October 17, 2022

Forefront’s Monday Market Update

Is This the Bottom?

An entire generation of investors has never experienced a complete stock market correction and an economic recession that does not have some government intervention.

Since 2008 almost every major global crisis has been met with some level of government intervention. We are all well educated on the massive bailouts banks and corporations needed in 2008 to stave off what has been described as “guaranteed economic collapse.”

Market corrections since 2008

After the great financial crisis, our first taste of another correction happened in April 2010 when Standard & Poor’s downgraded Greece’s sovereign credit rating to junk status. This occurred just four days after the International Monetary Fund and the EU had just agreed to a massive bailout (read: government intervention).

A little over a year later, in May 2011, we entered a short-lived bear market between May and October 2011, when the market declined by 21.58%. Moody’s had just downgraded the US from AAA to AA+, and there was a raging debate about the debt ceiling. Alas, the government stepped in and passed the Budget Control Act of 2011 in August. Saved again by government intervention.

A slow couple of years was followed up in 2015 by a significant stock market sell-off between June 2015 and June 2016. During this time, the Chinese stock market fell by 43% in just two months, and another Greek debt default in June 2015. Finally, in June 2016, we had the Brexit referendum.

In 2018 as interest rates slowly rose, we peaked in September of that year, only to fall 19+% by Christmas Eve. The Fed stopped raising rates in December 2018 when the Fed Funds Rate was between 2.25-2.50%. They promptly started cutting rates in August 2019 and buying bonds. By the end of 2019, rates were back at 1.50% and would fall further.

No one is coming

There is no sweeping government intervention this time; in fact, the Fed is RAISING rates as our economy is slowing down. The thing is, the fed wants our economy to slow down, so the idea of some intervention isn’t going to happen. This is a good thing, although it is hard to see as many of us open our financial statements to what looks like a blood bath.

A traditional correction and recession

I don’t know this for sure, and if I did, I can promise I would share it with the masses, but what we are experiencing and witnessing will look much more like a traditional correction and recession than anything we have seen since 2008.

The market fell 20+% between January and July of this year. We had it pop 8+% in August, and that would have been the place where traditional intervention would have taken place.

A traditional correction will always have some bounce at a point, and then the market will fall below its previous lows and settle in and bounce around in a range at the bottom for some time.

This is where we are now. Instead of intervention in August, we allowed the market to pop and plummet in September. Since the start of October, we have seen days where the market is up nearly 1000 points and down about 1000 points—bouncing around in a range near the bottom.

No one to ring a bell

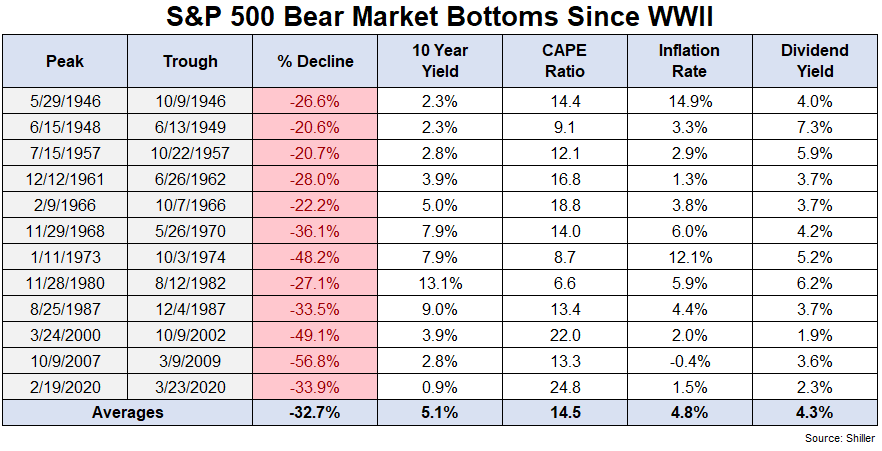

No one will ring a bell at a market top or announce once the market hits its low. Although that is what we all want, there is no magic PA system telling us, “ALL CLEAR, THE STOCK MARKET HAS HIT IT’S LOW; TIME TO GET BACK IN.” Stock market bottoms do not look the same, and predicting them is a fool’s game. Take a look at the chart below and the various fundamental indicators that are shown. None of them are similar from one bear market to the next.

The best indicator that a bear market/correction is over is price. The price of stocks will start to rise. Pretty simple and almost ridiculous, but there is no other clear indicator. The problem is, much like August, every time the marker bounces, we will hear that it’s a bear market rally, a dead cat bounce (what an awful name), or that it will fizzle out.

Yeah, maybe, but one of those bounces will take hold, and we will continue our upward trend. I don’t know which one, though, and predicting it, as I mentioned, is a fool’s game. Anticipating corrections within your plan is a better preparation method because no bear market is the same as last time.

So What?

So how does this impact all of you?

-

The stock market is UP 194% (11.5%/yr) over the last 10 years!You wouldn’t earn the 11.4%/yr without enduring the -23% drops.

-

No bear market is the same, trying to plan to get in and out is impossible.

Stock market calendar this week:

| MONDAY, OCT. 17 | |

| 8:30 AM | Empire State manufacturing index |

| TUESDAY, OCT. 18 | |

| 9:15 AM | Industrial production index |

| 9:15 AM | Capacity utilization rate |

| 10:00 AM | NAHB home builders’ index |

| 2:00 PM | Atlanta Fed President Raphael Bostic speaks |

| 5:30 PM | Minneapolis Fed President Neel Kashkari speaks |

| WEDNESDAY, OCT. 19 | |

| 8:30 AM | Building permits (SAAR) |

| 8:30 AM | Housing starts (SAAR) |

| 1:00 PM | Minneapolis Fed President Neel Kashkari speaks |

| 2:00 PM | Beige Book |

| 6:30 PM | Chicago Fed President Charles Evans speaks |

| THURSDAY, OCT. 20 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing index |

| 10:00 AM | Existing home sales (SAAR) |

| 10:00 AM | Leading economic indicators |

| 1:45 PM | Fed Gov. Lisa Cook speaks |

| FRIDAY, OCT. 21 | |

| 12 noon | Index of common inflation expectations, 5-10 years |

| 12 noon | Index of common inflation expectations, 10 year |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.