Forefront‘s Monday Market Update

Why is the market down? Time to panic?

Growing up I made frequent trips to India with my parents to visit family. When I was very young, I can still remember my grandmother reading me the story “Chicken Little,” and although it was never my favorite book, it would make my grandmother laugh and giggle until she was holding her sides from laughing so hard. I never understood why, until I went to go visit my grandfather after my son AJ was born. My grandmother had passed away already, but I started reading “Chicken Little” to AJ, and I could see my grandpa’s face light up.

“Chicken Little” was a comedy to my grandma because in her lifetime, the sky had been falling only 10 times a year. Poverty, lack of education, and violence during the 1947 India and Pakistan partition are only a few of the obstacles she had to overcome to raise her 2 children, and provide an incredible life for my mother and her brother growing up. When my grandfather finished telling me WHY the story meant so much to my grandma, he gave me advice I tell my children today.

“If you think the sky is falling, it’s just rain. Grab an umbrella and don’t let it ruin your day.”

September malaise

September is never a good month for the stock market, with an average performance of down .6% according to The Stock Market Almanac. Generally, the back half of the month tends to be weaker than the beginning of the month, and that is exactly what we are seeing in 2021. I am surprised the headline from this morning that I put up above didn’t have some mention of the major indexes being down 3 weeks in a row.

Be ready for the media to push the fear narrative, and you will hear the words correction, bear market, and even depression thrown around because CNBC doesn’t care if you panic or not, they care that you are watching, and they can sell that to sponsors. Trees don’t grow to the sky, and neither does the stock market, a pull back, or a correction, and even a bear market are all good for the long-term health of both the economy and the stock market.

Ask ourselves (or your advisor) why?

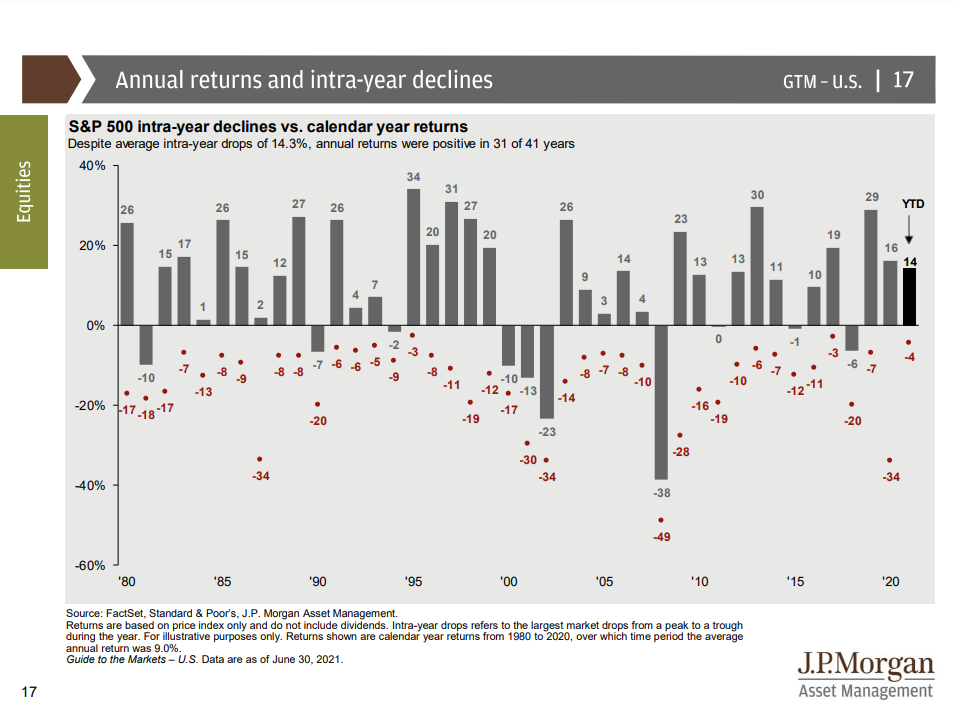

The market hasn’t pulled back by 5% or more in nearly 10 months, which is a very long time seeing as how it averages a 5% pullback 2-4 times a year. Just like I like to say every time Brett Gardner is up at bat, “he is due”. So are the major indexes of the stock market, we are due for a bit of a pullback and might even be seeing it now. We can attribute it to a number of things but I will touch on the top 2.

We are a global economy no matter how much we don’t want to admit it. The Chinese property market has become soft, like melted ice cream in a very short period of time. The China Evergrande Group which is a large Real Estate and property developer has fallen 80% in 3 months and is on the brink of default. A massive slowdown in the Chinese economy, or a real estate bubble bursting will have a wide-reaching impact across the global economy.

The Federal Reserve begins their 2-day meeting on Tuesday, and investors believe they will signal a start to a tapering of monetary stimulus as we see inflation continue to surge, and the jobs market improve dramatically. There is only one way to describe cheap money to the stock market, and that is by equating it to pain killers in a human. In the beginning they are necessary because you just had surgery or an injury, just like monetary stimulus when the market has an unexpected, and catastrophic event occur. Eventually, the pain goes away, and the NEED to take pain killers does as well, but the good feeling you get when taking them remains. So, it doesn’t end, but you know eventually this needs to stop. The same goes for monetary stimulus, except we don’t have rehab to get the stock market off the good feeling of cheap money, but it is necessary, and a good thing over time.

Call your advisor

This is when most investors will make a mistake, when they try and zig and zag and outsmart a market that hasn’t been outsmarted consistently in the entire history of investing. That doesn’t stop all of us from thinking that we can still do it, and all those other people who tried just weren’t as good as us.

This is when panic sets in and investors start wondering if they should sell, go to cash, buy bonds, or put the money in their mattress. All you should do is call your advisor, because there is no way to make your account not go down when the rest of the market is down, that would be magic. You should have a plan set up that has your dollars diversified both in investments, and in risk tolerance, so as one piece of your plan feels the volatility, another piece is helping to weather it. The one thing you can’t do, is let emotions drive the bus.

Remember, “if the sky is falling, it’s just rain. Grab an umbrella and don’t let it ruin your day”.

So What?

So how does this impact all of you?

- Don’t let headlines cause you to panic, pullbacks are okay.

- Understand why the market is moving down, and stay calm

Stock market calendar this week:

Wednesday September 22nd:

FOMC Statement @ 2:00PM

Fed Chair Jerome Powell news conference @ 2:30PM

Thursday September 23rd:

Initial and continuing jobless claims @ 8:30AM

Most anticipated earnings for this week