The Good News…….and The Bad News

The most challenging part about the economy, and the stock market in general, is that much like your high school crush, it keeps sending us mixed signals. When things are going well, there are always signs of impending doom that may or may show up. On the contrary, when the markets and economy have been punched in the mouth, and it seems like the apocalypse is near, there are glimmers of hope that things are improving.

So, the question is, in the current economic and market conditions, what is the good news and bad news?

Inflation

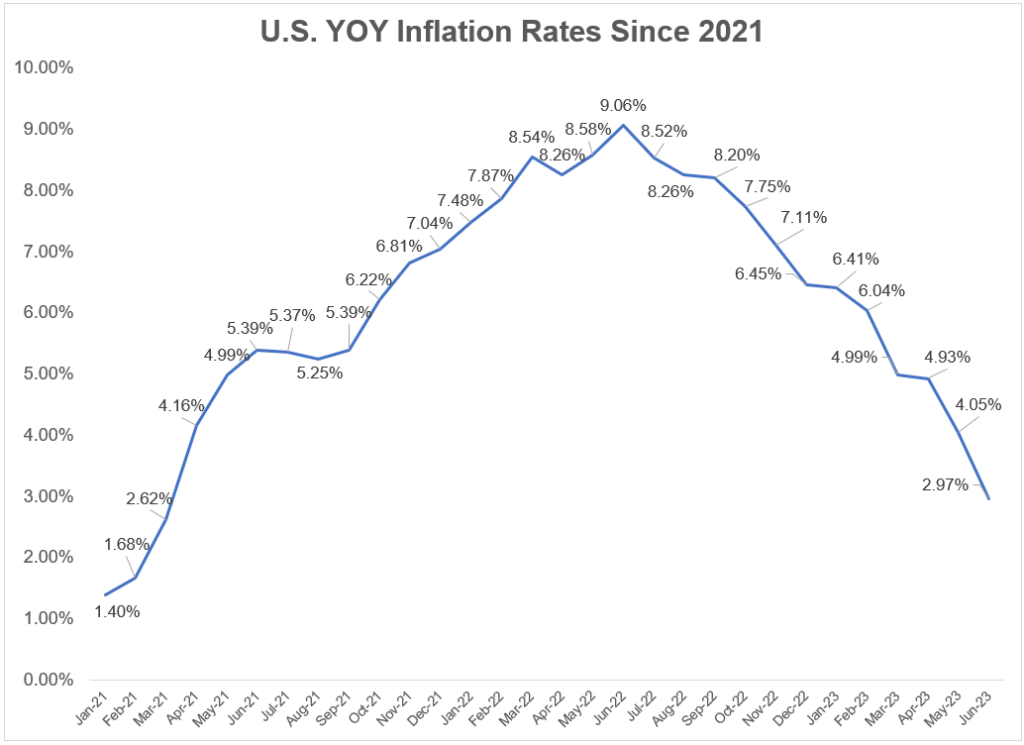

The dreaded I word. The good news is that inflation is falling rapidly, and after watching year-over-year inflation go above 9% last June, our latest inflation reading for last month was just under 3%.

As we watched inflation climb, it took us nearly sixteen months to go from 3% to over 9%, but it has only taken us another 12 months to watch that inflation fall back below the 3% mark.

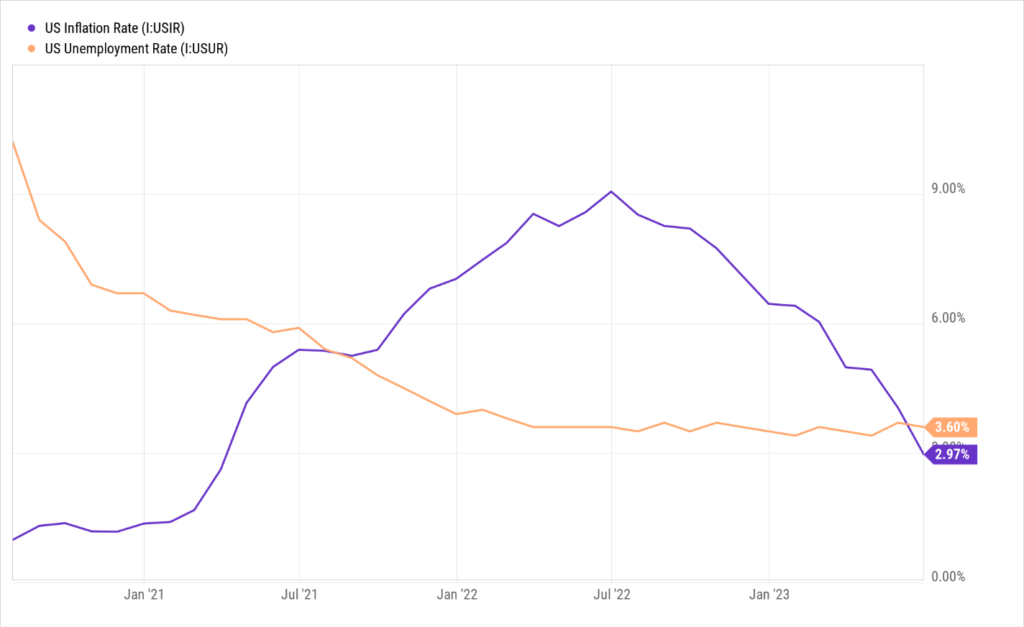

The bad news is that inflation has been higher than wage growth for a significant amount of time. We are finally seeing some wage growth, but consumer sentiment remains low even during a booming labor market.

Soft Landing

While inflation has been falling, the unemployment rate has remained steady, meaning a soft landing seems possible. Did The Fed actually get something right? That is pretty good news to me!

I don’t want to give them too much credit just yet, because while there is some good news, the aggressive rate hikes might impact the economy on a lag. The bad news is the unknown of did the Fed go too hard too fast, and we just haven’t experienced the side effects yet.

Housing

I have family members currently looking to purchase their first home, and the emotional turmoil they are dealing with of low inventory and being outbid on every house they have tried to purchase over the past two years does not paint a very rosy picture.

The good news is that housing prices never crashed. I know buyers would like to see home prices come down, but home prices coming down would almost certainly lead to an economic slowdown.

The bad news is that homes remain unaffordable for many, with stiff competition for low inventory and 7%+ mortgage rates.

Recession

A soft landing is possible, but the inevitable bad news that I know will happen at some point is that the economy will slow, people will lose their jobs, and businesses will fail.

The good news is that a recession is nothing new, and we have lived through it before. Recessions aren’t a bug of the system; they are a feature of the economic system we are a part of.

Sometimes things get worse, but then they get better. The good news-bad news dynamic of the economy and markets is why trying to time the market or focus on the portfolio leads to issues within the plan. Remember, the plan is the product, not the portfolio.

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, JULY 17 | |

| 8:30 AM | Empire State manufacturing survey |

| TUESDAY, JULY 18 | |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Business inventories |

| 10:00 AM | Home builder confidence index |

| WEDNESDAY, JULY 19 | |

| 8:30 AM | Housing starts |

| THURSDAY, JULY 20 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 10:00 AM | Existing home sales |

| 10:00 AM | U.S. leading economic indicators |

| FRIDAY, JULY 21 | |

| None scheduled |

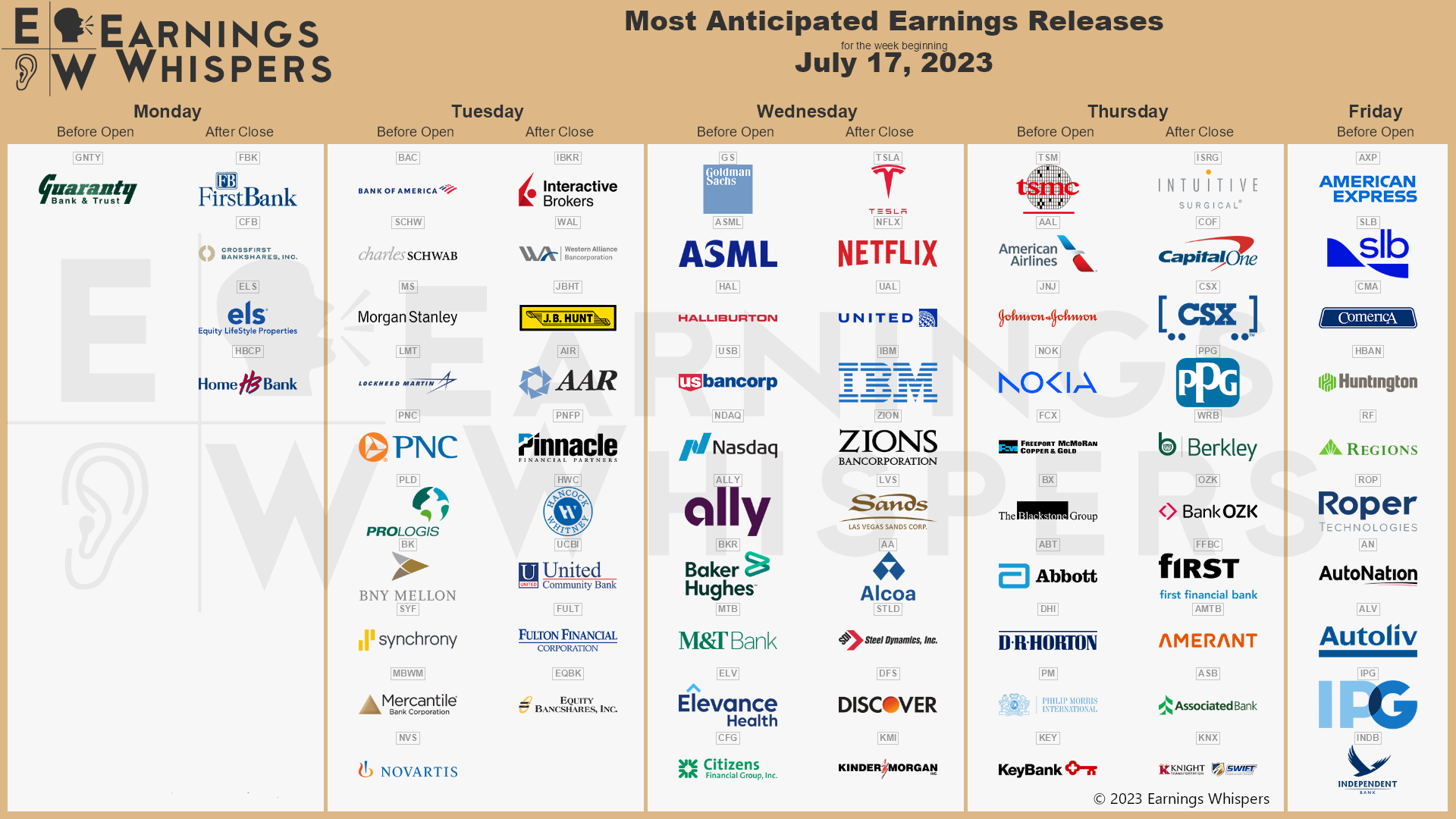

Most anticipated earnings for this week:

Did you miss our blog last week?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.