by Matthew Terzian, CFA, CFP

Just like the 2008 financial crisis, investors are fleeing to cash during the Coronavirus Pandemic, and this migration comes at an extreme cost, better known as a cash drag. Merriam Webster defines the word “drag” as a burden or encumbrance. Growing up, many of us heard stories from our parents and grandparents where cash was stored under a mattress, coming out of the Great Depression. The mattress has evolved into a money market account, which likely yields between 0.01% and 1.00%, so while allowing for better safekeeping – has a similar long-term negative effect on one’s wealth.

Through June 25, 2020 (MarketWatch), close $1.30 trillion has moved into money market funds. While cash might seem like an anchor, the tide’s movement is a constant. Over long periods of time, the market has a penchant for an upward trajectory and it is easy to get left behind stuck in port.

Using the last 20-year average total return of the S&P 500 through June of this year of just under 6% and rounding it up and using a money market return of 1.00%, we looked at the potential impact of moving a significant portion of an investor’s portfolio to cash over the next five and ten years. A $1 million equity portfolio and using the assumptions above, where an investor moves 50% to cash, the value over ten years would be approximately $330,000 lower due to the cash drag (or for most people the cost of a vacation home). And if higher stock returns in the future were equal to the past fifty years, at approximately 10.8%, the difference would be even more significant at over $847,000 over ten years.

Using the 6% equity return scenario, an investor planning on living off only the income of their portfolio after retiring in a decade – and assuming a 3% yield – would see a yearly decline in cash flow of $10,500 in year 11 (year 1 of distributions) growing to $17,150 in year 15 (year 5 of distributions).

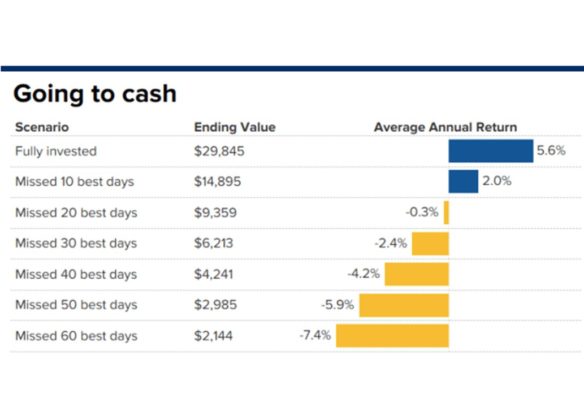

Looking at the chart below shows how $10,000 invested in the S&P 500 for the 20- year period of 1999 through 2018, would have performed under various scenarios. Just missing a few days can significantly alter returns downward.

Source: CNBC/JP Morgan

Understandably, investors often struggle to stay invested in volatile times. We suggest investor should consider their investment time horizon rather than focusing on daily moves. Typically, investors quickly regret panicking and hiding in cash, but staying invested in times of turmoil is unfortunately not easy. While it seems like we have had a 100-year storm or a Black Swan event every few years, the world will go on, and strong companies will prevail and prosper. Competent stock and bond selection are essential, looking at a company’s ability to achieve continued growth on both the top and bottom lines, coupled with such factors as a strong balance sheet and proven management team, where the asset can be purchased at a discount to its intrinsic value.

Looking at the world, and hence market, with a long-term perspective and not focusing on the short-term noise, is imperative to growing your wealth over the long-term. Using the Growth at a Reasonable Price (GARP) framework for security selection – where a portfolio is consists of a portfolio of securities at a discount to the overall equity market – can provide a buffer for the downside while allowing for higher risk adjusted returns. GARP investing is a hallmark at ACM, and we stand ready to help navigate the stormy seas that are an innate part of market.

Research Assistance: Jack Borzilleri

ACM is a registered investment advisory firm with the United States Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. All written content on this site is for information purposes only. Opinions expressed herein are solely those of ACM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. ©ACM Wealth