April 11, 2022

Forefront’s Monday Market Update

Is Inflation Bad for Stock Prices?

It is natural, as an investor, and a human, to be nervous about your life savings. I am a financial planner for a living, and I am constantly nervous about my life savings. Having children who are 8 and 7 years old has just further deepened my belief that saving money is HARD! Between winter jackets costing $100 dollars, sports and activity costs, and everything in between, I understand that any money saved up came from sacrifice and planning.

So, I feel the anxiety and stress just as much as my clients when we hear data points that seem scary, and are exacerbated by our own emotions, and the overall media industry inflating the severity of pretty much everything. Over the past few weeks, the buzz word we keep hearing is inflation, inflation, inflation.

How bad is it?

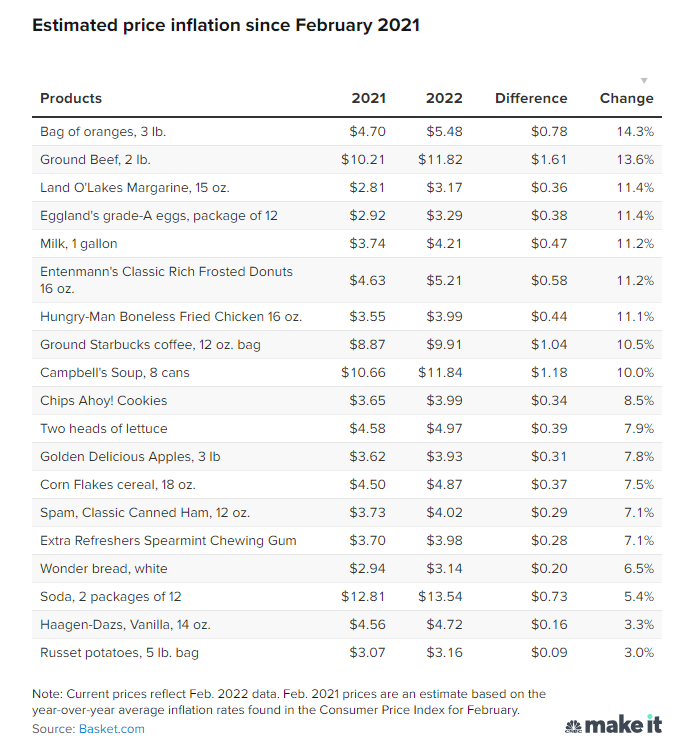

The chart above is just for grocery items, but it does a good job of illustrating that the costs of goods are certainly going up, and is absolutely impacting all of our wallet’s day to day. I update budgets with my financial planning clients on an ongoing basis and every single person has needed to increase their monthly budget for a number of items -, food, and fuel being the top of that last. We know rising costs have an impact on our budgets in the short term, but what does inflation mean for the stock market?

Inflation and stock prices

I continue to have conversations with clients who are asking if they should change their stock allocation, and move more money into US Treasury bonds. While most advisors scoff at clients wanting to make any changes, I don’t blame my clients at all! In fact, if we look at the data, it is quite clear that U.S stocks have lower returns in years of high inflation and after the yield curve has inverted. If you are not sure what an inverted yield curve is, check out last week’s blog post where I give an easily understood explanation.

When inflation exceeds 7%, as it does right now, the median return for U.S stocks over the year was 7.3% compared to 10.3% when inflation is below 7%.

We can take a look at the same data, but instead of looking at it while inflation is above or below 7%, we can look at the data to see what happens after a yield curve inversion. Since August of 1978 the median inflation-adjusted return of U.S stocks was 4.7% after a yield curve inversion, compared to 9% during all other periods.

With those data points, it is easy to understand why people want to reduce their stock allocation, and move towards the safety of bonds. This is where CNBC and talking heads would stop their segment, because the juicy information has been provided, and causing stress and anxiety to the masses has been achieved. How come they don’t give us the data on how U.S treasury bonds have performed under the same circumstances I described above?

Inflation and Bonds

When inflation is higher than 7% the inflation adjusted return on the 5-year U.S Treasury bond is -2.6% over the next year, which is far lower than the 7.3% in U.S stocks.

Again, going back to August of 1978, each yield curve inversion saw the median inflation adjusted return on the five year to be 3.9%, compared to the 4.7% for U.S stocks over the following year.

Enough data, tell me what to do!

First, don’t panic. We are all long-term investors, except we all want to know what the stock market did TODAY! Short term volatility needs to be solved with a proper savings plan, and emergency fund. There is no way to trade your account away from volatility – but what’s important is to make sure you have enough cash that makes you comfortable, and focus on the long term.

History is a nice indication of what happened in the past, but it doesn’t mean that is what will happen in the future. The last time the yield curve inverted was in August of 2019, and if you had cashed out your portfolio at that point, you would have missed out on the 68% returns we have seen since then. In that time, we also saw the market fall hard because of covid but no one said the returns would be only going up, volatility is a thing, and we all have to be prepared for it.

I must sound like a broken record at this point, but the final thing for you to do is stay the course. I won’t link all of the blog posts, but the data and evidence is clear, time is what makes you money in the market. Exposing your money, and leaving it alone for as long as possible. Trying to outsmart an irrational market in the short term, is going to make you miss the potentially tremendous gains that the market will undoubtably have over time.

So What?

So how does this impact all of you?

- The market has lots of indicators, sometimes going off at the same time, telling your opposite things.

- Predicting what will happen is not the way, planning for all economic environments is the best way to build and preserve wealth.

Stock market calendar this week:

| MONDAY, APRIL 11 | |

| 11:00 AM | NY Fed median 1-year expected inflation |

| 11:00 AM | NY Fed median 3-year expected inflation |

| 12:40 PM | Chicago Fed President Charles Evans speaks |

| TUESDAY, APRIL 12 | |

| 6:00 AM | NFIB small-business index |

| 8:30 AM | Consumer price index (monthly) |

| 8:30 AM | Core CPI (monthly) |

| 8:30 AM | CPI (year-over-year) |

| 8:30 AM | Core CPI (year-over-year)) |

| 12:10 PM | Fed Gov. Lael Brainard speaks at WSJ event |

| 2:00 PM | Federal budget deficit |

| 6:45 PM | Richmond Fed Fed President Tom Barkin speaks to Money Marketeers |

| WEDNESDAY, APRIL 13 | |

| 8:30 AM | Producer price index final demand |

| THURSDAY, APRIL 14 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Continuing jobless claims |

| 8:30 AM | Retail sales |

| 8:30 AM | Retail sales excluding motor vehicles |

| 8:30 AM | Import price index |

| FRIDAY, APRIL 15 | |

| 8:30 AM | Empire state manufacturing index |

| 9:15 AM | Industrial production index |

| 9:15 AM | Capacity utilization |

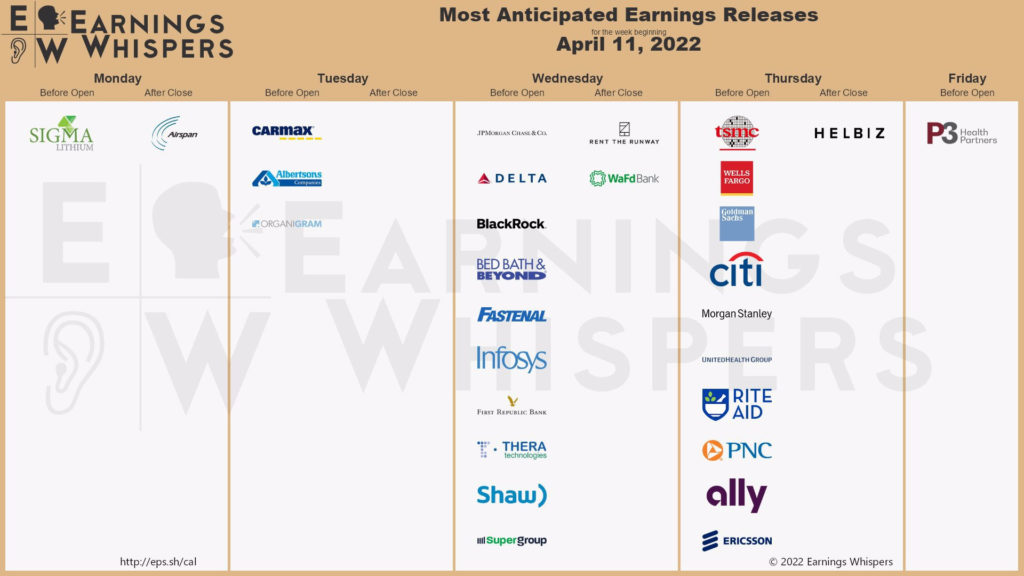

Most anticipated earnings for this week:

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.