April 4, 2022

Forefront’s Monday Market Update

What Does an Inverted Yield Curve Mean?

On Tuesday of last week, I felt like I was living in a distorted version of the children’s book, “Chicken Little”. Everywhere you turned, all you heard was “the yield curve has inverted, the yield curve has inverted”, as just like Chicken Little running through the farm telling all the animals that the sky was falling. As I began getting questions about an inverted yield curve, I realized that most people were unaware of what it meant, and its indication for the future.

What is an inverted yield curve?

The yield curve inverts when a shorter duration treasury bond, like the 2-year treasury bond, has an interest rate that is higher than a longer duration treasury bond, like the 10-year treasury bond. In practice, this means that borrowing for the short term is more expensive than borrowing for the long term.

If you ask to borrow money from me for a short period of time, the interest I might charge you will be determined by the amount of time my money will be tied up, how safe of a bet that my money will be returned on its due date, and how long in the future that due date occurs. Shorter term means my money is tied up for less time, thus comes with a lower interest rate.

If that same scenario from above occurs, but this time you want to borrow the money for 5X as long, the interest rate will be higher because my money is tied up for longer, and there is a greater risk of something happening over a long period of time than a short period of time.

What does it mean?

Many investors look at an inverted yield curve as a recession indicator for the future. Last Tuesday when the 2-year and 10-year treasury bond yields inverted it sent warning signals throughout the markets, and that was reflected in the drop in equity values.

Since 1900 the 2/10-year treasury yields have inverted a total of 28 times, and in 22 of those 28 times a recession followed. The average time before a recession after the yield curve inversion was about 22 months, but tends to range from between 6 months and 36 months.

The last time the yield curve inverted was 2019 and a recession followed in 2020. This data is very clear, but I have to wonder, did the yield curve way back in 2019 know that there would be a global pandemic?

Why is the yield curve inverting now?

The yields on short term government debt have been rising quickly in anticipation of multiple interest rate hikes by the U.S Federal Reserve, as they have indicated to the public during each of their meetings this year. This has occurred while longer term government debt has seen yields move at a much slower pace, as investors are concerned that by raising interest rates it might hurt the overall economy, which is keeping long term interest rates lower.

We are only talking about the 2-year and the 10-year treasury bonds inverting, but what about other parts of the yield curve? Are we being given just the bad news so we have an emotional response and keep watching or clicking?

Mixed signals

Another widely monitored and studied spread on the yield curve is the difference between the yield on 3-month treasury bills and 10-year treasury notes. That spread has been widening this month which is generally a good signal, making some think a recession is not imminent. Some are making the argument that the Fed’s bond buying program over the past two years has resulted in a severely undervalued 10-year yield that will rise as the central bank shrinks their balance sheet further.

Bottom line

No matter how much data you analyze, luck, in the short term, plays a huge role in market predictions.

An inverted or flat yield curve does mean a few concrete things. Borrowing money becomes more expensive. This goes for both consumers and businesses, as everything from mortgages to credit cards, to small business loans will become more expensive. When there is a large spread between short- and long-term rates, it is more profitable for banks, but as the spread becomes lower, banks may restrict lending. These are real issues that can impact the markets, but predicting, if they will, or when they will is not something that can be done consistently. Build your plan to withstand all different economic environments, especially the difficult and uncertain ones.

So What?

So how does this impact all of you?

- The market has lots of indicators, sometimes going off at the same time, telling your opposite things.

- Predicting what will happen is not the way, planning for all economic environments is the best way to build and preserve wealth.

Stock market calendar this week:

| MONDAY, APRIL 4 | |

| 10:00 AM | Factory orders |

| 10:00 AM | Core capital equipment orders (revision) |

| TUESDAY, APRIL 5 | |

| 8:30 AM | Foreign trade deficit |

| 9:45 AM | S&P Global (Markit) services PMI (final) |

| 10:00 AM | ISM services index |

| 11:00 AM | Fed Gov. Lael Brainard speaks on inflation inequality |

| 12:30 PM | San Francisco Fed President Mary Daly speaks on the economy |

| 2:00 PM | New York Fed President John Williams speaks on health |

| WEDNESDAY, APRIL 6 | |

| 9:30 AM | Philadelphia Fed President Patrick Harker speaks on the economy |

| 2:00 PM | FOMC minutes |

| THURSDAY, APRIL 7 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 9:00 AM | St. Louis Fed President James Bullard speaks on the economy |

| 2:00 PM | Fed bank presidents Charles Evans and Raphael Bostic speak on inclusive full employment |

| 3:00 PM | Consumer credit |

| FRIDAY, APRIL 8 | |

| 10:00 AM | Wholesale inventories (revision) |

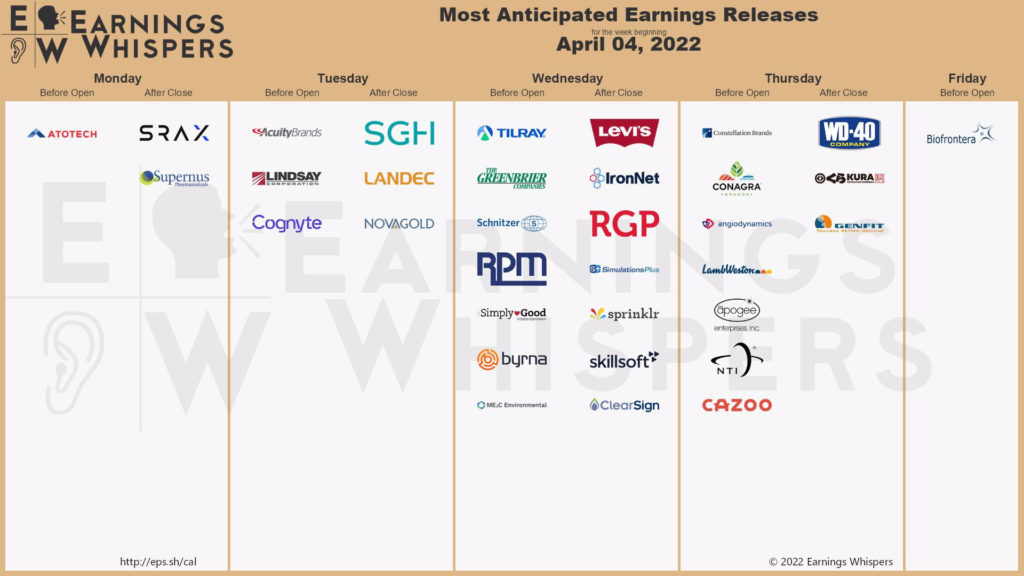

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.