Vacations Are Expensive

Humans are very similar to the printer in your house, which sometimes decides not to work. The best solution is to unplug the printer and plug it back in. This is what vacation does for most people, a chance to unplug and rejuvenate themselves. There is just one problem with this; vacations are costly!

At Least it Wasn’t Disney World

I love the beach and spent last week on Long Beach Island with my wife and children. Going on vacation with a 10 and 9-year-old isn’t a chance to unplug for the parents, but the joy of seeing our children happy is enough to make it through until the next trip. A common theme during our trip was that when the check came at the end of meals, I would mutter under my breath at the end of a meal, “At least it isn’t Disney World prices.”

During every beach trip, I look forward to being woken up by our dogs. Unlike at home, when they wake me up at 5 AM, at the beach, I can take them for a walk while enjoying a beautiful sunrise with my toes in the sand. I never miss the chance to reflect on how lucky I am to be able to enjoy that sunrise at that moment and how many other families don’t have that opportunity because the cost is so prohibitive.

I felt the same gratitude when I watched the joy on my children’s faces in Disney World and a feeling of remorse at the parents who might never have the opportunity to bring their children to Disney World because of the cost.

Kids

As we sat on the beach watching fireworks on July 4th, with a picnic dinner of Pizza, we all started talking about our Disney trip from last year. I was sure my kids would say their favorite part of the trip was a particular ride or character. Maybe it would be a character meal we ate, which cost nearly as much as a mortgage payment.

Nope. Their favorite part of the trip was staying in a hotel room with my wife and I. They talked about all of us lying in bed, reading before going to sleep, and waking up together in the mornings. Their favorite meal at Disney was not the $600 meal with characters walking around, but instead, the meal we ate huddled under an awning during a torrential downpour. We sat on the ground, eating Uncrustables, laughing as we randomly quoted our favorite movies with each other.

At the time, it seemed inconvenient, ruining our agenda for the day and all the other stressful things a parent thinks of at that moment, but to the kids, it was undivided time spent with their parents.

What Does This Have to Do With Money?

If you made it this far, you must be asking, what does any of this have to do with money or personal finance?

Emotions such as parenting guilt play a huge role in financial decisions; if we don’t recognize it, we will make mistakes.

The day after our picnic dinner on the beach, AJ, my son, had a surfing lesson, which he loved, and did terrific at. He immediately wanted a surfboard, and although I am always willing to support the things he likes, spending $350 on a surfboard after one lesson was not going to happen. AJ sulked for a while afterward, and the guilt crept up. Yes, it was expensive, but we had planned for and budgeted for this trip.

Christina and I both work very hard and want to be able to give our kids the things we didn’t have as children. I could have justified going back and buying the surfboard without any issue until I told Christina, my wife, that I was having a change of heart.

She reminded me that Uncrustables and sleeping in the same hotel room as us were the kid’s favorite parts of Disney World. Not the light sabers and droids we built, the expensive meals, or the stuff we bought.

As parents, especially Gen X and Millennial parents, we constantly try to give our children the things we didn’t have growing up. What our children really want from us is time and access. They want undivided access to our attention and enough time with us to fill up their souls. Without the conversation the night earlier, I would have caved and bought the surfboard, but having perspective helped me keep $350 in my pocket.

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, JULY 10 | |

| 10:00 AM | Wholesale inventories |

| 10:00 AM | Fed Vice Chair Barr speaks |

| 11:00 AM | San Francisco Fed President Daly speaks |

| 11:00 AM | Cleveland Fed President Mester speaks |

| 3:00 PM | Consumer credit |

| TUESDAY, JULY 11 | |

| 6:00 AM | NFIB optimism index |

| WEDNESDAY, JULY 12 | |

| 8:30 AM | Consumer price index |

| 8:30 AM | Core CPI |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI year over year |

| 8:30 AM | Richmond Fed President Barkin speaks |

| 1:00 PM | Atlanta Fed President Bostic speaks |

| 2:00 PM | Fed Beige Book |

| THURSDAY, JULY 13 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| 2:00 PM | Federal budget |

| 6:45 PM | Fed Governor Waller speaks |

| FRIDAY, JULY 14 | |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 10:00 AM | Consumer sentiment |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Business inventories |

| 10:00 AM | Consumer sentiment |

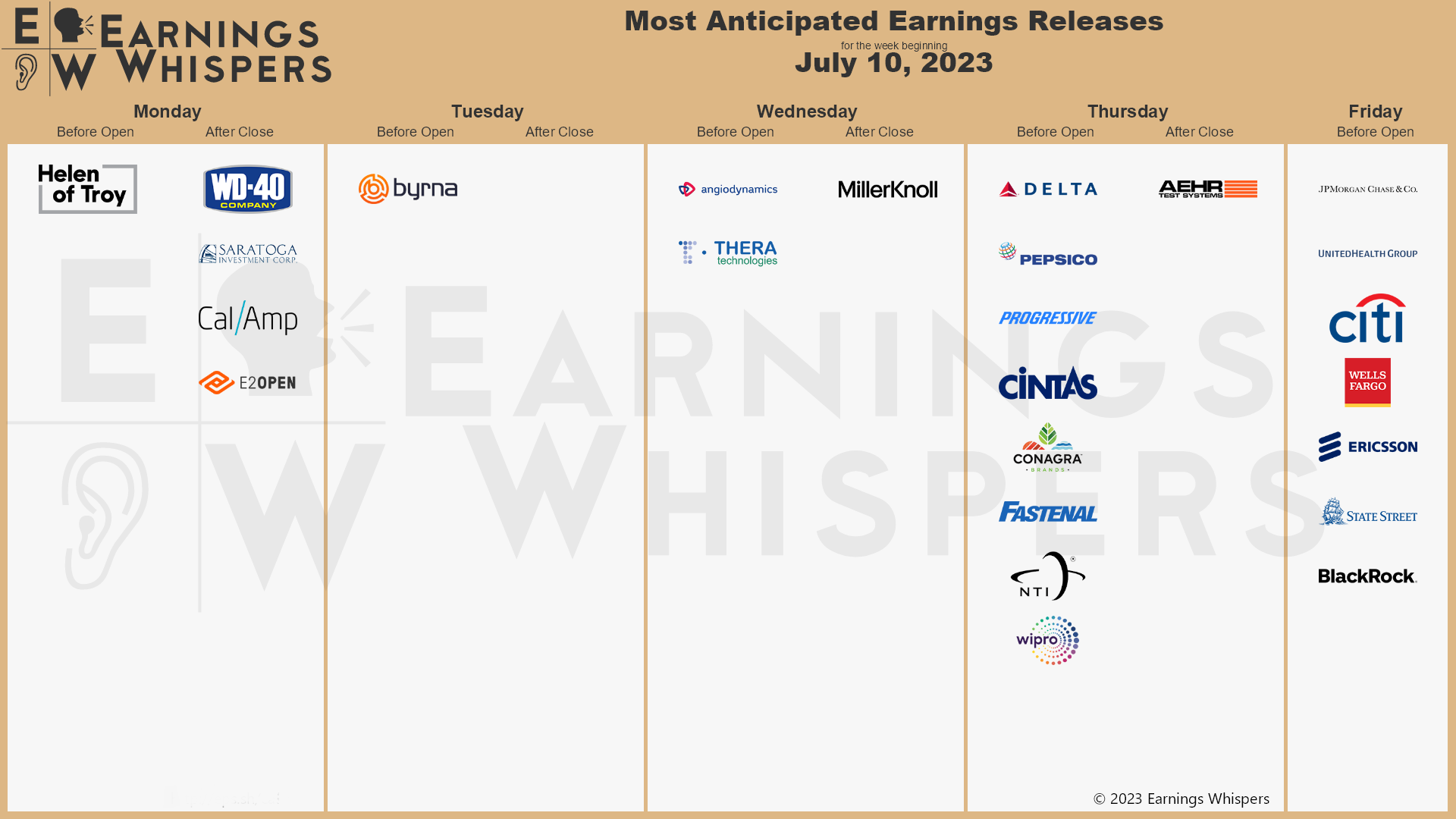

Most anticipated earnings for this week:

Did you miss our blog last week?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.