Forefront’s Monday Market Update

What questions to ask before hiring an advisor

I recently had to bring our puppy, Moose, to the vet because he seemed to be suffering from some pretty bad allergies. I love my veterinarian, not only because I trust her with my animal’s life, but because I know the structure in which her, and her colleagues are compensated, and it’s a structure that eliminates conflict of interest.

You see, many veterinarians are compensated via a percentage of the total dollar amount of lab work they get done. When they recommend you do a senior blood panel for $600 you have to always ask if this is actually for your animal, or is this for the Dr. to drive some revenue? My vet advertises how this is not their structure, and as a client one of the first things I asked about was conflict of interest. In made me think, if I am asking this about a veterinarian, what are the major questions that one should ask when getting ready to hire a financial planner?

Fiduciary

The first question you want to always ask of a potential financial advisor, is if they are a Registered Investment Advisory firm only? This means they fall under the fiduciary standard. A financial fiduciary is prohibited from selling financial products in return for a commission. This is key, because how your advisor is compensated matters (hint: this is question 2).

Many advisory firms are what’s called “duel registered”, which is when you are both a Registered Investment Advisor (RIA) AND a Broker/Dealer (BD). This means you can sell stuff for a commission under the BD side, but claim to be a fiduciary under the RIA side. Many companies do this, and it is disingenuous as best, and shouldn’t be allowed.

Have you ever walked into a car dealership, and immediately someone was in your face trying to sell you a car? The only way that person pays their bills is to sell you a car, regardless if it’s the right car for you or not. This same idea holds true for advisors who are not fiduciaries. If they way they pay their bills is to sell something for a commission, they are going to sell that product whether it is suitable for you or not.

Compensation

How are you paid?! This isn’t a rude question, but rather a very important one when making your determination if you want to work with a particular advisor or not. The key to this question isn’t necessarily how much they are paid, but rather HOW are they compensated. How does the compensation structure create a conflict of interest? If you get a commission for selling a product, well we know that’s pretty terrible.

You want to look for advisors who have multiple structures, designed to be flexible to be able to help everyone. Many advisors have a rigid fee structure as a way of pushing those who actually need the help away, and drawing in those who have already built their wealth.

For example, I use both a percentage of assets under management model (1% or sell) OR a monthly retainer/subscription model designed to be flexible to help those who have a majority of their investable assets tied up in a 401K or other vehicle that doesn’t allow for direct management.

Let’s grab dinner

Money is an extremely personal subject matter, that taps into deep rooted emotional and behavioral aspects of all of our personalities. It is the leading cause of divorce in our country, and can cause unimaginable stress for people. Finding a good financial advisor is very much about the X’s and O’s of planning, but almost as important is if you connect with them. Do you share similar values? Do you get along well and do you feel comfortable opening up to them? The relationship you have with your advisor matters more than almost anything else.

You need a relationship built on trust and understanding between like minded people, so when your advisor tells you not to panic…..you listen. Good advisors aren’t telling you they are smarter than the next guys, rather good advisors are telling you to be keenly aware of an emotional response to anything in the market. Time is what matters, and having an advisor you trust that will stop you from trying to zig and zag is paramount to success.

So What?

So how does this impact all of you?

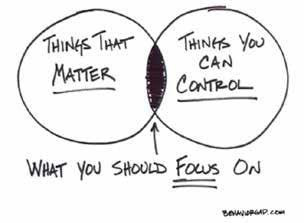

- Avoiding conflict of interest is priority number 1

- Having a connection with your advisor matters. It is a personal relationship, not just business

Stock market calendar this week:

Wednesday June 30th:

ADP Employment Report @ 10AM

Fed Chair Jerome Powell press conference @ 2:30PM

Thursday July 1st:

Initial and continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week

Do you want to know more about Cryptocurrency. Have questions, but are a little embarrassed to ask? You aren’t alone, listen to the latest episode of Understanding the Power of Money and get answers to your questions!

Listen to episode 12 of Understanding the Power of Money.