Forefront’s Monday Market Update

Top 4 questions for 2022

As many of us finish taking down our Holiday decorations, and begin our push through the short, but cold days of winter I can’t help but notice that I am being asked the same few questions by an awful lot of my clients, and prospective clients.

Is the sky falling? When will the stock market inevitably crash?

Yes…….No…..Maybe!? At Forefront Wealth Planning we never, ever, look at the stock market as a short-term instrument, but rather as a loooooooong 30+ year investment.

If you hold the investment for that long period of time, the odds of your dollars being significantly higher at the end is extremely likely. The issue with these gains is that they will be inconsistent because corporations don’t earn, and distribute their profits on a consistent basis. Much like business cycles are inconsistent, stock market gains will be the same.

What we think of as a “crash” needs to be reframed in the publics mind as volatility. As stocks trade at higher multiples, meaning investors are willing to pay more in stock price for every dollar of earnings, the average draw down during times of volatility will grow. From 1980-2000 the average stock market drawdown was about -12%. From 2000-2020 the stock market multiples increased and the average drawdown increased to -16%. Higher multiples over the past 2 decades have led to higher returns, but have also been consistent with higher volatility.

Trying to predict what a long-term instrument will do in the short term is irrational and doesn’t work. It’s why I am so critical of talking heads on TV, they don’t have a clue what is going to happen, but love to stir up emotions so people will continue to tune in or click.

Although making predictions is irrational, we do expect to see a year in the market with far more potholes in the road than we saw in 2021. As long as we approach these potholes cautiously, and intelligently the sky won’t ever be falling.

Will inflation kill the economy?

Governments across the entire globe printed a TON of money, both to fend off the pandemic, as well as to combat other economic challenges that we have faced over the past decade. Now, throw in some pretty unique supply constraints and you have a perfect recipe for an inflationary environment. The fed has indicated, and followed through with a plan to reduce bond purchases and unwind their balance sheet. Back in October the Fed was buying nearly 50% of all new treasury bond issuance, compared to only 26% now. This is a key driver of interest rates moving up.

We should see a seasonal decline in shipping, along with some people returning to the office and back into a traditional work structure as we knew pre-pandemic. This should help to loosen supply chains, and we are seeing this play out in real time. Commodity prices have come down 4% since October. Do not think that this means we return to our sub 2% inflation like we had grown accustomed to. Be prepared to see top line CPI of 6% well into 2022, but it will subside as the year goes on.

What is going on in the housing market?

Much like the stock market, your house isn’t really meant to be looked at as an investment, but if you choose to do so, it needs to be viewed as a long-term investment of 20+ years. Making short term predictions on a long-term investment is irrational at best. That being said, one of the major drivers to our pandemic recovery was the massive about of investment people put into their primary residence. Your house all of a sudden became not only your home, but also your office going forward, and for about a year a classroom as well. If I had to pick one real risk I see to the US economy over the next 12-18 months it would be some level of reversal in home prices, and even though we may not see our home price come down, the days of selling your home in 72 hours, with 16 offers, and 20% above ask are going to end sooner rather than later.

Should I buy bitcoin or crypto currency in general?

I find crypto currency and block chain technology to be absolutely fascinating. I love to read and learn about it and really dive in head first. From all of my learning, I have understood two major factors when it comes to investing in crypto. You MUST be willing to lose all of your money, and you MUST leave the investment alone for a long period of time.

Yes, some people day trade crypto currency, and it’s who we hear about on the internet all the time, but most of us just don’t have the time or desire to be day trading anything. Crypto currency is the definition of wild volatility, and if you can’t stomach it, you will inevitably make an emotional decision costing yourself money. It serves as a fun, speculative investment that certainly has a place in some people’s overall portfolios.

So What?

So how does this impact all of you?

- Investing is a long term endeavor. We can make short term predictions, but most will be wrong.

- Cynics sound smart, optimists build wealth

Stock market calendar this week:

| MONDAY, JAN. 10 | |

| 10:00 AM | Wholesale inventories (revision) |

| TUESDAY, JAN. 11 | |

| 6:00 AM | NFIB small-business index |

| 9:12 AM | Cleveland Fed President Loretta Mester speaks |

| 9:30 AM | Kansas City Fed President Esther George speaks |

| 10:00 AM | Fed Chairman Jerome Powell confirmation hearing |

| 4:00 PM | St. Louis Fed President James Bullard speaks |

| WEDNESDAY, JAN. 12 | |

| 8:30 AM | Consumer price index (month-to-month) |

| 8:30 AM | Core CPI (month-to-month) |

| 8:30 AM | Consumer price index (year-over-year) |

| 8:30 AM | Core CPI (year-over-year) |

| 1:00 PM | Minneapolis Fed President Neel Kashkari speaks |

| 2:00 PM | Federal budget |

| 2:00 PM | Beige book |

| THURSDAY, JAN. 13 | |

| 8:30 AM | Initial jobless claims (regular state program) |

| 8:30 AM | Continuing jobless claims (regular state program) |

| 8:30 AM | Producer price index |

| 10:00 AM | Fed Vice Chairman-select Lael Brainard’s confirmation hearing |

| 12 noon | Richmond Fed President Tom Barkin speaks |

| 1:00 PM | Chicago Fed President Charles Evans speaks |

| FRIDAY, JAN. 14 | |

| 8:30 AM | Retail sales |

| 8:30 AM | Retail sales excluding autos |

| 8:30 AM | Import price index |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | UMich consumer sentiment index (preliminary) |

| 10:00 AM | Business inventories |

| 11:00 AM | New York Fed President John Williams speaks |

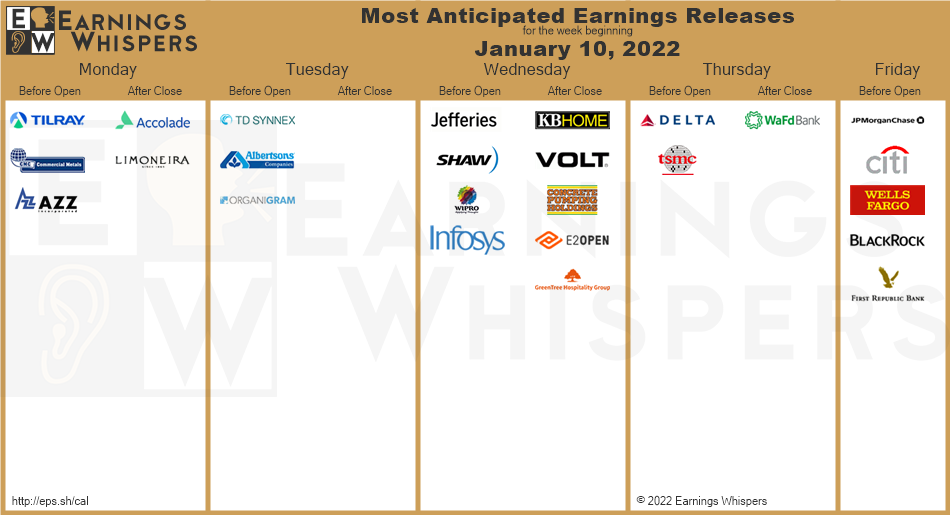

Most anticipated earnings for this week: