By Jeff Deiss

CFP, AEP, Wealth Advisor

Your ACM Wealth Advisor’s experience and guidance can help you visualize your future in retirement and make the decisions to keep you on track, taking these key retirement income considerations into account and how your investment portfolio should be designed based on your individual needs, goals and risk tolerance.

Plan for a long Life

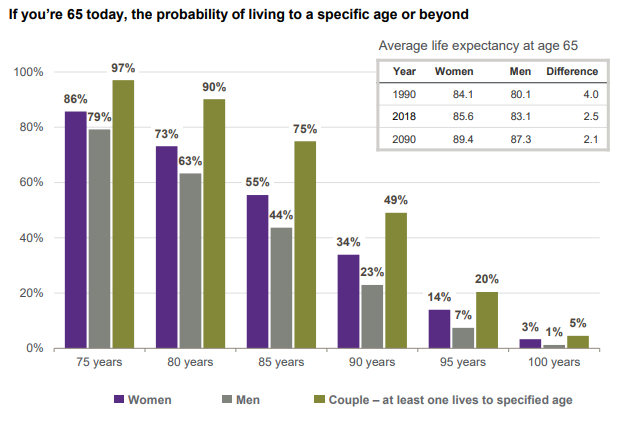

There is a prevailing tendency for people, and forecasters, to underestimate their longevity.

Combined with advances in medical technologies and pharmacology, people are living longer because they’re healthier, active and taking better care of themselves.

As average life expectancy continues to increase, there’s a real possibility that you may need 30 or more years of retirement income and you need to plan for this accordingly.

From an investment standpoint, this means that your time horizon does not end when your earned income ends, but rather you continue to maintain a long-term investment time horizon in retirement. It also means that you may need your assets to provide income for a longer period of time than you may anticipate.

Delaying social security retirement benefits is one option to consider as it can provide increased income later in life. It’s not for everyone, however, and depending on when you retire, it may require you to bridge the gap by tapping your portfolio first until your benefits begin. In the meantime, your ACM Wealth Advisor can help you to understand the trade-offs involved with when to begin your social security retirement benefit.

Plan for health care costs

Longer life spans and medical costs that typically rise faster than general inflation make planning for and managing health care costs in retirement an important priority.

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2020 may need approximately $295,000 saved (after tax) to cover health care expenses in retirement. Other sources indicate that it may be prudent to estimate an annual health care inflation rate of 6.0%.

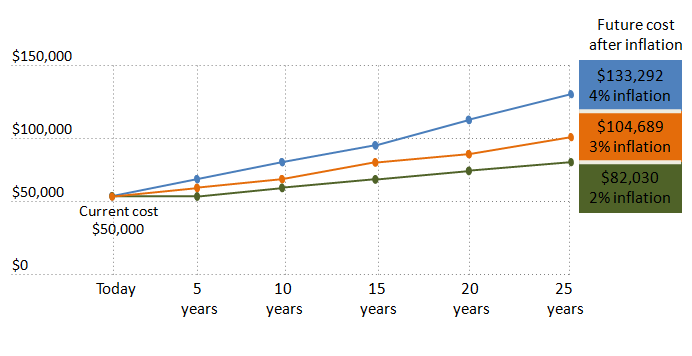

As a result, you’ll need to include growth, as well as income, in your retirement portfolio, in order to keep up with increased health care costs over time.

And that doesn’t include long-term care (LTC) expenses. Various sources report that about 70% of those over 65 will require some type of LTC assistance, either at home, in adult day care, in an assisted living facility or in a nursing home. Having a pool of money for long-term care expenses may ultimately protect yours, or your spouse’s, retirement income. Long term care insurance remains an option to consider.

For those who are still working, the triple-tax advantage offered by health savings account (HSAs) to save for health care costs in retirement remains very appealing.

Plan for inflation

Even a low inflation rate can reduce the purchasing power of your money over the course of a normal retirement.

Attempting to preserve your assets at the level you started with at retirement will only result in a loss of purchasing power over time.

Plan for growth and use time to your advantage

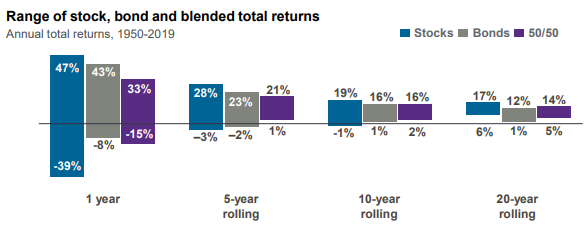

Overly conservative investments expose your portfolio to the erosive effects of inflation, limit the long-term upside potential that stocks can provide, and can diminish how long your money may last. Being too aggressive, on the other hand, increases the probability that you may exit the stock market and lose money in down or volatile markets. Portfolios with more stocks have historically provided more growth over the long term, but have also experienced bigger short-term price swings.

As a result, many investors employ a balance of growth (stocks) and capital preservation (bonds) in retirement. Stocks provide the growth to keep your purchasing power in line with inflation over time while bonds can help smooth out the inherent volatility of the stock market and improve the odds that you’ll stay invested.

Given the long-term time horizon of a normal retirement today, you have time on your side to and staying invested is the key to realizing the long-term returns that financial markets provide.

Maintaining six months to a year of cash on hand to meet regular spending needs in retirement can also help provide “peace of mind” and improve the odds of staying invested when markets turn down or experience normal volatility.

Minimize your taxes to maximize your retirement

Managing taxes over the course of a retirement requires a balance of your current and future tax situation.

There are certain life events in retirement, like turning on social security retirement benefits, the commencement of ‘required minimum distributions’ from retirement accounts and the compressed tax bracket for a surviving spouse that typically result in more taxable income and therefore potentially higher income taxes and Medicare premiums.

Understanding what lies ahead can help you make decisions to plan for these events in advance. Contributing to Roth IRAs and Roth 401ks early in careers and even in peak earning years can help. As will contributions to Health Savings Accounts. Withdrawing funds from retirement accounts and/or proactive Roth IRA conversions in lower income retirement years may also help to prevent required minimum distributions from pushing you into a higher tax bracket later in life.

Keep spending in check

Unlike previous generations when pension benefits made up a significant portion of retirement income, most people retiring today only have social security, which may cover a smaller portion of living expenses. As a result, withdrawing funds from accumulated financial assets (401ks, IRAs, brokerage and bank accounts, etc.) in retirement has become a predominant method for covering living expenses in retirement.

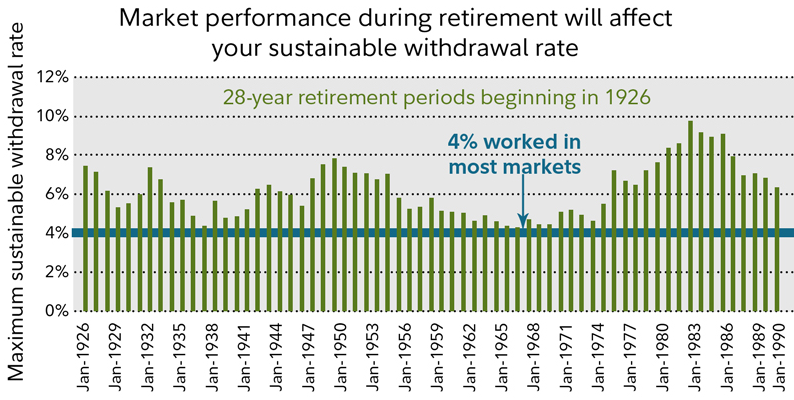

In order to make your accumulated financial assets last over a 20-40 year retirement, maintaining a sustainable portfolio “withdrawal rate” is critical.

As tempting as it may be when are healthy and eager enough to do so, spending too rapidly early in retirement can result in running out of money sooner or having to make unpleasant spending cuts later in life. And, when combined with an overly conservative portfolio, you can put retirement at risk.

On the other hand, setting your spending at retirement too low and not adjusting along the way may only serve to short-change yourself on your many years of hard work.

History suggests that the prevailing market environment when you retire is also important. A down market early in retirement can diminish your retirement savings as you begin to take withdrawals. A strong stock market in the early years of retirement can put the wind at your back.

Looking back, withdrawal rates of 4% to almost 10% would have worked depending on the date that someone retired.

A good rule of thumb is to consider withdrawing no more than 4% -5% in the first year of retirement and then adjust that percentage for inflation in future years.

If you work until age 70, or if you have health issues that may compromise your life expectancy, then you may want to plan on a shorter retirement period – say 25 years. History shows that, over a 25 –year retirement period and assuming a portfolio of 50% stocks/40% bonds/10% cash, a withdrawal rate of 4.9% resulted in not running out of money 90% of the time.

If you have a history of longevity in your family and are in line for a longer than average retirement, then you should target a more conservative withdrawal rate. In the case of a 35-year retirement, 4.3% was the most you could withdrawal for a plan that did not run out of money in 90% of the historical periods.

Of course, your personal sustainable withdrawal rate will vary based on many things, including some you can’t control—like how long you live, inflation, tax rates and the long-term risk and return of the markets—and others over which you have some control—like your retirement age, managing taxes, the lifestyle you adopt and the investments you choose.

Making the decision to end your earned income and switch from saving money to spending the money you’ve saved can be stressful and, for some, overwhelming. It can be difficult to make decisions amid the uncertainty.

Understanding the key considerations we’ve highlighted will help, but it’s still not enough. You need to have a plan in advance for when the time comes so that you can see what the future holds.

Working with an experienced advisor will also help. Retirement may be a once in a lifetime event for you, but your advisor is working to help people like you to make these decisions day-to-day. Your ACM Wealth Advisor’s experience and guidance can help you visualize your future in retirement and make the decisions to keep you on track, taking these key retirement income considerations into account and how your investment portfolio should be designed based on your individual needs, goals and risk tolerance.

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth