July 4, 2022

Forefront‘s Monday Market Update

Let’s Be Real

The United States economy is already in a recession. We don’t need to wait for Q2 GDP numbers to be released later this month. The evidence is clear. More importantly, what many are missing, this is a good thing.

Trust the Data

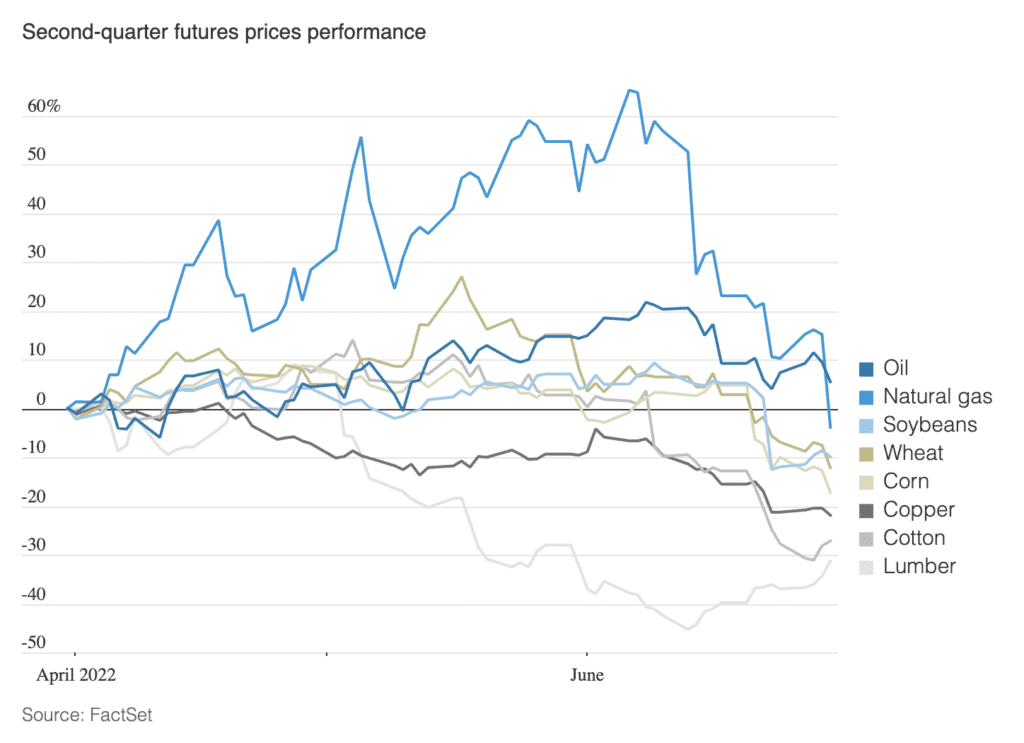

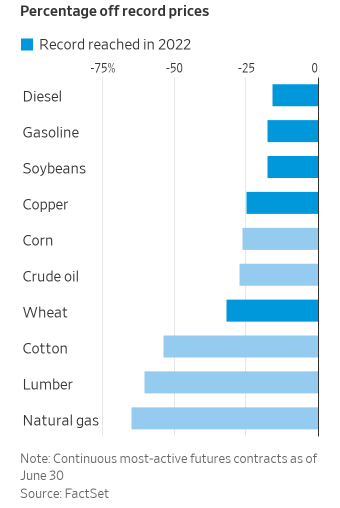

In Q2, Natural Gas Prices popped a tremendous 60% before plummeting and ending the quarter 3.9% lower. We saw crude oil prices slip from $120 a barrel to $106 a barrel by the quarter’s end. A host of other major commodities, such as wheat, corn, and soybeans, are cheaper now than in March. Since early May, cotton prices have dropped by 30+%, and the cost of copper and lumber fell 22% and 31%, respectively.

Will this impact the CPI and other inflation numbers this month or next? I don’t really know, and maybe it will take three months for this to trickle through the system, but I do know a waterfall-type drop in commodity prices will almost certainly translate to a reduction in inflationary stats and data.

A Recession Doesn’t Mean Doom

We all want the market to grow, adding to our net worth, very little stress, and feeling wealthy. It is ideal. Also, completely unrealistic. For the past fourteen years, we have had meager interest rates and an accommodative monetary policy. It has allowed our country to recover from the housing and jobs crisis in 2008, avoid plunging back into a recession in 2011, and weather the storm during a global pandemic that blindsided us.

With the data already pointing to inflation beginning to regulate, we have turned our attention to the idea of a recession. As I have already pointed out, it is not a news flash that the US economy is already in a recession.

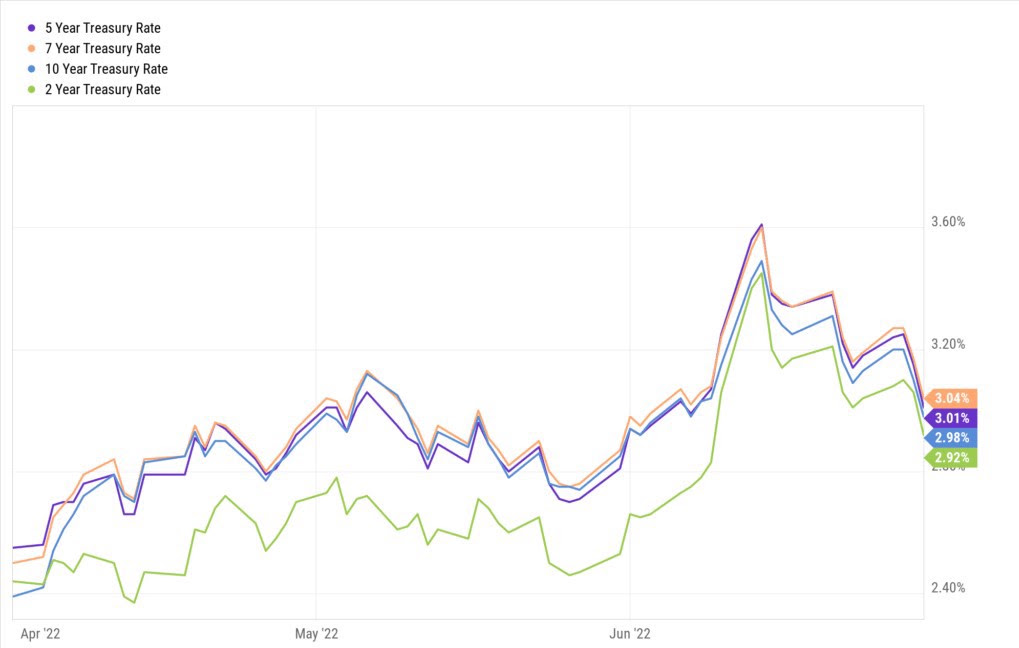

The bond market has been telling us that for nearly a month, and the chart above is a perfect illustration. Here you see the 2-, 5-, 7-, and 10-year treasury yields peak and start to fall as data softens and the markets begin to anticipate a recession being the greater risk, as data shows softening and inflation regulating.

Silver Lining

This is not exactly the market condition where silver linings are easy to find, but they exist and tell an important story.

Value and valuations are finally being restored after a long period of help from central banks. We are already seeing companies and entire oversold sectors, which bodes well for ALL long-term investors.

No longer will companies be propped up because of cheap money or because that cheap money is so readily available that investors pile into riskier and riskier trades. Companies that deserve to succeed and work to make their vision a reality and give value to shareholders will rise, while meme stocks and the like will fall away. The market will no longer feel like gambling because valuations are so far out of whack, and fundamentals will once again matter.

Bond yields and savings accounts will once again start to give a fixed interest rate that is better than .01% and will allow an older generation of Americans to utilize fixed income as a way to generate income in retirement. This has not been a viable option for income for nearly two decades. This is an excellent thing for older Americans.

I know it is hard to see silver linings, and there might be more pain and anxiety to deal with in the short term, but trust the data. We are already on the other side of this hill, even if the news and media want to keep us in fear for as long as possible.

So What?

So how does this impact all of you?

- Trust the data.

- There are silver linings, you just have to find them.

Stock market calendar this week:

| MONDAY, JULY 4 | |

| Independence Day holiday. None scheduled | |

| TUESDAY, JULY 5 | |

| 10:00 AM | Factory orders |

| 10:00 AM | Core capital equipment orders revision |

| WEDNESDAY, JULY 6 | |

| 9:45 AM | S&P Global U.S. services PMI (final) |

| 10:00 AM | ISM services index |

| 10:00 AM | Job openings |

| 10:00 AM | Quits |

| 2:00 PM | FOMC minutes |

| THURSDAY, JULY 7 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Foreign trade balance |

| 1:00 PM | St Louis Fed President James Bullard speaks |

| 1:00 PM | Fed Gov. Christopher Waller speaks at NABE conference |

| FRIDAY, JULY 8 | |

| 8:30 AM | Nonfarm payrolls (monthly change) |

| 8:30 AM | Unemployment rate |

| 8:30 AM | Average hourly earnings |

| 8:30 AM | Labor force participation rate, ages 25-54 |

| 10:00 AM | Wholesale inventories revision |

| 3:00 PM | Consumer credit |

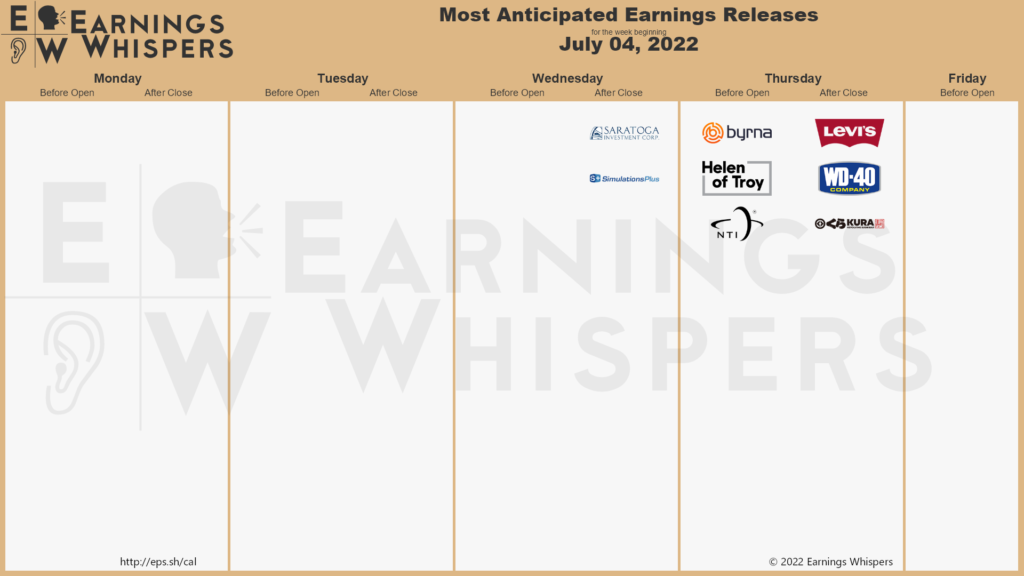

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.