Forefront’s Monday Market Update

Is inflation actually bad for your portfolio?

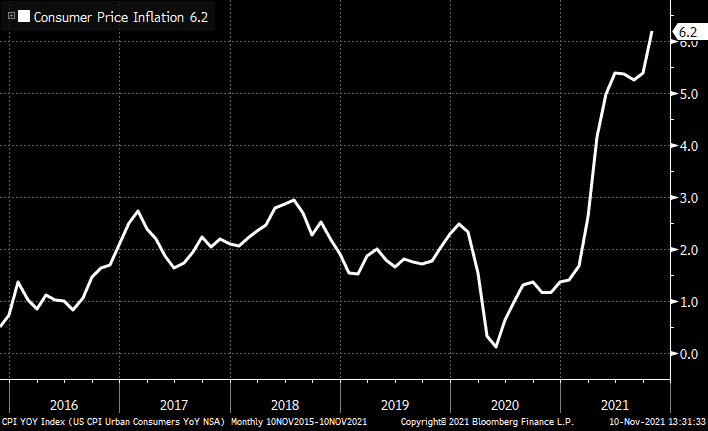

Last week the Bureau of Labor Statistics released their inflation number for the year ending October 2021, and it came in at a whopping 6.2%. This is the highest inflation has been since 1990.

So where do I put my money?

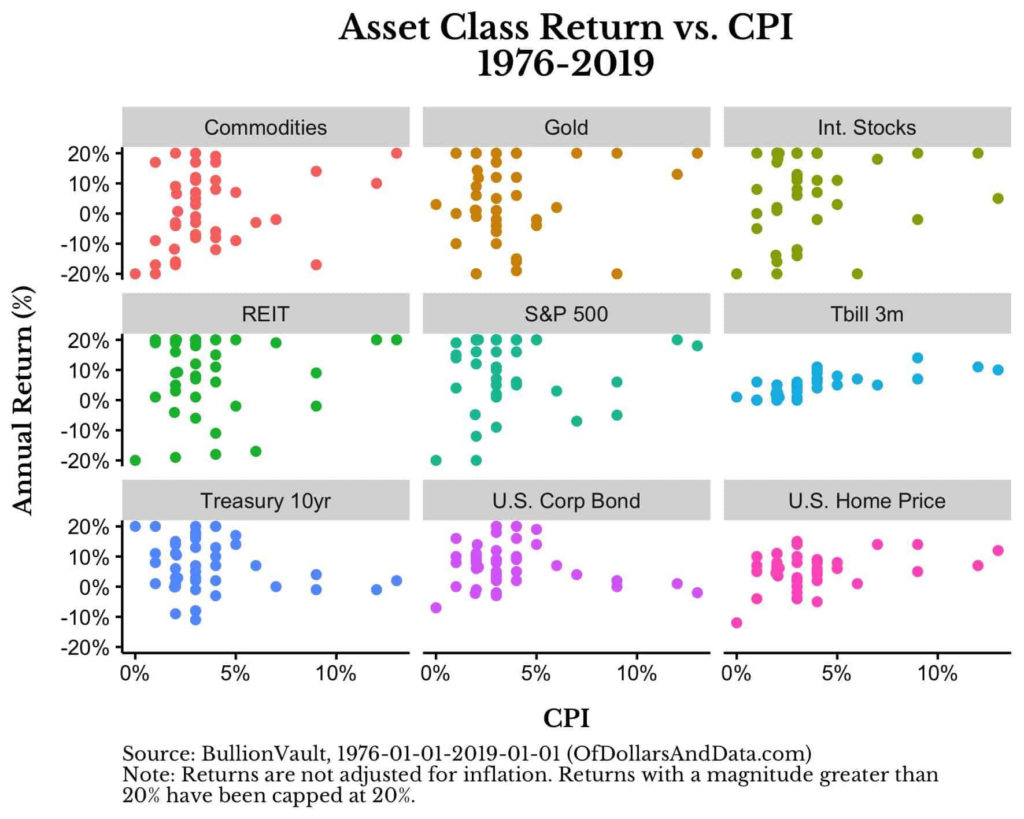

Take a look at the chart below, it plots the returns for various asset classes as inflation (CPI) changes over time. The chart is pretty clear in showing that the asset classes that perform the best against high inflation are those asset classes with the highest volatility. Equities, REITS, and Real Estate.

From the data we draw a conclusion that the best asset classes to preserve buying power in times of high inflation are Equities, REITS, and real estate. This makes sense when you really think about it, as all of these asset classes are based on giving money to a business or landowners. If the payments start to go up because of inflation, it is natural that the value of the underlying asset (business or property) also increases.

The chart above also helps to show that the asset classes that perform the worst during inflationary times, are those that pay their investors a fixed payment over time. As inflation rises, these fixed payments remain fixes, thus losing purchasing power.

The Forefront Approach

I write a lot to help educate as many people as I can, but I am always asked what my approach is during different economic times.

I remember my father telling me something as a child, and it is the perfect investing advice for times of inflation, and frankly for all times.

“Value is created when you create or provide something that helps the world.”

He always preached that whatever we did as humans, we would be successful if our goal was to help others.

When thinking about investing, the same principals hold true. If you create, or provide something that people will want or need, it doesn’t matter what is happening in the world. Our approach is to build diversified portfolios with varying risk, that are investing in areas that provide value to consumers, and the world. This helps to create a shield against the various economic events that can cause your emotions to take over and derail your plan.

This approach does lead to more volatility during times of inflation, but volatility has become the norm over the past 15 years or so. It used to be major news if an index fell by more than 1% in a day. Now the market can fall by 5% in a given day, and it rolls right off the back of most investors. Volatility is only a problem if you don’t have a relationship with someone who can bring those emotions down a bit and prevent you from panicking and making bad financial decisions.

So What?

So how does this impact all of you?

- Inflation hurts the wallet, but it doesn’t have to hurt your portfolio

- The asset classes the media tells us will work against inflation, like gold, don’t actually work.

Stock market calendar this week:

| MONDAY, NOV. 15 | |

| 8:30 AM | Empire State manufacturing index |

| TUESDAY, NOV. 16 | |

| 8:30 AM | Retail sales |

| 8:30 AM | Retail sales ex-autos |

| 8:30 AM | Import price index |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | NAHB home builders’ index |

| 10:00 AM | Business inventories |

| 12 noon | Fed Presidents Barkin, Bostic, George speak on racism |

| 2:30 PM | San Francisco Fed President Mary Daly speaks |

| WEDNESDAY, NOV. 17 | |

| 8:30 AM | Building permits (SAAR) |

| 8:30 AM | Housing starts (SAAR) |

| 12:40 PM | San Francisco Fed President Mary Daly speaks |

| 4:00 PM | Chicago Fed President Charles Evans speaks |

| THURSDAY, NOV. 18 | |

| 8:30 AM | Initial jobless claims (regular state program) |

| 8:30 AM | Continuing jobless claims (regular state program) |

| 8:30 AM | Philadelphia Fed manufacturing index |

| 10:00 AM | Leading economic indicators |

| 2:00 PM | Chicago Fed President Charles Evans speaks |

Most anticipated earnings for this week: