Jargon of Estate Planning Explained

The jargon of a topic that you don’t know about is always intimidating and can often lead to people just avoiding the subject altogether. Estate planning is already a morbid topic to have to discuss, but it is a necessary one. Add in the confused look most of the families I serve get when discussing the various documents they need, and I knew it was a topic that needed a layman’s vocabulary breakdown.

Last Will

This is just your basic and normal will. Some attorneys will call it your last will or your last will and testament just to add some drama to the proceedings—a nice reminder of how morbid this is by adding the world last in there.

Simply put, your last will is what happens to your stuff when you pass away. Who would inherit what possessions, and who would be your children’s guardian if you weren’t here.

At the most basic level, this is an estate planning document that almost everyone needs, and if you have a spouse or children, it is a must!

Living Will

This sounds better; at least it has the word living in the title.

Your living will serve an incredibly important purpose, which is to answer the question if I am incapacitated and not able to make decisions for myself, do I want artificially supplied nutrition to keep me alive, do I not want it, or do I leave that decision up to my Health Care Representative.

Trust

Trusts serve many purposes, but most often, trusts are designed to remove assets from your estate for tax or healthcare purposes. Trusts are also used to control assets “beyond the grave.” When creating a trust, several questions arise: is it a revocable or irrevocable trust, each being used for something separate. Who will manage the trust as the trustee, and who are the beneficiaries?

There are so many types of trusts; I could take a blog post and turn it into a dissertation just on trusts, so this is a topic that we can look at in layman’s terms but should be given a lot of time and energy to understand the exact problem you are trying to solve for, and if a trust will be the solution.

Power of Attorney

Power of Attorney, or POA as it is most commonly called, is a scary term for most people because they think the scope of power a POA has is far greater than it really is. A POA can be broken down into two separate pieces: a healthcare POA and a financial POA. The same person can serve as both, but the scope of each job is different.

A financial POA is who can legally act on your behalf regarding financial matters. A POA does not need to go into effect at signing; it can specify that it only goes into effect at incapacity.

A healthcare POA is who can legally act on your behalf regarding medical matters and decisions, such as leaving your living will decision up to them. This does not need to go into effect at signing but can go into effect when incapacitated.

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, SEPT. 25 | |

| None scheduled | |

| TUESDAY, SEPT. 26 | |

| 8:30 AM | New home sales |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 10:00 AM | Consumer confidence |

| 1:30 PM | Fed Gov. Bowman speaks |

| WEDNESDAY, SEPT. 27 | |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Durable-goods minus transportation |

| THURSDAY, SEPT. 28 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | GDP (revision) |

| 1:00 PM | Fed Gov. Cook speaks |

| 4:00 PM | Fed Chairman Powell speaks |

| FRIDAY, SEPT. 29 | |

| 8:30 AM | Personal income |

| 8:30 AM | Personal spending |

| 8:30 AM | PCE index |

| 8:30 AM | Core PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE (year-over-year) |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 9:45 AM | Chicago Business Barometer |

| 10:00 AM | Consumer sentiment (final) |

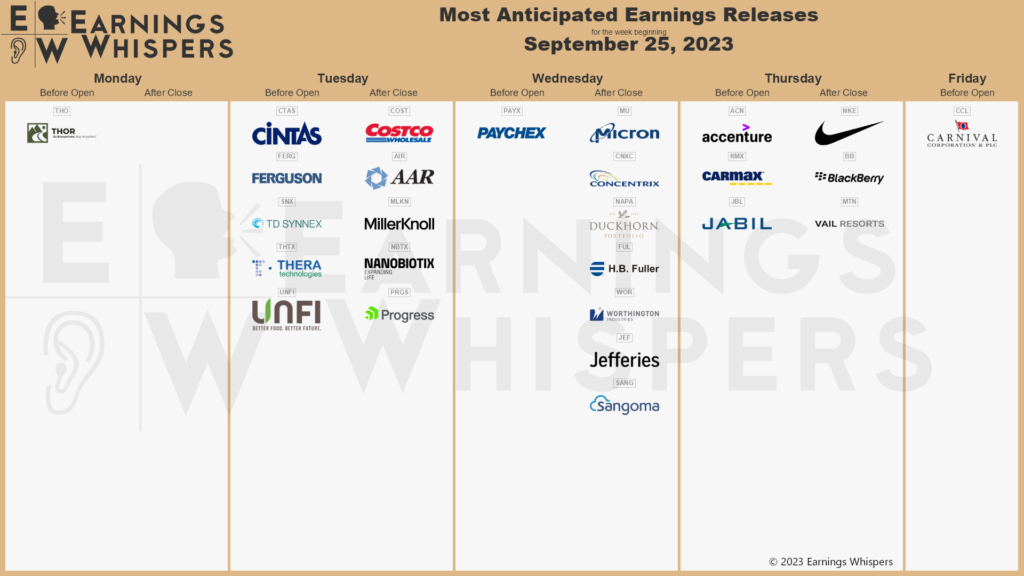

Most anticipated earnings for this week:

Did you miss our blog last week?

Experiences Are Never a Waste of Money

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.