Being right all the time is hard, actually it’s impossible

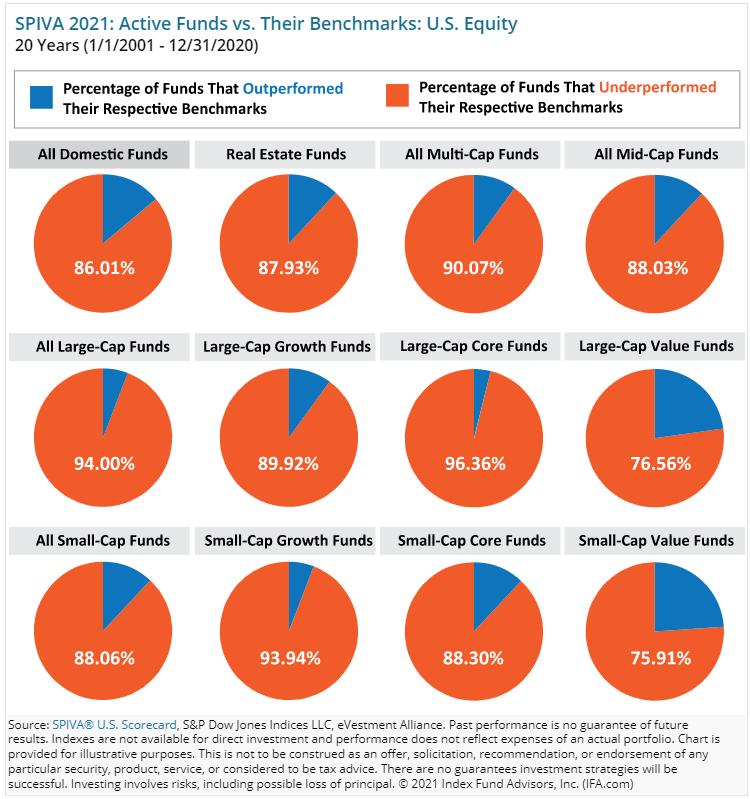

1 out of 10 active managers beats the overall index, and the best part…. That one manager changes all the time. There aren’t a few people out there who just consistently can beat the markets over and over the way Tom Brady goes to Superbowls or Mariano Rivera closed out baseball games.

When you look at the chart above you see that managers across all different fund domains generally underperform their respective benchmarks. So, why would someone ever do anything but simply buy index funds?

Not the answer most people expect

If you are below the age of 45 or so, you already are predominantly investing in index funds. Your employer sponsored retirement account (401K, 403B) provides limited choices to you, most of which are index funds. For most people just entering the middle part of their careers, a majority of your wealth is tied up in your home and your employer sponsored plans. If you leave your job, you can now move your 401K into an IRA and your investment restrictions are gone.

Buying index funds is okay. Most people are hesitant to tell me that is their strategy for fear that it will offend me as a financial planner or something. That couldn’t be further from the truth. This is a great strategy for a lot of people and something I will always stand behind. You don’t hire a financial planner to pick investments for you, you hire them to map out your plan.

Nothing new

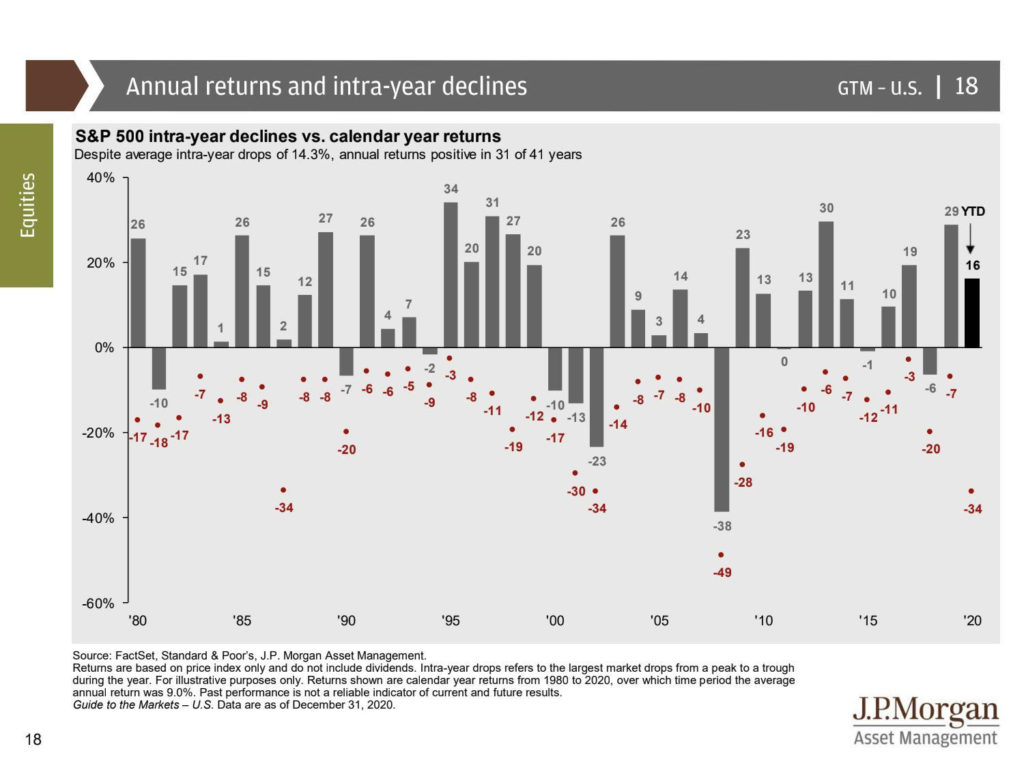

I have shared the chart above before, but its important to take a look at again. It shows the returns of the S&P 500 each year, but the red dots below the 0% line show the intra year declines the market felt at some point in that given year. In 2020, before the market increased by 16% it was down by 34%. Most people have a tough time stomaching swings like that in their portfolio, but it had widely been accepted as the new norm. Making sure your financial plan is aligned with your behavioral tendencies is the difference between success and failure.

So What?

So how does this impact all of you?

- If your plan isn’t alligned with your behavioral tendencies, it will be harder to succeed.

- Beating an index is nearly impossible, it’s not a measure of success

Stock market calendar this week:

Thursday April 22nd:

Initial and continuing Jobless Claims @ 8:30AM

Most anticipated earnings for this week