Forefront’s Monday Market Update

The tail that wags the dog

If the chart for the past couple of weeks were a rollercoaster track, all of our stomachs would be churning from the steep drops. If you compare that chart to other draw downs in the overall market you will realize that instead of riding Space Mountain, we were actually on the Dumbo Ride.

Now here is the crazy part of the current market volatility; the more diversified you are, the worse your performance has been. Seems like the opposite of what is supposed to happen right?

Market Capitalization

Before I discuss the current volatility, let’s get a bit of education out of the way. A companies Market Cap is a measure of a company’s value in the most simplistic terms. You can calculate the market cap by simply multiplying the number of shares outstanding with the share price.

Weighting

Indexes like the S&P500 are what you call market cap weighted indexes. This means, the larger the company, the more weighting it has in the overall index. The easiest way to look at this is the bigger the company the more impact it has on moving the market. If the top 20 companies in the S&P500, which makes up 35% of the overall index are all up for the day, it will take a healthy drop in the other 480 companies for the index to actually be down for the day.

The reality of what’s going on

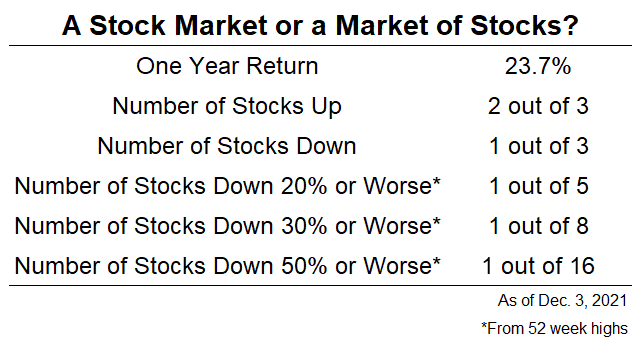

As the market is up roughly 18+% this year, one out of three stocks have a negative return for the year. 33% of stocks are down for the year, and 20% of stocks are down by 20% or more.

If you think that’s crazy, 12.5% of stocks are down more than 30% from their 52-week high, and a little more than 5% of stocks are down 50% from their 52-week highs.

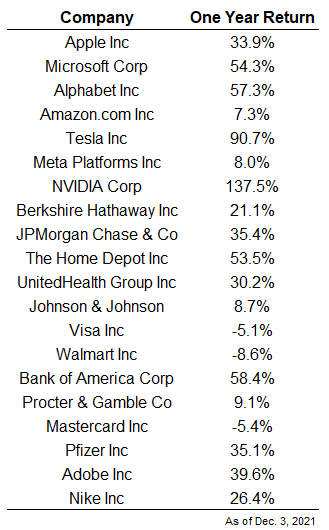

The chart above shows the top 20 names from the Russell 3000, which is a much wider breadth of the overall market because it tracks 3000 companies rather than 500 like the S&P or 30 like the Dow.

Only 3 of the top 20 stocks is down for the year, but given the media hysteria, one would think all of these companies should be down for the year.

CNBC et al. have made a living on making the public think that things are much better or much worse than they actually are. The more emotional you are, the more you will tune in.

What do we do going forward?

Soap and your portfolio have a lot in common; the more you touch them, the faster they will disappear.

All of my writing is meant to be educational, and never to spark you to do one thing or another. The simple truth is the best way to achieve investing success is to automate savings and investing, start as early in life as possible, and leave your money alone.

What we have to keep in mind during times of extreme volatility is perspective.

For many of you reading this, you have lived through multiple market drops, corrections, and even times when we thought the world might be over (hello 2008). The market, and subsequently the world, is not as bad as social media or the news wants you to think it is.

If you find yourself stressed, or on the brink of panic when you see stock market red, or read the headlines, then fall back on the plan you have created with your advisor/planner.

The reason financial plans are so important is not only a guide for the future, but also a place to take solace when trees don’t grow to the sky, which is inevitable.

A good plan will have considered all types of volatility, but more importantly should be custom tailored around who you are. How much risk can you take and not panic? What market events in the past have caused you the most distress vs others that you barely noticed? What is the family dynamic, and what is coming up in the future?

The performance of XYZ stock is not what will help you sleep at night. Knowing you have a plan in place, and have considered whatever might be thrown your way is exactly what you need to sleep well at night.

So What?

So how does this impact all of you?

- Your portfolio and soap are a lot alike, the more you touch them the faster they disappear

- Your financial plan isn’t just a guide for the future, but a resource to help stay calm during market pull backs.

Stock market calendar this week:

| MONDAY, DEC. 6 | |

| None scheduled | |

| TUESDAY, DEC. 7 | |

| 8:30 AM | Trade deficit |

| 8:30 AM | Productivity revision (SAAR) |

| 8:30 AM | Unit labor costs revision (SAAR) |

| 3:00 PM | Consumer credit (monthly change) |

|

WEDNESDAY,

DEC 8

|

|

| 10:00 AM | Job openings |

| 10:00 AM | Job quits |

| THURSDAY, DEC. 9 | |

| 8:30 AM | Initial jobless claims (regular state program) |

| 8:30 AM | Continuing jobless claims (regular state program) |

| 10:00 AM | Wholesale inventories (revision) |

| 12 noon | Real household wealth |

| 12 noon | Real domestic nonfinancial debt |

| FRIDAY, DEC. 10 | |

| 8:30 AM | Consumer price index |

| 8:30 AM | Core inflation |

| 8:30 AM | CPI (year-over-year change) |

| 10:00 AM | UMich consumer sentiment index (preliminary) |

| 10:00 AM | Expected inflation, five-years (preliminary) |

| 2:00 PM | Federal budget |

Most anticipated earnings for this week: