Forefront’s Market Notes:

July 8th, 2024

Stocks steadily advanced over the holiday week thanks to strength in mega-cap tech issues and encouraging jobs data.

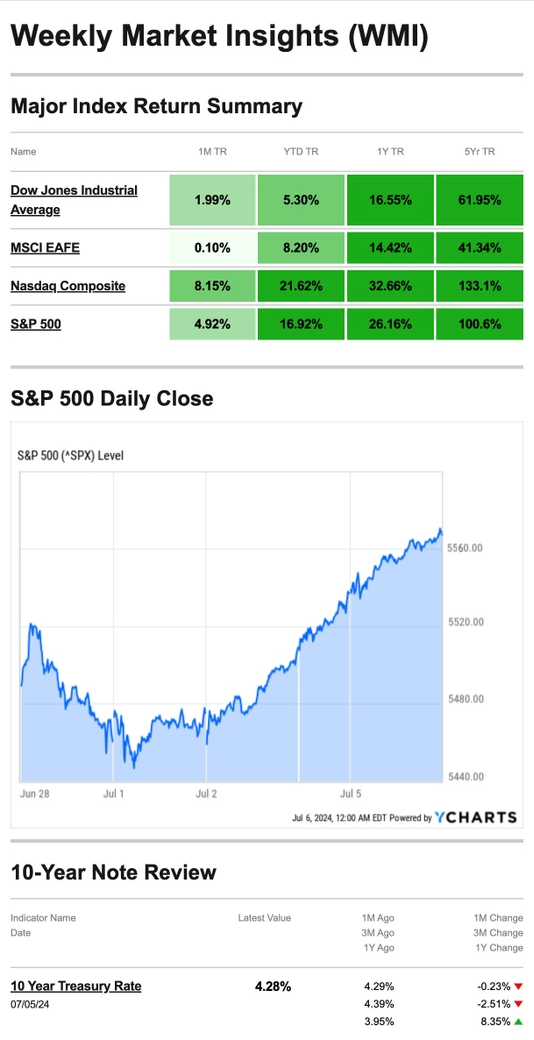

The Standard & Poor’s 500 Index rose 1.95 percent, while the Nasdaq Composite Index added 3.50 percent. The Dow Jones Industrial Average edged up a modest 0.66 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, rose 2.30 percent for the week through Thursday’s close.1

Nasdaq, S&P Extend Runs

ADP’s employment report on Wednesday showed private-sector employers added 150,000 jobs in June—slightly slower than May’s pace—adding to investor hopes that a slowing economy may prompt the Fed to adjust short-term rates as early as September. The Nasdaq and the S&P hit their 23rd and 33rd record closes, respectively, for the year.2

Friday morning’s jobs report from the Labor Department showed 206,000 jobs added last month, which also suggested a strong-but-cooling economy. News of slower job growth, slowing wage growth, and a slight uptick in unemployment helped drive down Treasury yields, and stocks finished the short week with a strong rally. The Nasdaq and S&P both closed at all-time highs on Friday.3

Source: YCharts.com, July 6, 2024. Weekly performance is measured from Friday, June 28, to Friday, July 5.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Still Catching Up?

Driving much of the job growth in last week’s reports was a post-pandemic catchup effect: sectors such as healthcare and leisure/hospitality showed they are still recovering.4

The private-sector jobs data and the Labor Department report painted a similar picture of an economy creating jobs but at a slower rate than in the past.5,6

How to Apply for Tax-Exempt Status for Organizations

If an organization wants to apply for tax-exempt status under Section 501(c)(3), it starts by filling out a Form 1023-series application. It must submit a complete application and the user fee. Organizations also need their employer identification number to complete the application. Generally, an organization that is required to apply for recognition of exemption must notify the Internal Revenue Service (IRS) within 27 months from the date of formation.

Some organizations (including churches or public charities whose annual gross receipts are less than $5,000) may not need to apply for 501(c)(3) status to be tax-exempt. When the IRS determines an organization qualifies for exemption under Section 501(c)(3), it will also be classified as a foundation unless it is a public charity.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov7

Footnotes and Sources

1. The Wall Street Journal, July 5, 2024

2. The Wall Street Journal, July 3, 2024

3. The Wall Street Journal, July 5, 2024

4. The Wall Street Journal, July 5, 2024

5. The Wall Street Journal, July 5, 2024

6. Marketwatch.com, July 5, 2024

7. IRS.gov, May 7, 2024

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, JULY 8 | |

| 3:00 PM | Consumer credit |

| TUESDAY, JULY 9 | |

| 6:00 AM | NFIB optimism index |

| 9:15 AM | Fed Vice Chair for Supervision Michael Barr speaks |

| 10:00 AM | Fed Chairman Powell testimony to Senate |

| 1:30 PM | Fed Governor Michelle Bowman introductory remarks |

| WEDNESDAY, JULY 10 | |

| 10:00 AM | Wholesale inventories |

| 10:00 AM | Fed Chairman Powell testimony to House |

| 2:30 PM | Chicago Fed President Austan Goolsbee and Fed Governor Michelle Bowman at Fed event on childcare industry |

| 7:30 PM | Fed Governor Lisa Cook speaks |

| THURSDAY, JULY 11 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Consumer price index |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI |

| 8:30 AM | Core CPI year over year |

| 10:30 AM | Atlanta Fed President Raphael Bostic speaks |

| 1:00 PM | St. Louis Fed President Alberto Musalem speaks |

| 2:00 PM | Monthly U.S. federal budget |

| FRIDAY, JULY 12 | |

| 8:30 AM | Producer price index |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI |

| 8:30 AM | Core PPI year over year |

| 10:00 AM | Consumer sentiment (prelim) |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: July 1st

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.