October 24, 2022

Forefront’s Monday Market Update

How Come Inflation Isn’t Falling?

Since March of this year, we have had annual inflation prints of 8% or higher each time. Sure, we might go from 8.5% to 8.3%, but with aggressive rate hikes, supply chains improving, and oil prices falling, why hasn’t inflation fallen by more already?

We are all wealthier

I am not going to break down each piece of the inflation calculation. Still, if you want a riveting breakdown of owners’ equivalent rent, many videos on Youtube will help cure even the worst case of insomnia.

Instead, let’s look at a couple of simple explanations that give a good idea of what is going on without bogging you down with a plethora of data.

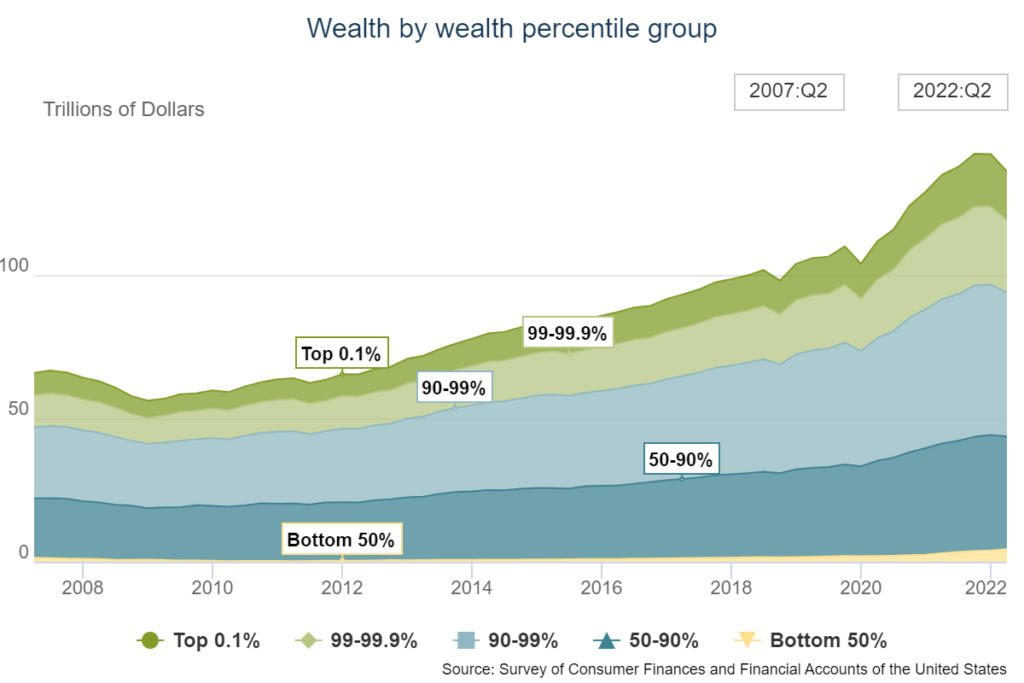

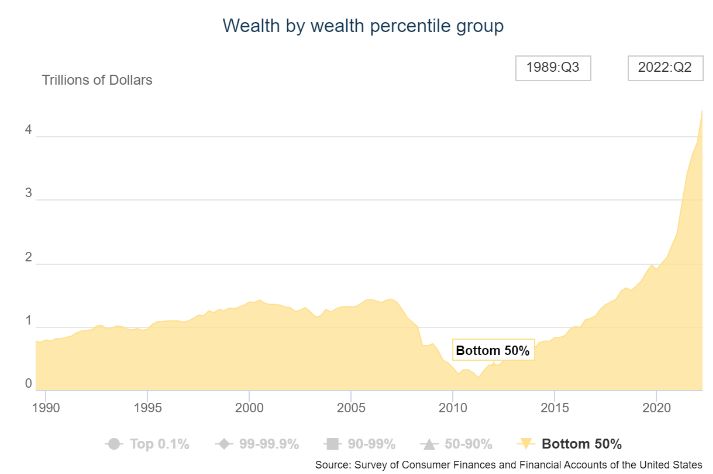

During the pandemic, US households got much more prosperous. I understand not everyone, but overall, it is safe to say we are all wealthier.

This wasn’t just due to stimulus dollars being injected into the system, which directly benefited the bottom 50% of income earners (see chart below), but because no one had anywhere to go. We skipped vacations, drove less, bought less, and spent less collectively. Working from home saved us dollars on commuting, gas, and car wear and tear. We saved money in numerous ways, leading to everyone collectively being wealthier.

Inflation stinks, but the US consumer was in the best position to deal with the high inflation and perhaps even a potential recession we are seeing now. Usually, all the various factors going on would lead to a reduction in spending for Americans, but that hasn’t happened yet. Americans, flush with the added wealth built up over the pandemic, have continued to spend despite inflation.

Corporations aren’t starving

We can all agree that the cause of inflation is some combination of the pandemic, stimulus as a result of the pandemic, supply chain issues, consumer spending, and of course, the big two, the Fed, and the war between Ukraine and Russia.

That might be the cause of inflation, but higher prices come directly from corporations selling the product when push comes to shove. Corporations may not have caused inflation, but that won’t stop them from taking advantage of it.

Operating profit margins continue to rise even as inflation shoots up. Although you will hear corporate CEOs complain about labor shortages and higher wages, there is no need to feel bad for them.

There is also no need to vilify them either. A CEO of a public company has a fiduciary duty to their shareholders, and as long as they aren’t egregiously harming the fabric of society, raising the cost of your product because you recognize that the market is willing to spend more on it is what anyone who runs a business would do.

Eventually, this ends. Consumers do not have an endless supply of capital, and as we are back on some normal ground after the pandemic, the typical living costs have crept back in. We already see the price of luxury goods drop, and we will start to see that happen with everyday goods as consumers stop spending savings and decide they can wait another year for that new couch or stove.

So What?

So how does this impact all of you?

- Inflation will come down the most, when we as consumers stop spending.

- As we get more bearish short term, we should be getting more bullish long term.

Stock market calendar this week:

| MONDAY, OCT. 24 | |

| 8:30 AM | Chicago Fed national activity index |

| 9:45 AM | S&P U.S. manufacturing PMI |

| 9:45 AM | S&P U.S. services PMI |

| TUESDAY, OCT. 25 | |

| 9:00 AM | S&P Case-Shiller U.S. home price index (SAAR) |

| 9:00 AM | FHFA U.S. home price index (SAAR) |

| 10:00 AM | Consumer confidence index |

| WEDNESDAY, OCT. 26 | |

| 8:30 AM | Trade in goods (advance report) |

| 10:00 AM | New home sales (SAAR) |

| THURSDAY, OCT. 27 | |

| 8:30 AM | Real gross domestic product, first estimate (SAAR) |

| 8:30 AM | Real final sales to domestic purchasers, first estimate (SAAR) |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Durable goods orders |

| 8:30 AM | Core capital equipment orders |

| FRIDAY, OCT. 28 | |

| 8:30 AM | Employment cost index (SAAR) |

| 8:30 AM | PCE price index |

| 8:30 AM | Core PCE price index |

| 8:30 AM | PCE price index (12-month change) |

| 8:30 AM | Core PCE price index (12-month change) |

| 8:30 AM | PCE price index (3-month SAAR) |

| 8:30 AM | Core PCE price index (3-month SAAR) |

| 8:30 AM | Real disposable income (SAAR) |

| 8:30 AM | Real consumer spending (SAAR) |

| 10:00 AM | UMich consumer sentiment index (late) |

| 10:00 AM | UMich consumer 5-year inflation expectations (late) |

| 10:00 AM | Pending home sales index |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.