Financial Planning and Self Care

Financial wellness is an essential aspect of our overall well-being, and it’s closely linked to our ability to manage stress, maintain good physical and mental health, and enjoy a balanced, fulfilled life. Just as self-care encompasses pillars to foster a holistic approach to well-being, achieving financial wellness can be viewed through the same lens.

Physical Self Care

Physical well-being is the foundation upon which all other aspects of self-care are built. The first step of physical self-care is to assess the number of calories you put into your body and the number of calories your body is burning for energy throughout the day. Once you have determined this, you can start exercising based on your most immediate needs, but over time, you will settle into a routine that works specifically for you.

This same principle and discipline needed for success are the same as the foundation of building your financial plan: to determine money coming in and money going out. Once we have established what we bring in and what we spend, we can set about an “exercise” routine to save money that is custom to your unique situation.

Much like physical self-care, there are a lot of self-proclaimed experts out there, all giving “advice,” but as you dig deeper, you realize most of these talking heads are just trying to sell you their product or program.

Emotional Self Care

Managing your emotions is vital for financial wellness. The term retail therapy is a thing for a reason, and emotional distress can often lead to impulsive spending. Life is hard, and feeling a certain way sometimes can’t be helped, but when those emotions cloud your judgment when making financial decisions, the effects can devastate your overall plan.

A significant area we work with clients is understanding not just their plan to build and distribute wealth but also the things that will impact it and separate emotional feelings, with strategic changes designed to bring you closer to your goals.

Intellectual Self Care

Intellectual self-care when it comes to financial wellness is tough. I always promote reading and learning to my clients, but often, that causes the pendulum to swing too far in the opposite direction. I met with a family early this year that hadn’t made a budget in fifteen years, but after reading a Dave Ramsey book, I think they budgeted so diligently that they didn’t want to spend money on their child’s braces.

Educating yourself and building knowledge is a fantastic way to take control of your intellectual self-care. Still, we have to be very careful that we have perspective on our lives so we don’t take the advice and knowledge we are learning to be taken too far.

So, What

My daughter, Priya, turned nine years old last Friday, and every year, I am constantly reminded of her first birthday party. At her first birthday party, I weighed nearly 320 pounds and was lying on the ground with her playing, but I was out of breath from getting to the ground and standing back up.

Taking control of my physical self-care made me a better dad, husband, friend, and financial planner. Some people don’t need to lose weight; maybe they need a friend to lean on or a shoulder to cry on, but taking control of your self-care will also translate into better financial health.

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, OCT. 16 | |

| 8:30 AM | Empire State manufacturing survey |

| 10:30 AM | Philadelphia Fed President Patrick Harker speaks |

| 4:30 PM | Philadelphia Fed President Patrick Harker speaks |

| TUESDAY, OCT. 17 | |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:30 AM | Fed Gov. Michelle Bowman speaks |

| 10:00 AM | Business inventories |

| 10:00 AM | Home builder confidence index |

| 10:45 AM | Richmond Fed President Tom Barkin speaks |

| 10:30 AM | Minneapolis Fed President Neel Kashkari speaks |

| WEDNESDAY, OCT. 18 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 12:00 PM | Fed Gov. Chris Waller speaks |

| 12:30 PM | New York Fed President John Williams speaks |

| 2:00 PM | Fed Beige Book |

| 6:55 PM | Fed Gov. Lisa Cook speaks |

| THURSDAY, OCT. 19 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 10:00 AM | Existing home sales |

| 10:00 AM | U.S. leading economic indicators |

| 12:00 PM | Fed Chairman Jerome Powell speaks |

| 1:20 PM | Chicago Fed President Austan Goolsbee speaks |

| 1:30 PM | Fed Vice-Chair for Banking Michael Barr speaks |

| 4:00 PM | Atlanta Fed President Raphael Bostic speaks |

| 6:40 PM | Dallas Fed President Lorie Logan speaks |

| FRIDAY, OCT. 20 | |

| 12:15 PM | Cleveland Fed President Loretta Mester speaks |

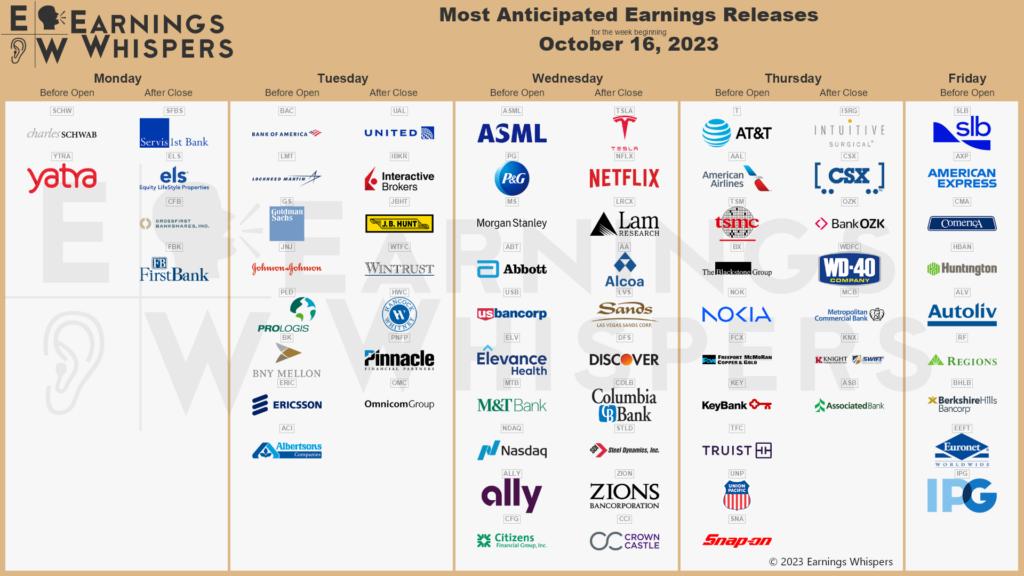

Most anticipated earnings for this week:

Did you miss our blog last week?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.