September 5, 2022

Forefront’s Monday Market Update

I’m Bearish, But Not Foolish

It finally happened; after a 16-year career, I was told this weekend that I am always bearish!

Me?!

Bearish?

I couldn’t believe my ears. As most of my friends and family will tell you, I am normally called a perma-bull because I tend to always be positive about the USA and our economy. For the record, I am still positive about the USA and our economy, but in retrospect, yes, I am indeed bearish at the moment. Bearish, but not foolish.

Bearish is okay

Things don’t seem that great right now. I can sprinkle in some stats and data that will refute my thesis, but ask 10 strangers how they feel about the future, and the picture is painted for you. How we all feel matters, and the federal reserve knows it, which is why the large interest rate moves have both a real-life impact, but also an emotional one.

By driving the stock market down, the federal reserve is accomplishing its goal of making Americans feel less wealthy. When your net worth decreases due to market drops, subconsciously, we all begin to tighten our belts even if this decrease in net worth is inconsequential to your actual life. Most of it is happening within retirement accounts that you have no intentions of touching for a decade +, but it still stops you from buying that new snow blower for the upcoming winter.

“Don’t fight the fed” has taken on an entirely new meaning as they actively push for a lower market, so bearish is okay.

Foolish is NOT okay

As I explained this weekend to my friend, being bearish does not mean you stop your savings plan or even adjust your investing plan. Savings and investing are long-term endeavors, and you don’t witness the true power of compounding until close to the end of your savings and investing period of your life.

It is okay to be realistic about the short-term of the stock market without it impacting your long-term view of the economy. Foolishly trying to time the market because you are bearish or simply going to cash will never be the solution to calm your emotions. Being realistic about what might happen in the short term might be viewed as bearish, and that’s okay, but it doesn’t change your long-term plan.

So What?

So how does this impact all of you?

- Financial decisions are more often about consequences than facts, especially when dealing with an uncertain future.

- Being bearish is okay, but not an excuse to be foolish.

Stock market calendar this week:

| TUESDAY, SEPT. 6 | |

| 9:45 AM | S&P U.S. services PMI (final) |

| 10:00 AM | ISM services index |

| WEDNESDAY, SEPT. 7 | |

| 8:30 AM | International trade balance |

| 10:00 AM | Cleveland Fed President Loretta Mester speaks |

| 12:35 PM | Fed Vice Chair Lael Brainard speaks |

| 2:00 PM | Beige Book |

| 2:00 PM | Fed Vice Chair for Bank Supervision Michael Barr speaks |

| THURSDAY, SEPT. 8 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 9:10 PM | Fed Chair Jerome Powell speaks |

| 10:00 AM | Average consumer expenditures |

| 10:00 AM | Quarterly services survey |

| 12 noon | Chicago Fed President Charles Evans speaks |

| 3:00 PM | Consumer credit |

| FRIDAY, SEPT. 2 | |

| 10:00 AM | Wholesale inventories revision |

| 10:00 AM | Chicago Fed President Charles Evans speaks |

| 12 noon | Kansas City Fed President Esther George speaks |

| 12 noon | Fed Gov. Chris Waller speaks |

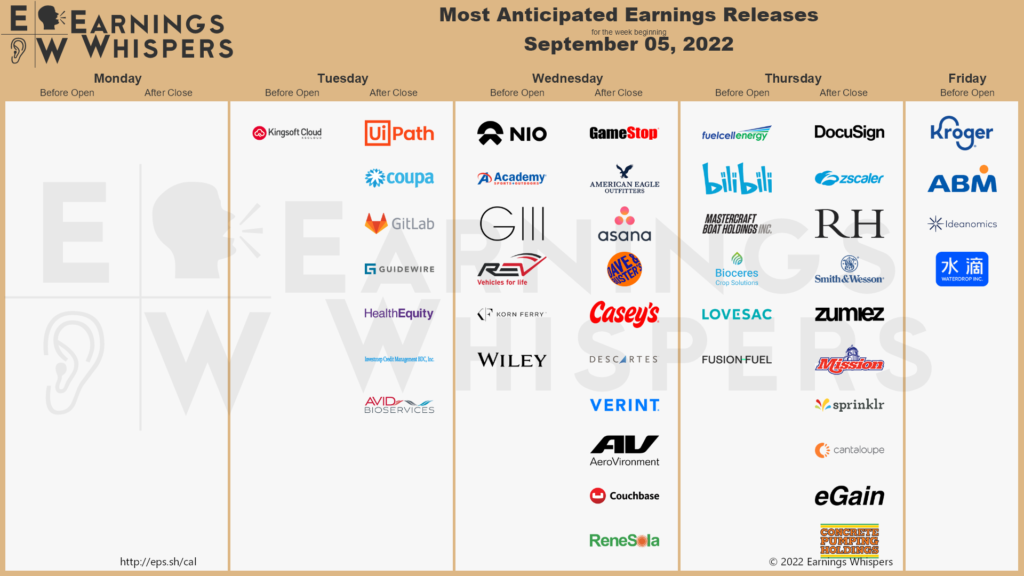

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.