The Market Will Fall.

It’s Still Not Taking You Back to 1995

Fear never changes

The market is going to fall again. That isn’t a prediction. It’s a fact. Markets rise, markets fall, and every time they fall, it feels like this one is different. This one feels bigger. Scarier. More permanent.

Every downturn convinces people that decades of progress are about to vanish overnight. That portfolios are about to rewind to a distant past. That retirement is suddenly pushed back ten years. That everything they worked for is now fragile.

That emotional reaction is normal. It’s also wrong.

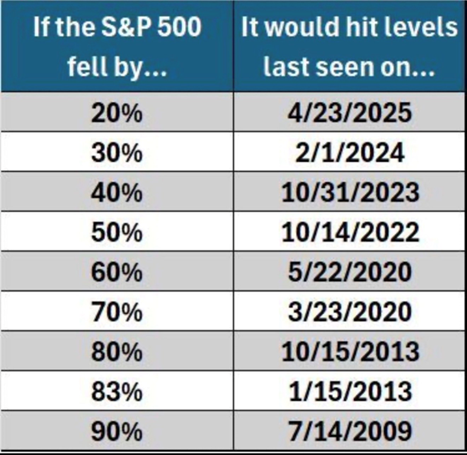

And the image above is a good reminder of why.

A market drop is not a time machine

When people hear “20 percent market decline,” they don’t picture math. They picture catastrophe. They picture the world breaking. They picture their account balance evaporating back to some ancient era.

But look at the actual numbers.

A 20 percent drop in the S&P 500 only takes you back to April 2025. A 30 percent drop takes you back to early 2024. Even a 40 percent drop lands you in late 2023. That’s not history. That’s recent memory.

The reason this feels unintuitive is that markets compound upward over time. When prices fall, they usually fall from a much higher starting point. Most corrections aren’t erasing decades of growth. They’re giving back the most recent stretch of gains.

Your brain doesn’t experience it that way, though. Losses feel heavier than gains. A good year feels nice. A bad year feels personal. That emotional imbalance is built into us. It’s why downturns feel like existential threats even when the numbers don’t justify that reaction.

The real risk isn’t the drop

The market falling is not the main threat to your long-term plan. The danger is how people respond when it happens.

When prices fall, people sell because they want the pain to stop. They move to cash because it feels safe. They promise themselves they’ll get back in once things “settle down.” They wait for clarity.

The problem is that clarity always shows up late. Markets don’t recover when headlines turn optimistic. Headlines turn optimistic after markets recover. If you wait until things feel safe again, you usually miss the most important part of the rebound.

That’s how temporary declines turn into permanent damage. Not because the market went down, but because the investor couldn’t tolerate uncertainty.

Every crash feels unique while you’re living through it

Every downturn brings a perfectly tailored narrative explaining why this one won’t resolve like the others. This time, the Fed is powerless. This time, inflation is different. This time, the politics are worse. This time, the debt is too high. This time, it’s a war, a virus, a banking crisis, or some new technology no one fully understands.

The story is always convincing in real time. It has to be. If it didn’t feel convincing, people wouldn’t panic.

Then, slowly, things stabilize. Businesses keep operating. Profits recover. Markets move higher. And the panic fades into memory. The same pattern repeats, with new characters and a new storyline.

What it would actually take to go “back in time”

To reach 2009 levels, the market would need a collapse of about 90 percent. That’s not a normal bear market. That’s a financial system reset. Could it happen? In theory, yes. But building your plan around that scenario isn’t prudent. It’s catastrophic thinking.

Most real-world declines don’t rewind decades. They rewind months or a few years. And historically, those periods have been followed by recoveries that reward people who stayed invested while everyone else was trying to protect themselves from discomfort.

Staying the course is a behavior, not a slogan

Staying the course doesn’t mean ignoring risk or pretending volatility doesn’t exist. It means making decisions when you’re calm and sticking to them when you’re not. It means keeping enough cash on hand so you’re not forced to sell investments at the worst possible time. It means continuing to invest when prices are lower, even when that feels counterintuitive. It means rebalancing rather than reacting.

Most of all, it means remembering what your portfolio is for. It’s not there to make you feel smart in bull markets or safe during bear markets. It’s there to fund goals that are years or decades away. Volatility is part of the deal. You don’t get long-term growth without enduring short-term discomfort.

The only part you control

The market will fall again. That’s inevitable.

What isn’t inevitable is acting on fear. A downturn doesn’t automatically send you back to 1995. Panic selling does that. Emotional decisions do that. Turning temporary declines into permanent losses does that.

The market doesn’t punish investors. It punishes emotional investors.

And most of the time, avoiding that one mistake is enough.

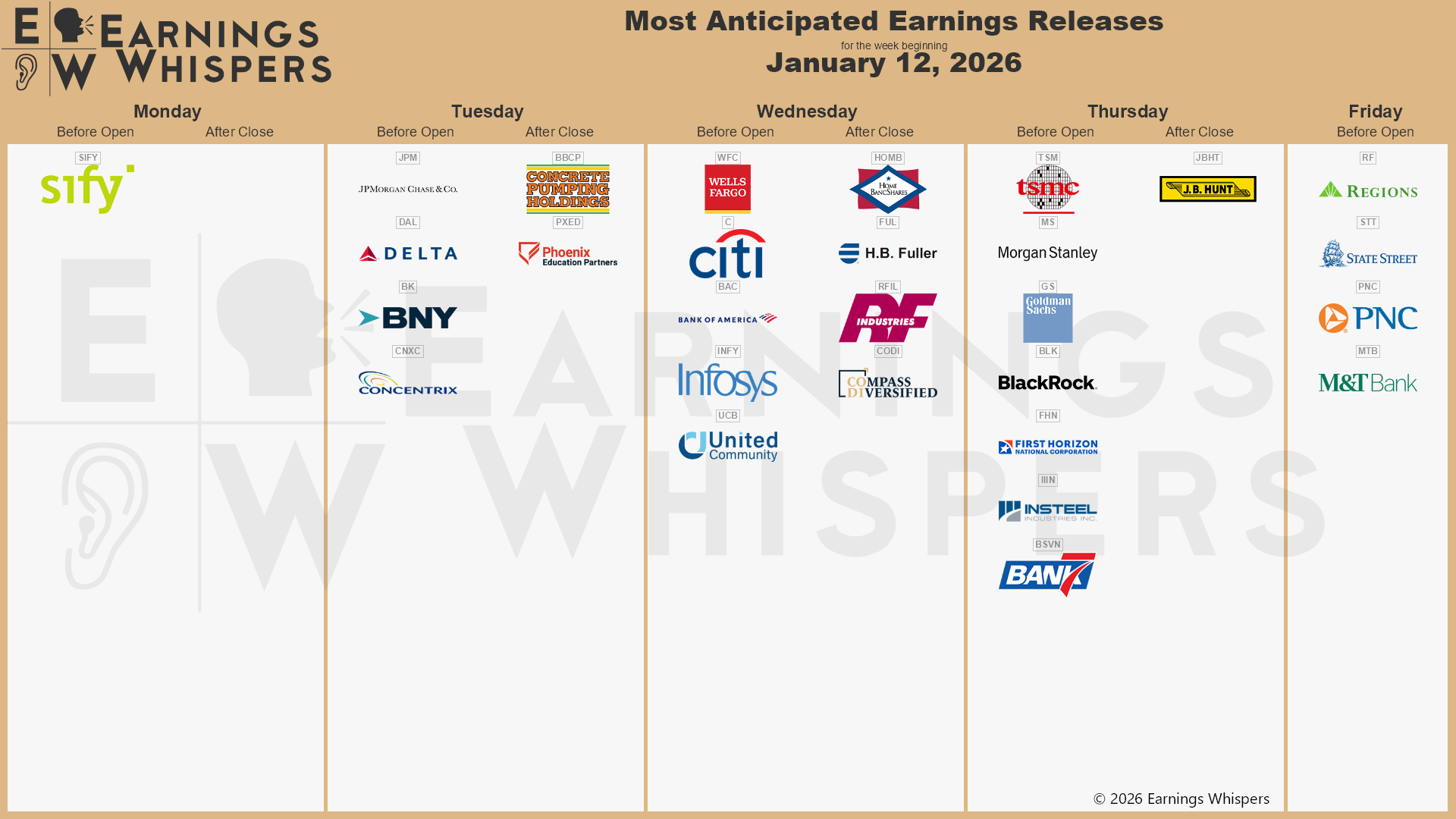

Stock Market Calendar This Week:

| Time (ET) | Report |

| MONDAY, JAN 12 | |

| 12:30 PM | Atlanta Fed President Raphael Bostic speaks |

| 12:45 PM | Richmond Fed President Tom Barkin speaks |

| 6:00 PM | New York Fed President John Williams speaks |

| TUESDAY, JAN. 13 | |

| 6:00 AM | NFIB optimism index |

| 8:30 AM | U.S. Consumer price index |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI |

| 8:30 AM | Core CPI year over year |

| 10:00 AM | U.S. new home sales |

| 10:00 AM | St. Louis Fed President Alberto Musalem speaks |

| 2:00 PM | U.S. budget deficit |

| 4:00 PM | Richmond Fed President Tom Barkin speaks |

| WEDNESDAY, JAN. 14 | |

| 8:30 AM | U.S. retail sales (delayed report) |

| 8:30 AM | Retail sales minus autos (delayed report) |

| 8:30 AM | U.S. Producer price index (delayed report) |

| 8:30 AM | Core PPI (delayed report) |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| 10:00 AM | U.S. Business inventories (delayed report) |

| 10:00 AM | Existing home sales |

| 12:00 PM | Atlanta Fed President Raphael Bostic speaks |

| 12:30 PM | Fed Governor Stephen Miran speaks |

| 11:00 AM | Minneapolis Fed President Neel Kashkari speaks |

| 2:00 PM | Federal Reserve’s Beige Book |

| 2:10 PM | New York Fed President John Williams opening remarks |

| THURSDAY, JAN. 15 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. import prices (delayed report) |

| 8:30 AM | Empire state manufacturing survey |

| 8:30 AM | Philadelphia Fed’s manufacturing survey |

| 9:15 AM | Fed Governor Michael Barr speaks |

| 12:40 PM | Richmond Fed President Tom Barkin speaks |

| 1:30 PM | Kansas City Fed President Jeff Schmid speaks |

| FRIDAY, JAN. 16 | |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 11:00 AM | Richmond Fed President Tom Barkin speaks |

| 3:30 PM | Federal Reserve Vice Chair Philip Jefferson speaks |

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.