Forefront’s Monday Market Update

Chinese Energy Crisis

Around May of 2021 reports began to surface out of China. They had begun to experience energy disruptions at warehouses and manufacturing facilities. The biggest impact to the global economy was in the South China region of Guangdong, which is a major manufacturing province in China.

The crisis got worse in June of 2021, when Unit 1 of the Taishan Nuclear Power Plant needed to be shut down for unexpected maintenance and repairs. The Guangdong region also relies heavily on hydroelectric power, supplied to it from the Yunnan Province. The capacity of hydroelectric power it was receiving was reduced due to a much drier Spring than anyone had predicted. Yes, weather plays a roll in energy production around the globe.

These two things, coupled together, had caused a reported 15% reduction in total power available to the region. A self imposed embargo with Australia was about to make it much worse.

Global Impact

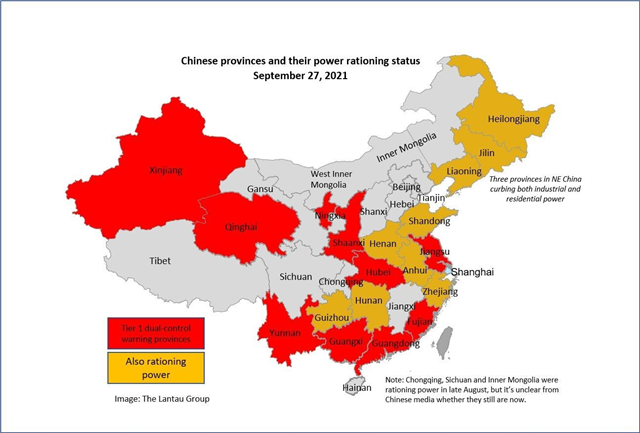

Recent weeks have brought with it much more aggressive measures to ration energy. The chart above shows just how aggressive those actions are. It paints a bleak picture. Most manufacturing facilities within the Guangdong Province are now only allowed 1-2 days of production per week. Instead of keeping them closed for 1 or 2 days a week, now they are only letting them be open for 1 or 2 days a week. The same thing is being reported in Jiangsu, Hubei, and Fujian, all of which are major manufacturing areas.

The hits keep coming

With a shutdown of Unit 1 at the Taishan Nuclear Plant, and a reduction in Hydroelectric output, one has to ask themselves how could it possibly get worse? Hello self imposed trade embargo.

Coal for Christmas

China has run through its strategic coal reserves and has completely depleted any store of coal they had built up. This is their own doing, as they imposed a trade embargo on Australia which provides 70% of the coal they use. The expectation is that China will be forced to drop the embargo in the next few months. If China does not drop the embargo the consistency and continuity that the China supply chains have historically had, will be severely damaged in the short and intermediate term.

Not a word

Has anyone noticed, that this might be the first time you are even hearing about a Chinese energy crisis? The media doesn’t want to report real news anymore unless it causes outrage and anger. Dividing our nation, and sewing anger and outrage has never been better for the bottom line of the main stream media. Don’t let the news cause anger and outrage. Seek our real sources, who are trying to provide insight and information to help you make good decisions.

So What?

So how does this impact all of you?

- The supply chain issue is not because people don’t want to work or some other made up reason that the media feeds you.

- The global economy is all intertwined, even if we don’t want it to be

Stock market calendar this week:

| MONDAY, OCT. 4 | |||||

| 10 am | Factory orders | ||||

| 10 am | Core capital goods orders (revision) | ||||

| TUESDAY, OCT. 5 | |||||

| 8:30 am | Trade deficit | ||||

| 9:45 am | Markit services PMI (final) | ||||

| 10 am | ISM services index | ||||

| WEDNESDAY, OCT. 6 | |||||

| 8:15 am | ADP employment | ||||

| THURSDAY, OCT. 7 | |||||

| 8:30 am | Initial jobless claims (regular state program) | ||||

| 8:30 am | Continuing jobless claims (regular state program) | ||||

| 3 pm | Consumer credit | ||||

| FRIDAY, OCT. 8 | |||||

| 8:30 am | Nonfarm payrolls | ||||

| 8:30 am | Unemployment rate | ||||

| 8:30 am | Average hourly earnings | ||||

| 10 am | Wholesale inventories (revision) |

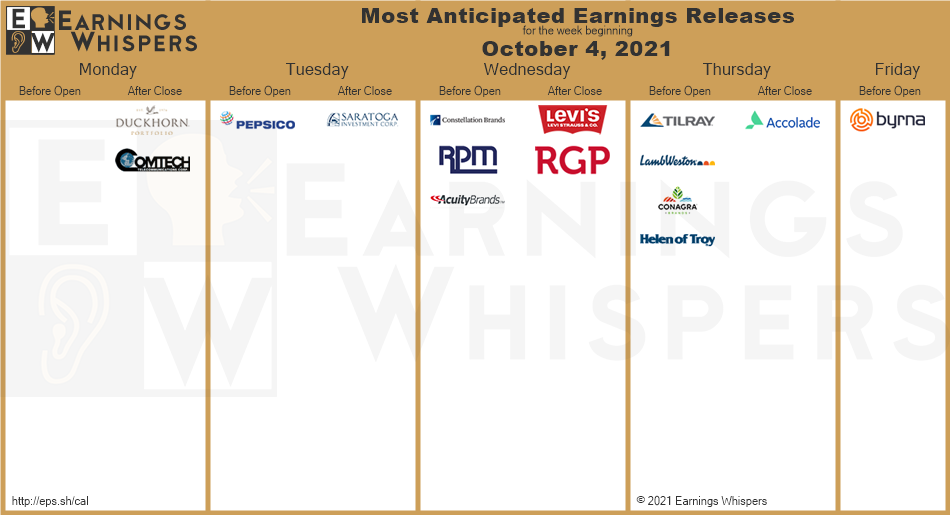

Most anticipated earnings for this week: