Forefront’s Market Notes:

September 23rd, 2024

Stocks moved higher last week after the Federal Reserve’s half-point rate cut, bolstered by multiple data points supporting a cooling but still strong economy and decelerating inflation.

The Standard & Poor’s 500 Index gained 1.36 percent, while the Nasdaq Composite rose 1.49 percent. The Dow Jones Industrial Average moved ahead by 1.62 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, inched up 0.42 percent.1,2

Fed Cuts Rate 0.5 Percent

Stocks traded in a narrow range for the first half of the week as anxious investors awaited the outcome of the Federal Open Market Committee’s (FOMC) September meeting.3,4

Shortly after 2 pm ET Wednesday, the Fed announced it was cutting rates by a half percentage point—a more significant cut than some investors anticipated. Stocks initially rose in response and then fell. Some market watchers attributed the decline to concern that the Fed might be concerned about economic growth.5,6

But after sleeping on it, stocks rallied Thursday, with the Nasdaq, S&P, and Dow climbing 2.5 percent, 1.7 percent, and 1.3 percent, respectively. The Dow topped 42,000 for the first time, while the S&P crossed the 5,700 mark.7,8

.Source: YCharts.com, September 21, 2024. Weekly performance is measured from Monday, September 16, to Friday, September 20. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Fed’s Move

The half-point cut was the first change in the Fed Funds Rate in 14 months and the first reduction in 4½ years, bringing its target range to 4.75-5.0 percent. Fed Chair Powell said the decision reflected the Committee’s “greater confidence that inflation is moving sustainably toward 2 percent” and that the “risks to achieving its employment and inflation goals are roughly in balance.”9

Tax Treatment of Hobbies

Taxpayers who earn money from their hobbies might have to report the income to the Internal Revenue Service (IRS). Here are some tips to help:

- The IRS taxes income differently depending on whether it comes from a true hobby or a for-profit business.

- Your hobby may entail expenses required to do it well. For example, you may need to buy yarn to knit scarves. You might be able to deduct expenses associated with your hobby or business.

- In some instances, you can deduct approvable expenses only up to the amount you brought in for income.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov10

Footnotes and Sources

1. The Wall Street Journal, September 20, 2024

2. Investing.com, September 20, 2024

3. CNBC.com, September 16, 2024

4. The Wall Street Journal, September 18, 2024

5. CNBC.com, September 18, 2024

6. The Wall Street Journal, September 18, 2024

7. The Wall Street Journal, September 19, 2024

8. The Wall Street Journal, September 20, 2024

9. The Wall Street Journal, September 18, 2024

10. IRS.gov, May 8. 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, SEPT. 23 | |

| 8:00 AM | Atlanta Fed President Raphael Bostic speaks |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:15 AM | Chicago Fed President Austan Goolsbee speaks |

| 1:00 PM | Minneapolis Fed President Neel Kashkari speaks |

| TUESDAY, SEPT. 24 | |

| 9:00 AM | Federal Reserve Governor Michelle Bowman speaks |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 10:00 AM | Consumer confidence |

| WEDNESDAY, SEPT. 25 | |

| 10:00 AM | New home sales |

| 4:00 PM | Federal Reserve Governor Adriana Kugler speaks |

| THURSDAY, SEPT. 26 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Durable-goods minus transportation |

| 8:30 AM | GDP (second revision) |

| 9:10 AM | Federal Reserve Governor Adriana Kugler and Boston Fed President Susan Collins speak together |

| 9:15 AM | Federal Reserve Governor Michelle Bowman speaks |

| 9:20 AM | Federal Reserve Chair Jerome Powell gives opening remarks |

| 9:25 AM | New York Fed President John Williams speaks |

| 10:00 AM | Pending home sales |

| 10:30 AM | Federal Reserve Vice Chair for Supervision Michael Barr speaks |

| 10:30 AM | Federal Reserve Governor Lisa Cook speaks |

| 1:00 PM | Minneapolis Fed President Neel Kashkari speaks with Fed Vice Char for Supervision Michael Barr |

| FRIDAY, SEPT. 27 | |

| 8:30 AM | Personal income |

| 8:30 AM | Personal spending |

| 8:30 AM | PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE index |

| 8:30 AM | Core PCE (year-over-year) |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced wholesale inventories |

| 8:30 AM | Advanced retail inventories |

| 10:00 AM | Consumer sentiment (final) |

| 1:15 PM | Federal Reserve Governor Michelle Bowman speaks |

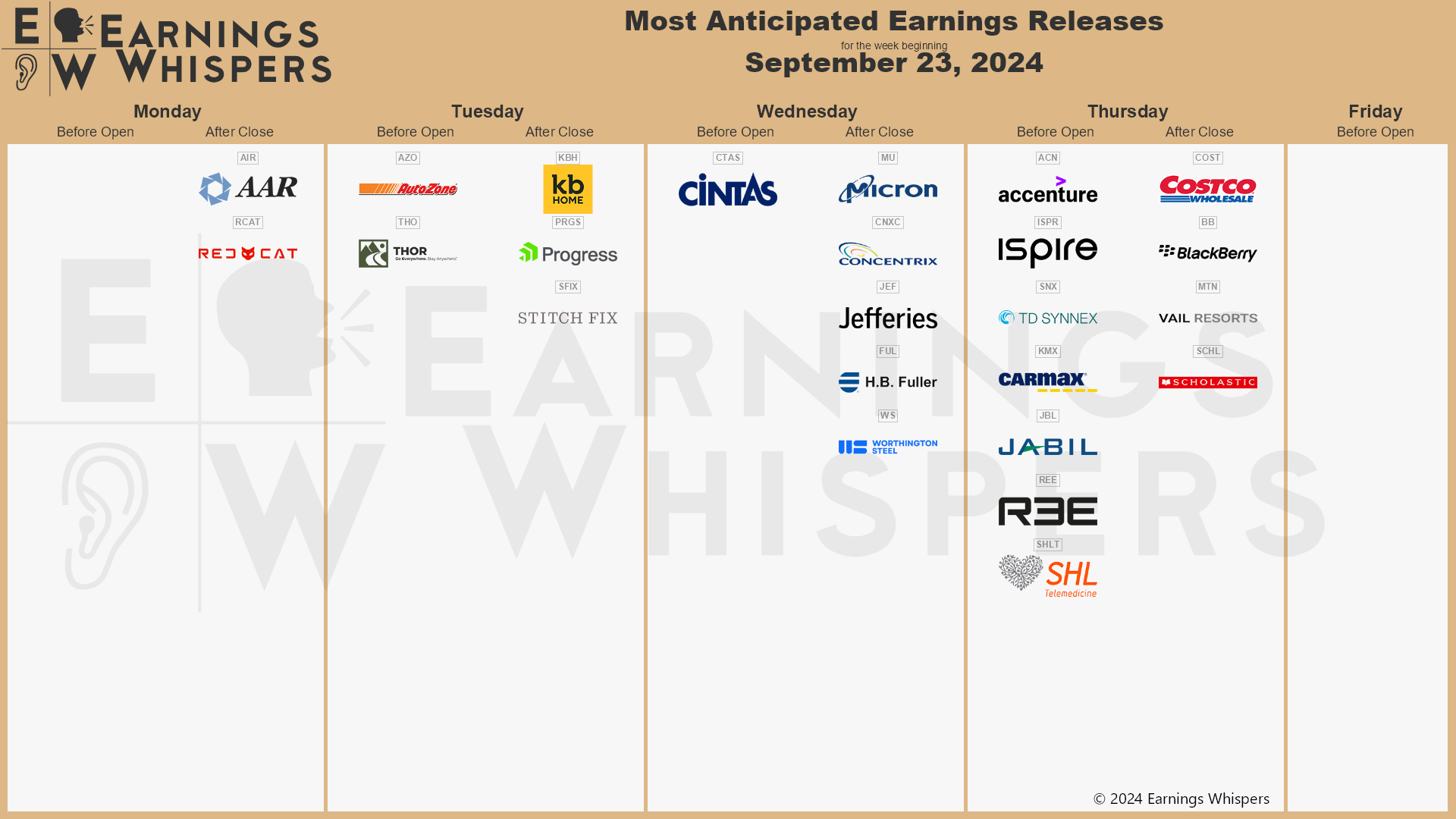

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: September 16th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.