Life Insurance Basics

Life Insurance Basics

Life insurance can be an incredible planning tool that reduces your family’s risk and protects them on your worst day. The biggest issue I find with clients is a lack of proper guidance when purchasing life insurance and people not understanding their needs, their options, and the most effective solution to solve them.

Before continuing, I should throw in a quick disclaimer. I don’t sell life insurance. I make absolutely no money if my clients buy life insurance, and I have no skin in the game whether you love life insurance or think it’s a scam.

One of the best pieces of advice my father ever gave me when making any large purchase is to have someone in the conversation who is not getting compensated for what you buy.

The Basics

There are two main types of life insurance: term and permanent insurance. Within permanent life insurance, there are four subcategories, with the most known type being whole life insurance.

Insurance agents are compensated via commission when selling you a life insurance policy, making very little money selling you a term policy and significantly more when selling you a permanent life insurance policy.

Insurance As an Investment

Permanent life insurance policies have hefty surrender fees, usually at least for the first ten years, so buying one is a commitment. If you trade your portfolio or are constantly looking for the next stock to buy, a commitment for this amount of time might not be suitable for you.

If you are looking to invest your money, then buy an investment. If you want to protect your family in case of catastrophe, purchase life insurance. Insurance should not be an investment.

You can borrow from a permanent life insurance policy “tax-free” is one of the major selling points of insurance as an investment, but keep in mind a loan from a bank is also “tax-free.” The other selling point is that our country’s Ultra High Net Worth individuals all have huge permanent life insurance policies. They also have tremendous needs and risks that they are trying to solve. These are often risks and needs that we non- Elon Musk types don’t have.

What do I Own?

The only life insurance policies my family owns are term insurance policies. We have found term policies to be cost-effective to provide millions of dollars of coverage to solve a specific need. When approaching any investment or tool, I always look at our needs first and then what tool will satisfy those needs. Life insurance is an important tool, but make sure the person you are buying it from is trying to solve your needs and not trying to sell you the highest commissionable product they can.

Stock market calendar this week:

|

TIME (ET)

|

REPORT |

| MONDAY, OCT 9 | |

| 9:00 AM | Dallas Fed President Logan speaks |

| 12:50 PM | Fed Gov. Jefferson speaks |

| TUESDAY, OCT 10 | |

| 6:00 AM | NFIB optimism index |

| 10:00 AM | Wholesale inventories |

| WEDNESDAY, OCT 11 | |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| 2:00 PM | Minutes of Fed’s September FOMC meeting |

| THURSDAY, OCT 12 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Consumer price index |

| 8:30 AM | Core CPI |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI year over year |

| FRIDAY, OCT 13 | |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 10:00 AM | Consumer sentiment (preliminary) |

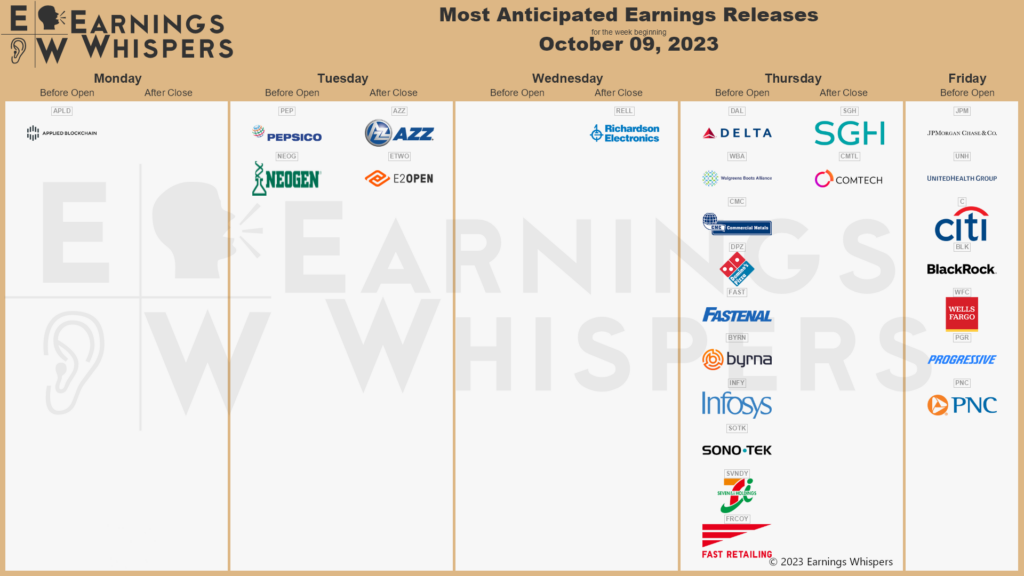

Most anticipated earnings for this week:

Did you miss our blog last week?

Jargon of Estate Planning Explained

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.