rolled with it. You didn’t complain. And now, you get to see what it looks like to bet on yourself and win. That lesson alone is worth every early morning and late night.

To the clients who came with me when I left my old firm, thank you. You didn’t just follow me; you believed in what I was building before there was much to show for it. No fancy office. Just me, a vision, and a whole lot of whiteboards. Your trust laid the foundation for Forefront, and your continued support has turned that foundation into something tangible. I will never forget who was there when it was just me and a laptop, and maybe a dog or two under the desk.

Starting a business is equal parts dream, delusion, and desperation. But I had a vision, one that didn’t fit inside the box of how “advisors are supposed to do things.” Toward the end of my tenure at my old firm, it became clear that the vision wouldn’t be supported. So, I left.

And now? That vision is reality. Clients who feel heard. Planning that actually gets done. Taxes that don’t sneak up on you like a bad horror movie. A firm that reflects who I am, not just what the industry expects me to be.

So, here’s to 7 years of independence, growth, mistakes, learning, and the occasional “what the hell did I sign up for?” moment.

To those who doubted, thank you. You were excellent fuel.

To those who supported, thank you. You kept the fire going.

And to the future, I hope you’re ready because we’re just getting started.

If you’re someone who’s been watching from the sidelines, whether you’re a business owner, a young professional, or simply tired of feeling financially behind, let this be your sign. The right financial plan doesn’t start with a product or a pitch. It starts with a conversation.

Let’s talk.

Stock market calendar this week:

| Time (ET) | Report |

| SUNDAY, June 1 | |

| 10:00 AM | San Francisco Fed President Mary Daly TV appearance |

| 8:00 PM | Fed Governor Christopher Waller speech |

| MONDAY, June 2 | |

| 9:45 AM | S&P final U.S. manufacturing PMI |

| 10:00 AM | ISM manufacturing |

| 10:00 AM | Construction spending |

| 10:15 AM | Dallas Fed President Lorie Logan speech |

| 12:45 PM | Chicago Fed President Austan Goolsbee speech |

| 1:00 PM | Federal Reserve Chair Jerome Powell opening remarks |

| TBA | Auto sales |

| TUESDAY, June 3 | |

| 10:00 AM | Factory orders |

| 10:00 AM | Job openings |

| 12:45 PM | Chicago Fed President Austan Goolsbee speech |

| 1:00 PM | Federal Reserve Governor Lisa Cook speech |

| 3:30 PM | Dallas Fed President Lorie Logan opening remarks |

| WEDNESDAY, June 4 | |

| 8:15 AM | ADP employment |

| 10:15 AM | Atlanta Fed President Raphael Bostic and Federal Reserve Governor Lisa Cook at Fed listens event |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| 2:00 PM | Fed Beige Book |

| THURSDAY, June 5 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. trade deficit |

| 8:30 AM | U.S. productivity |

| 12:00 PM | Federal Reserve Governor Adriana Kugler speech |

| 1:30 PM | Philadelphia Fed President Patrick Harker speech |

| FRIDAY, June 6 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

| 3:00 PM | Consumer credit |

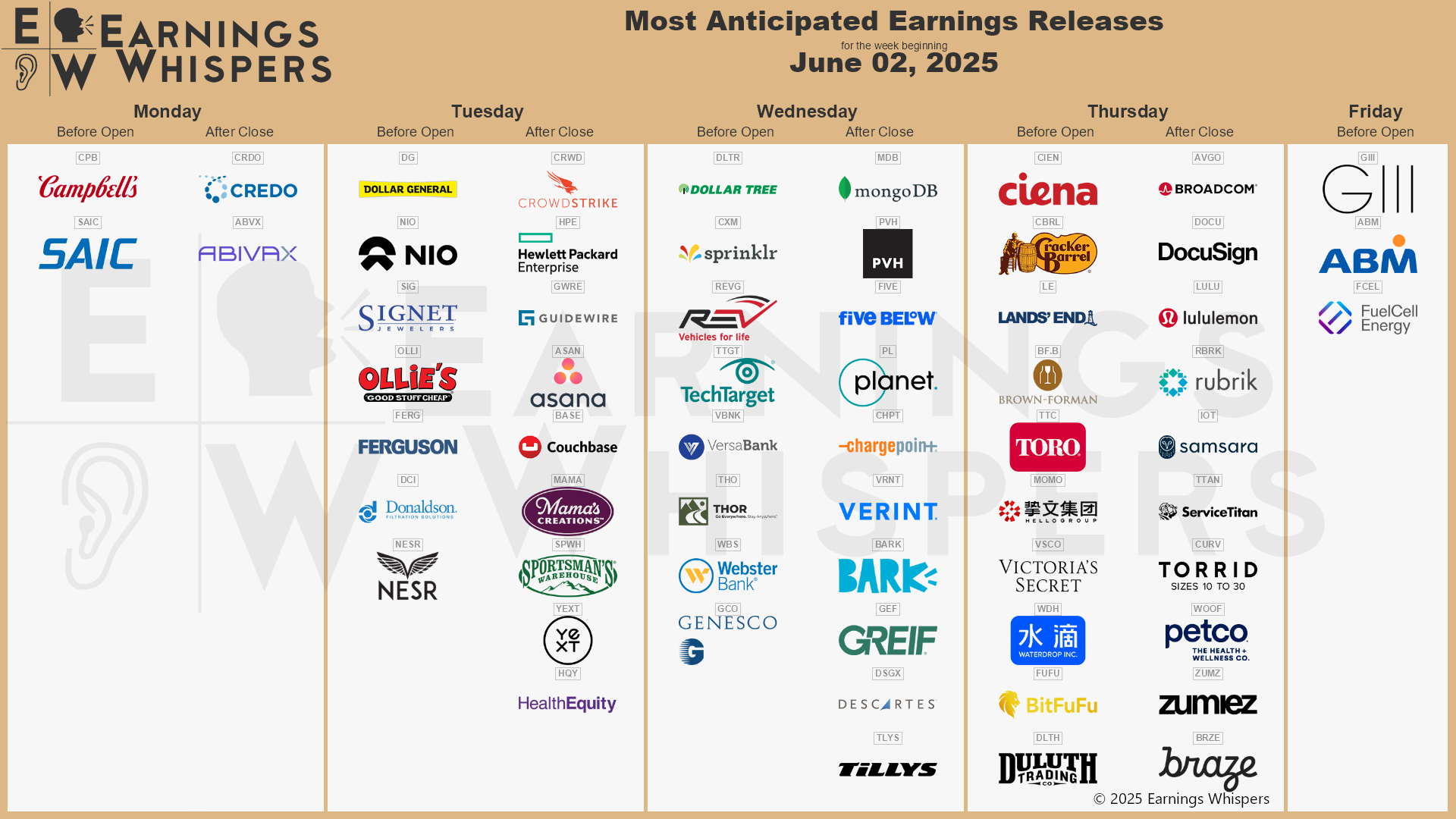

Most anticipated earnings for this week

Did you miss our last blog?

The Dream, The Fear, and The Honda Accord

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.