Forefront‘s Monday Market Update

Dog Days of Summer

Everyone needs a vacation, even the stock market. As the longer days of summer continue, and 90+ degree heat reminds us all that we should be on a beach somewhere, that same lull will be felt in the stock market as well.

Lower volume, and a light economic calendar all help to create a bit of a malaise during the summer months, which can often lead to some volatility because of that light volume.

Will we ever break out of this range?

The market seems to be quite content trading within its current range and doing as little as possible right now. There was an analyst note out last week that mentioned seeing profits being taken in areas like Energy and Financials, but no corresponding investment towards defensive and growth sectors which would be the naturally movement of the money. This is just one analyst note, but it does show that if this is being widely done, investors are keeping their powder dry for when we do eventually break out of this range.

Tug of War

The fundamentals of stocks just don’t point in one direction or another. There is nothing screaming a break out to the upside, just like there is nothing indicating a break out to the down side.

This, coupled with a tug of war between growth and value stocks are causing a week of people thinking were going to the moon, followed by a period of time where people think we’re in a recession, and start stocking up on canned goods.

The Psychology of Summer

With summer vacation brings with it two tiny voices asking for a snack just about every 6 minutes. Sometimes, they are still holding whatever they are currently eating, and are already asking for a snack. Boredom will do that to you, but lucky for my kids, I have tons of Math and Reading worksheets for that boredom.

It’s a little harder for adults who feel like no activity is somehow a bad thing. Boredom will lead to eating for adults as well, but it can also lead to trading. To trying to analyze your portfolio and you begin to think you have it figured out. You want to zig or zag, if for no other reason than to break up the monotony of boredom. Don’t fall for it, just like you work to not eat a bag of potato chip out of boredom, make sure you don’t let the malaise alter your plan.

So What?

So how does this impact all of you?

- Don’t let boredom throw you off track

- The dog days of summer are here, expect light volume with occasional volatility

Stock market calendar this week:

Wednesday July 7th:

FOMC Minutes 2:00PM

Thursday July 8th:

Initial and continuing Jobless Claims @ 8:30AM

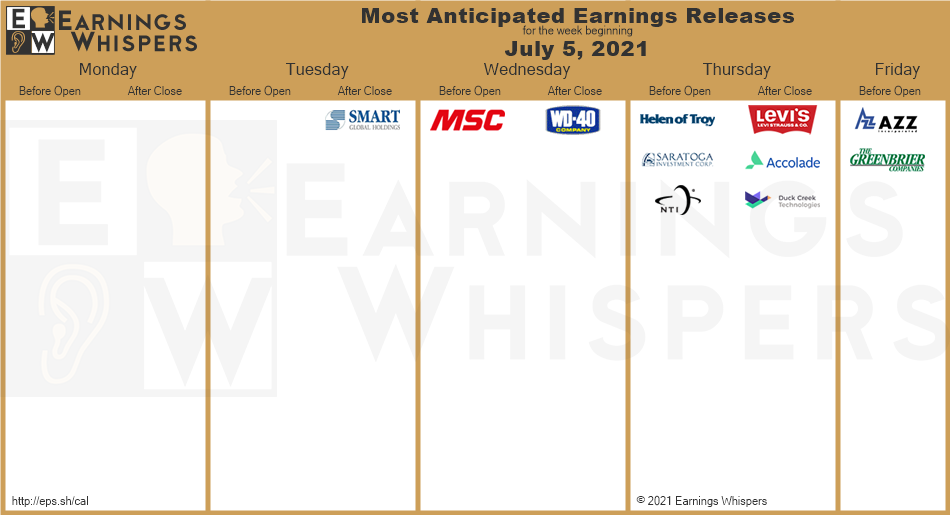

Most anticipated earnings for this week