Stop Trying to Time the Market:

Do This Instead

There’s a quote I think about often:

“More money has been lost preparing for market corrections than in the corrections themselves.”

We all want to believe we’re smarter than the market. That if we just watch closely enough, we’ll see the signs, dodge the downturns, and ride the rallies. But the data is painfully clear: timing the market doesn’t work.

The High Cost of Missing Just a Few Days

Over the last 30 years, if you stayed invested in the S&P 500, your return would’ve been just over 10% annually. But if you missed the 10 best days during that stretch? Your return drops to around 5%. Miss the 30 best days and you’re barely breaking even.

Here’s the kicker: most of those best days are clustered right next to the worst ones. In March 2020, the market’s sharpest single-day losses and gains were packed into the same eight trading days. So, unless your crystal ball tells you exactly when to get out, and back in, you’re probably better off just staying the course.

Even legendary investors like Peter Lynch and Warren Buffett say they never met anyone who could reliably time the market. And they’re not short on confidence or skill.

So, What Should You Focus On?

If timing doesn’t work, what does? The boring stuff. The stuff that isn’t flashy enough for TV segments or TikTok gurus. In other words, the things you can control: taxes, fees, behavior, and planning.

I’ve been saying this for years, but if you’re working with a financial advisor who spends more time discussing stock picks and market forecasts than they do on tax strategy, it might be time for a second opinion.

A New Challenge: The Price of Success

Let’s talk about a more recent problem, one born out of success.

Over the past 5, 10, 15, and even 20 years, many investors have done exactly what they were supposed to do. They bought and held. They ignored the noise. They stuck with companies like Apple, Amazon, and Nvidia—and were rewarded handsomely for it.

But now? They’re sitting on big, concentrated positions. And those gains come with a tax bill attached. Selling all at once would trigger huge capital gains. So, people end up holding and hoping, which is never a great strategy.

A Better Way to Unwind

This is where direct indexing with a tax-loss harvesting overlay comes in.

In simple terms, direct indexing lets you replicate an index—like the S&P 500—but with individual stocks instead of a fund. That means you can sell specific positions at a loss (even temporarily), helping offset the gains from those high-flying tech names.

The result? You can gradually reduce your concentrated exposure and potentially pay far less in taxes while staying fully invested. This isn’t some fringe strategy reserved for billionaires either. Thanks to tech improvements and fractional shares, firms like Vanguard, Fidelity, and Schwab have brought these strategies to a much wider range of investors.

And it works. According to multiple studies, tax-loss harvesting alone can add 1–2% annually in after-tax return, without needing to chase the market or pick “the next Nvidia.”

Stay Invested. Stay Intentional.

The truth is that markets are unpredictable. But your financial life doesn’t have to be. You can’t control when the market spikes or drops, but you can control how you respond.

Stay invested. Diversify intelligently. And use the tax code to your advantage.

That’s how real wealth is built, not in bursts of brilliance, but in decades of discipline.

Sources:

- Hartford Funds – “If you missed the market’s 10 best days over the past 30 years, your returns would have been cut in half. And missing the best 30 days would have reduced your returns by 83%”

- Motley Fool / J.P. Morgan Asset Management – Over the past 20 years, six of the seven best days occurred immediately after the worst days; missing the 10 best days would cut returns from ~9.8% to ~5.6%

- AQR – Data shows that omitting the 12 best (or worst) months results in a ±5–8% swing from average S&P 500 returns

- Parametric (Wealth Managers) – “Tax management can add 1–2% in after-tax excess returns” from direct indexing

- Vanguard – Personalized indexing (direct indexing) captures 1–2% in after‑tax returns with daily tax-loss harvesting

- Schwab – Direct indexing allows harvesting tax losses on underlying stocks to offset gains in taxable accounts

- Parametric (Tax-Loss Harvesting) – “Tax-management can add 1–2% in after-tax excess returns”

- Range.com Blog – Proactive, daily tax-loss harvesting within direct indexing can add 1%+ to annual after-tax returns

- Alpha Athena – Studies confirm tax-loss harvesting strategies can generate 1–2% in annualized after-tax “tax alpha”

- Barron’s – “Direct indexing…previously exclusive to wealthy investors, is now accessible with tech advances”; research shows ~1–2% boost in after‑tax returns

- Investopedia / Morningstar – New data reinforces that investors who try market timing often underperform a simple, diversified approach

- MarketWatch – Highlights how the sharpest market losses and biggest gains often land close together, making timing especially risky

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, JUNE 16 | |

| 8:30 AM | Empire State manufacturing survey |

| TUESDAY, JUNE 17 | |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Business inventories |

| 10:00 AM | Home builder confidence index |

| WEDNESDAY, JUNE 18 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 8:30 AM | Initial jobless claims |

| 2:00 PM | FOMC interest-rate decision |

| 2:30 PM | Fed Chair Powell press conference |

| THURSDAY, JUNE 19 | |

| None scheduled, Juneteenth holiday | |

| FRIDAY, JUNE 20 | |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 10:00 AM | U.S. leading economic indicators |

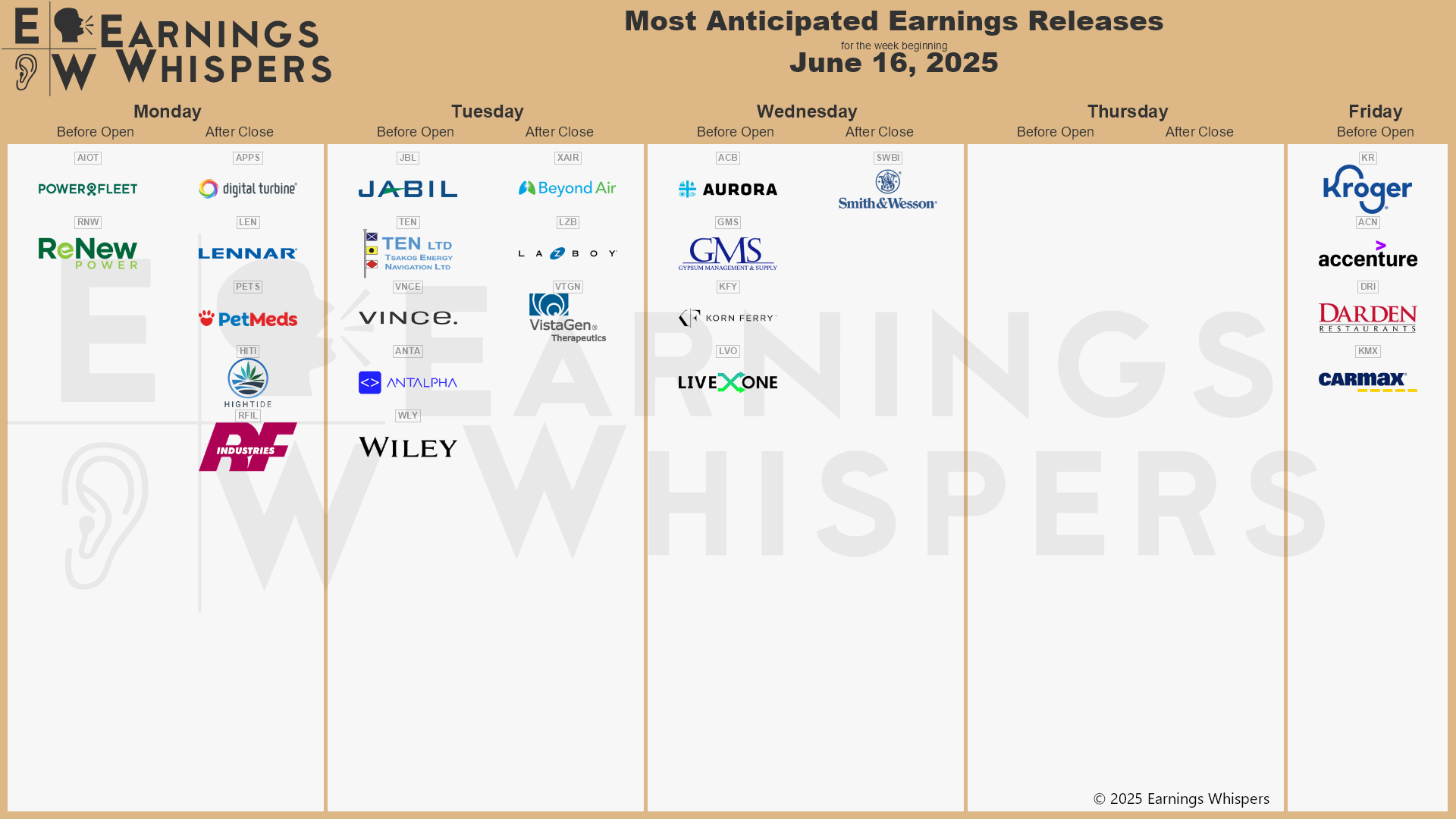

Most anticipated earnings for this week

Did you miss our last blog?

How Things Feel vs. How Things Are: The Bias Costing You Real Money

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.