Missing the boat

If you could make 7% on your investments for doing relatively little, would you take that deal? No, I am not going to try and sell you a newsletter with a get rich quick scheme, but I know the answer to my question is a loud and enthusiastic YES!

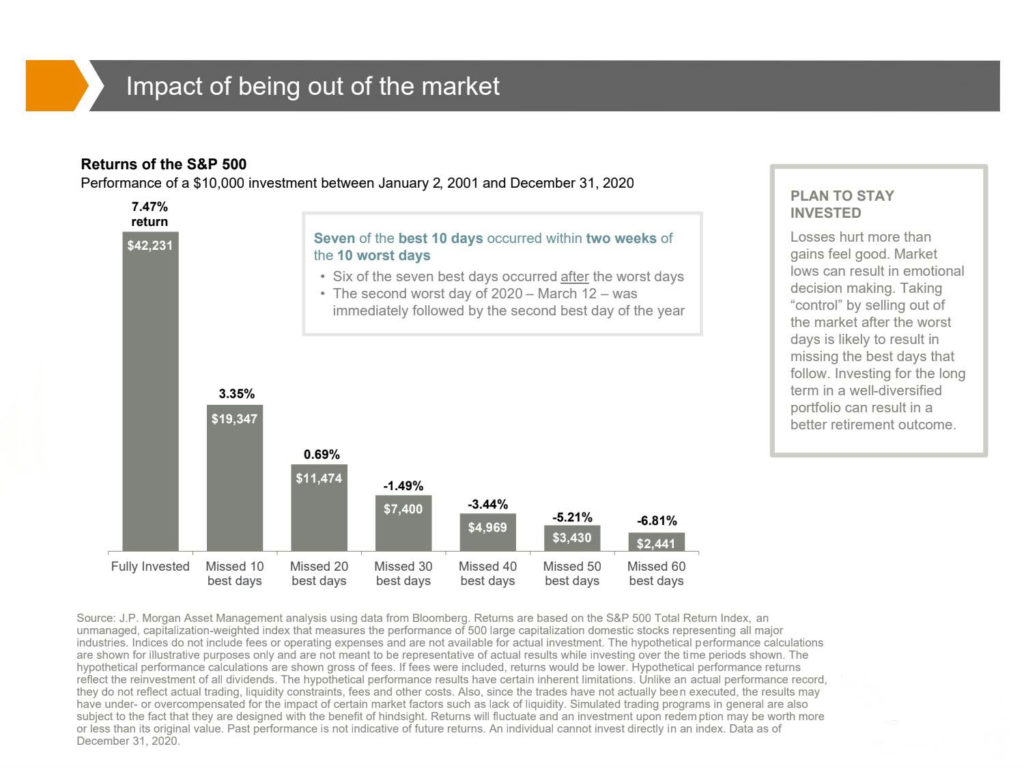

From Jan 1, 2001 to December 31st, 2020 the S&P500 total return index had an annualized rate of return 7.47% which includes reinvestment of dividends. There you go, 7% a year on your investments. All you had to do was ignore a few things.

Like a terrorist attack on September 11th, 2001.

Disregard a sudden drop in interest rates because of that attack which led to a housing bubble.

Once that bubble popped of course we had the housing and jobs crisis of 2008/2009 which I am sure we all still remember well.

Throw in some flash crashes, an absolutely bonkers political, and geopolitical landscape and student loan debt growing wildly out of control and it was an altogether uneventful 2 decades, right?

Did I forget to mention the global pandemic that shut down the world in 2020?

5,040

There are on average of 252 trading days per year. Since Jan 1, 2001 that is about 5,040 total trading days. If you missed the 10 best days your average annual returns fall from 7.47% to 3.35%.

Returns cut in half for missing 10 trading days out of 5,040.

Want to know the best part? Seven of the best 10 days occurred within two weeks of the 10 worst days. Six of the seven best days occurred AFTER the worst days. The 2nd worst day of 2020 was on March 12th. The very next day was the second-best day of 2020.

Intelligence vs Behavior

Investment success is a soft skill, not a hard science and your behavior will have far more to do with your likelihood of success than your intelligence.

The amount of data available telling you that time and discipline will almost certainly lead to success is mind boggling, but most people like to think they can outsmart the stock market. There are hundreds of YouTube channels promising trading tips and tricks, and if you don’t like YouTube, I am sure the local drycleaner has a good stock tip.

Overcoming this natural inclination to “play” the market will be one of the largest drivers to you eventually being wealthy. Especially right now as the future seems uncertain with a gradual reopening of the US economy, but the looming possibility of higher taxes and new policies.

How?

So how do we avoid this pivotal mistake in our investment management and financial planning? For some it means actually having a trading account! Only for 5-7% of their total investable assets, let’s not get carried away. Just enough to scratch the itch of trading and allow you to leave the serious money alone to grow in a disciplined plan over time.

Identifying personal behavioral triggers and trends and making sure your investments and your financial plan are built around them is also paramount. We are all shaped by our financial upbringing and all of us are unique. Making sure your plan is designed for you will let you sleep at night even during the most volatile of times in the market.

So What?

So how does this impact all of you?

- Missing specific days in the market drastically changes returns. Timing those days is impossible.

- Your behavior is more important than your intelligence. Focus on building a plan around your behavioral tendencies not on “playing” the market.

Stock market calendar this week:

Wednesday April 28th:

Fed Chair Jerome Powell press conference @ 2:30PM

Thursday April 29th:

Initial and continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week