Forefront’s Monday Market Update

What did 2021 teach us?

Every year between Christmas and New Years I go through an exercise of reflecting back on the previous 12 months and pulling lessons I have learned and putting them into a notebook. I look at this notebook daily and try and remind myself of all of the lessons I learn, so I can try and continue moving forward, both personally and professionally.

When I looked back at 2021, there are a few lessons that stand out to me.

If the earnings are there, the valuation will be supported

I wrote this lesson down at the end of 2020 as well, and I think I could have written this down at the end of each year for the past decade. There was a small sliver of time from the winter of 2014 until the summer of 2016 where earnings dipped, but other than that companies have grown their earnings pretty mightily.

The crazy part about 2021 is that the growth in valuation wasn’t based on pure speculation, the fundamentals supported that valuation growth 100%.

Amazon, Apple, Google, Microsoft, and Facebook have been growing at 30+% per year for the past 5 years, and that above all else is the best explanation for the run that the S&P500 is on. Earnings are the main fuel for stock price growth.

To start 2021 the S&P500 has a Price to Earnings (P/E) ratio of 30.7. Simply put, for every dollar of earnings you received, you paid $30.7 for that $1 dollar of earnings. At the end of 2021 the P/E ratio was 23.6.

Why would an investor have to pay less for that same dollar of earnings? Earnings grew faster than the S&P500 grew. Earnings were up 65% during 2021, far outpacing the 28% that the S&P500 was up.

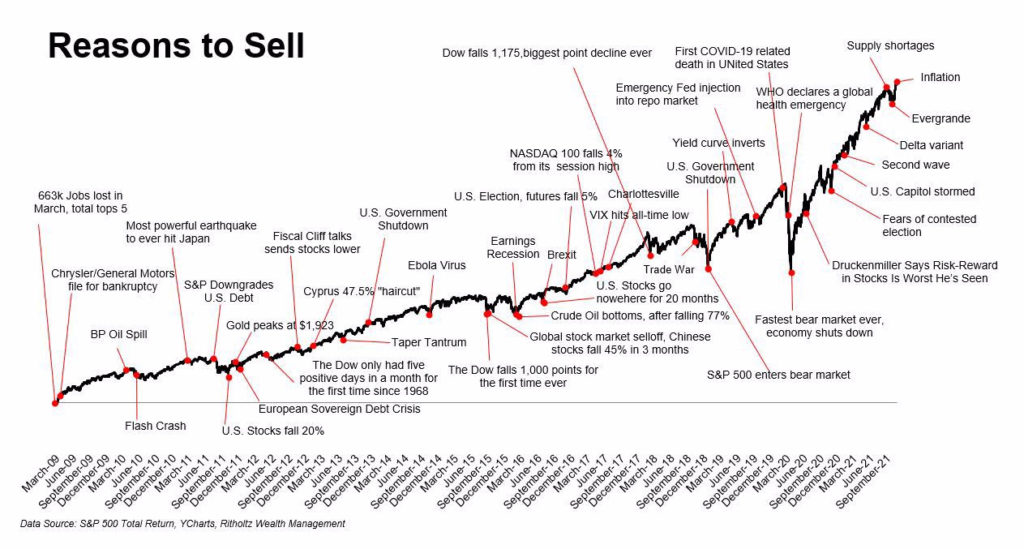

There is always a reason to sell, do you have the emotional control to fight the urge?

Stay at home stocks like Zoom and Teladoc are more than 70% off their all-time highs, and many thought that the bubble bursting in these stay-at-home plays would bring the rest of the market down with it. We had 70 all time highs in the S&P500 this year, more than the entire decades of the 1970s and 2000s, combined.

Bubbles exist within the broader markets, and just because some pop does not mean that will derail the entire market.

A bull market can last longer than we think, and having a knee jerk reaction to every single thing that might be a reason to sell would have had everyone sitting in cash waiting to get back in since 2009.

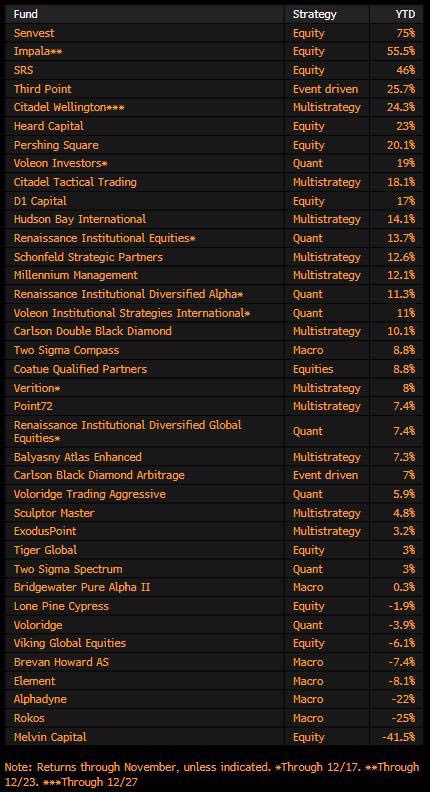

The experts are overrated

The hedge funds above have a combined 4,500+ years of experience in the market, and their performance really helps to show that experts are overrated.

Anytime you have an advisor who is telling you about how smart they are and their performance, and never once talks about their process, or planning, just know they aren’t actually that smart. We don’t necessarily get better at investing with experience because markets adapt, where humans sort of adapt, just very slowly.

Michael Batnick who is the Director of Research for Ritholtz Wealth Management has an amazing quote that sums up investing perfectly.

“The greatest lesson we can learn from history is that those who learn too much from it are doomed to draw parallels where none exist.”

Cynics sound smart, optimists build wealth

Talking heads on TV who tell you the world is ending can use data and numbers to sound very intelligent as they tell everyone to sell, sell, sell. All the while those talking heads are doing the opposite, but they sure do sound smart on TV. As the chart earlier shows, there will always be a reason to sell, but understanding that markets will go up and down, and keeping your emotions in check will be the key to building wealth.

Remember: Risk isn’t the possibility of something bad happening, risk is the possibility of something bad happening that you didn’t plan for!

So What?

So how does this impact all of you?

- Earnings matter, and is what justifies valuation

- Cynics sound smart, optimists build wealth

Stock market calendar this week:

| MONDAY, JAN. 3 | |

| 9:45 AM | Markit manufacturing PMI (final) |

| 9 AM | Construction spending |

| TUESDAY, JAN. 4 | |

| 10:00 AM | ISM manufacturing index |

| 10:00 AM | Job openings |

| 10:00 AM | Job quits |

| WEDNESDAY, JAN. 5 | |

| 8:15 AM | ADP employment report |

| 9:45 AM | Markit services PMI |

| 2:00 PM | FOMC minutes |

| THURSDAY, JAN. 6 | |

| 8:30 AM | Initial jobless claims (regular state program) |

| 8:30 AM | Continuing jobless claims (regular state program) |

| 8:30 AM | Trade deficit |

| 10:00 AM | ISM services index |

| 10:00 AM | Factory orders |

| FRIDAY, JAN. 7 | |

| 8:30 AM | Nonfarm payrolls |

| 8:30 AM | Unemployment rate |

| 8:30 AM | Average hourly earnings |

| 3:00 PM | Consumer credit |

Most anticipated earnings for this week: