October 3, 2022

Forefront’s Monday Market Update

Bullish or Bearish

When I was a child, I wanted to watch R-rated movies more than anything! I had an older brother who was 17 then and could see movies like Wayne’s World, which I was highly jealous of. To make it up to me one day, he sat me down and told me we were going to watch an old, black-and-white movie called Raging Bull. It was a true story about boxer Jake LaMotta, and for anyone who has seen the film, the scene that sticks in most of our minds is Jake fighting Sugar Ray Robinson for the first time, and getting beaten, badly. At the end of the fight, although he knew he had lost, Jake uttered, “You never got me down, Ray, you never got me down.”

Why would I be talking about this incredible classic movie so early on a Monday morning, you ask? Because we are all Jake LaMotta right now, and after the month of September and the market drop of 9+%, I am talking to all of my clients to ensure the market never got them down!

We are all pretty battered and bruised up, but if you didn’t hit the panic button and run, you are not only still in the fight, you are in the best position you could be for the rest of this fight!

Today and Tomorrow

Things aren’t great at the moment; I don’t think anyone can argue against that point. The Fed is actively trying to make stock prices go down, housing prices go down, and the overall economy slow to a crawl. Just a crawl, though; they have to get it right, so we don’t fall into a recession, and the Fed has a stellar track record of getting it right. We have war and inflation, currency issues, and energy shortages across the globe.

Just reading that paragraph back makes me feel like I took a right hook to the gut from LaMotta. It doesn’t take a Mensa Scholar to point out all the bad stuff; being a bear right now is easy. Things could always get worse before they improve, but the market is an excellent forward-looking tool, and I think the worst we speak of might already be anticipated.

With the bad news out of the way, let’s make one thing clear; this is not 2008, we are not at that level, and although precarious, our position now is nothing like the knife edge we walked as a society in 2008.

Beyond Tomorrow

An odd dichotomy starts to occur as I get more bearish in the short term. I become more and more bullish in the long term. If you sold out of your portfolio in March 2020, waiting for the next bear market to get back in, here it is. We are still 20+% higher now than we were in March of 2020. Bear markets of today are still more expensive than bear markets from the past.

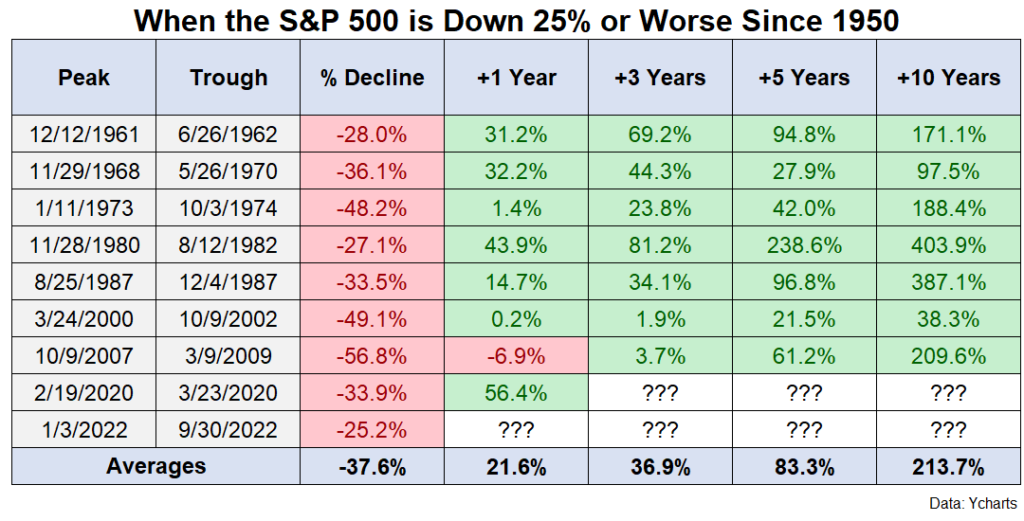

As the chart above shows, significant declines in the market are generally followed by gains. Markets go up and down, regardless if the Fed has been manipulating the markets over the past few years to the point where people thought trees just grew to the sky.

The stock market doesn’t fall by 25-20% often, but when it has, the returns afterward have proven pretty solid. I remember purchasing positions in 2008 and having the market fall another 20+%, and I don’t regret those purchases for a second. For those reading this who are my clients, you don’t regret the investments we made for you either. Some of the best companies in the world were beaten down, much like they are now, but providing a good or service that we can all see has become essential to our lives. This time is no different; as you get more bearish about the short term, it should push you to be more bullish for the long term.

So What?

So how does this impact all of you?

- The plan is the product, not the portfolio.

- As we get more bearish short-term, we should be getting more bullish long-term.

Stock market calendar this week:

| MONDAY, OCT. 3 | |

| 9:45 AM | S&P U.S. manufacturing PMI (final) |

| 10:00 AM | ISM manufacturing index |

| 10:00 AM | Construction spending |

| Varies | Motor vehicle sales (SAAR) |

| 3:10 PM | New York Fed President John Williams speaks |

| TUESDAY, OCT. 4 | |

| 7:15 AM | Cleveland Fed President Loretta Mester speaks on payment system |

| 10:00 AM | Job openings |

| 10:00 AM | Quits |

| 10:00 AM | Factory orders |

| 10:00 AM | Core capital goods orders revision |

| 11:45 AM | Fed Gov. Philip Jefferson delivers first speech as governor |

| 1:00 PM | San Francisco Fed President Mary Daly speaks to Council on Foreign Relations |

| WEDNESDAY, OCT. 5 | |

| 8:15 AM | ADP employment report |

| 8:30 AM | International trade balance |

| 9:45 AM | S&P services PMI (final) |

| 10:00 AM | ISM services index |

| 4:00 PM | Atlanta Fed President Raphael Bostic speaks |

| THURSDAY, OCT. 6 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:50 AM | Cleveland Fed President Loretta Mester speaks |

| 1:00 PM | Fed Gov. Lisa Cook delivers first speech as governor |

| 6:30 PM | Cleveland Fed President Loretta Mester speaks |

| FRIDAY, OCT. 7 | |

| 8:30 AM | Nonfarm payrolls (monthly change) |

| 8:30 AM | Unemployment rate |

| 8:30 AM | Average hourly earnings |

| 8:30 AM | Labor force participation rate, ages 25-54 |

| 10:00 AM | New York Fed President John Williams speaks |

| 10:00 AM | Wholesale inventories revision |

| 11:25 AM | Minneapolis Fed President Neel Kashkari speaks |

| 3:00 PM | Consumer credit |

| 5:00 PM | Fed Gov. Christopher Waller speaks |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.