May 30, 2022

Forefront’s Monday Market Update

Global Supply Chain – Where We Stand Now

Up until a year ago, most of us hadn’t ever heard the term “supply chain” or “supply chain issues,” but now we can’t escape it. Let’s get some basics out of the way in hopes of giving everyone some clarity which should lead to comfort.

Global supply chains are the networks that exist between companies, their suppliers, and their manufacturers to turn raw materials, and components into the products that they sell. If there is a kink in the process the entire thing is turned upside down.

Where are we now?

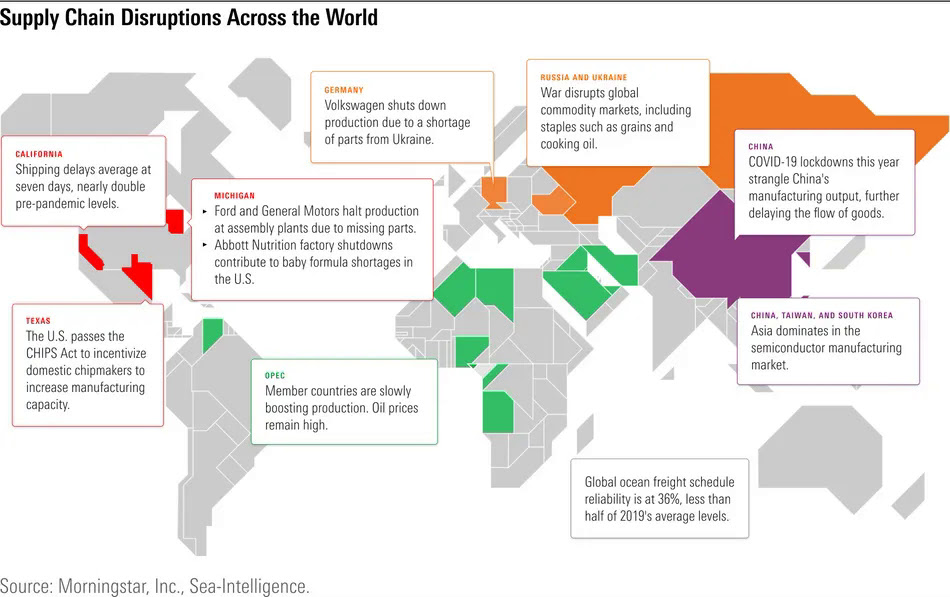

Supply chain issues are seen as one of the primary factors in pushing inflation to the levels we are currently seeing. Although this is partly correct, the supply chain crunch we are seeing has only a small impact on overall inflation. The hope was that during the first half of 2022, as the pandemic and its effects were contained, our supply chain issues would abate. But unfortunately, other events, such as the war in Ukraine, and continued lockdowns in Shanghai and other key cities across China have continued to throw up roadblocks.

Semiconductors (computer chips) have been one of the most significant sources of global supply chain issues, affecting an incredibly wide spectrum of industries. Things like mobile phones, and cars are the ones everyone thinks of when thinking about computer chips, but what about light bulbs, and toaster ovens? Computer and tech companies have been struggling to keep up with the roaring demand that started when workers shifted to working from home. Coronavirus factory shutdowns slammed chipmakers, also known as foundries, capacity to produce which then leads to a backlog of orders.

At the same time, chip makers are prioritizing their higher value chips that are much more profitable and lucrative for their bottom line. They are producing the chips that are used for the most advanced manufacturing processes, while the basic chips for your cars, and networking hardware are all taking a back seat. In the short term this isn’t the best news, but the processes that ALL semiconductor companies are putting in place to make sure we avoid these types of shortages again paint a bright picture for the likelihood of future computer chip shortages.

Can I buy a car yet?

Cars have been ground zero for semiconductor chip supply issues, and this has been a driving factor in the shortage of new cars which has caused a massive spike in the cost of used cars.

European automakers are also dealing with the war in Ukraine on top of the existing computer chip shortages. Volkswagen had to shut down two factories in Germany because they could not get critical wiring that is produced for them in Eastern Europe, in a plant that has been shut down due to the war. The analysts I spoke to all agree that the problem is getting better, but real relief won’t be seen until the second half of 2022, into Q1 of 2023. Even with chip shortages continuing for the automobile sector, we are starting to see signs of stabilization. US light vehicle inventory has remained steady at over 1 million vehicles in the last few months. In September of 2021, the bottom of the industry inventory was below 975K vehicles.

One sign that conditions are improving is a declining Manheim Used Vehicle Value Index, which measures pricing levels for used vehicles. The index started to decline from its all-time high in January and is down 5.7% for the year. As inventories are replenished and supply better meets demand, used-vehicle prices should also come down from their all-time highs

What’s next?

I wish there was a crystal ball or someway for me to give you some clarity on the future with certainty. That isn’t a thing unfortunately but what we can do is continue to look at the economic data coming out and making rational decisions based on data, not emotions. This week we have a big jobs number being released on Friday which will give us an indication if the labor market remains strong, or if we see some softening. We will also get ISM data that will give us a snapshot of the strength of economic expansion.

As data continues to roll in, we will see the markets react. But remember, this is not a reason for you to react! Markets will continue to be irrational on a day-to-day basis, moving on a whim because of a singular piece of information, or a talking head on TV making a prediction. This should not have any bearing on your decision-making process. Financial plans should be set up in such a way that short- term needs, obligations, and goals are all being met through dollars with limited to no market exposure. The longer-term buckets of dollars should be added to and left alone as the markets recover, just like they have for the past 100+ years. This time is not different, we just have a lot more noise that we have to listen to. The biggest risk we face is letting the noise guide our decision-making process, and instead of relying on data we make decisions based on emotion.

So What?

So how does this impact all of you?

- Controlling your emotions during times like this will be the difference between success and failure.

- Good information is your friend when uncertainty seems to be the only thing around

Stock market calendar this week:

| MONDAY, MAY 30 | |

| None scheduled — Memorial Day holiday | |

| TUESDAY, MAY 31 | |

| 9:00 AM | S&P Case-Shiller national home price index (year-over-year) |

| 9:00 AM | FHFA national home price index (year-over-year) |

| 9:45 AM | Chicago PMI |

| 10:00 AM | Consumer confidence index |

| WEDNESDAY, JUNE 1 | |

| 9:45 AM | S&P Global U.S. manufacturing PMI (final) |

| 10:00 AM | ISM manufacturing index |

| 10:00 AM | Job openings |

| 10:00 AM | Quits |

| 10:00 AM | Construction spending |

| 2:00 PM | Beige book |

| Varies | Motor vehicle sales (SAAR) |

| THURSDAY, JUNE 2 | |

| 8:30 AM | ADP employment report |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Productivity revision (SAAR) |

| 8:30 AM | Unit labor costs revision (SAAR) |

| 10:00 AM | Factory orders |

| 10:00 AM | Core capital goods orders revision |

| FRIDAY, JUNE 3 | |

| 8:30 AM | Nonfarm payrolls |

| 8:30 AM | Unemployment rate |

| 8:30 AM | Average hourly earnings |

| 8:30 AM | Labor-force participation, ages 25-54 |

| 9:45 AM | S&P Global U.S. services PMI (final) |

| 10:00 AM | ISM services index |

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.