Forefront’s Market Notes:

September 16th, 2024

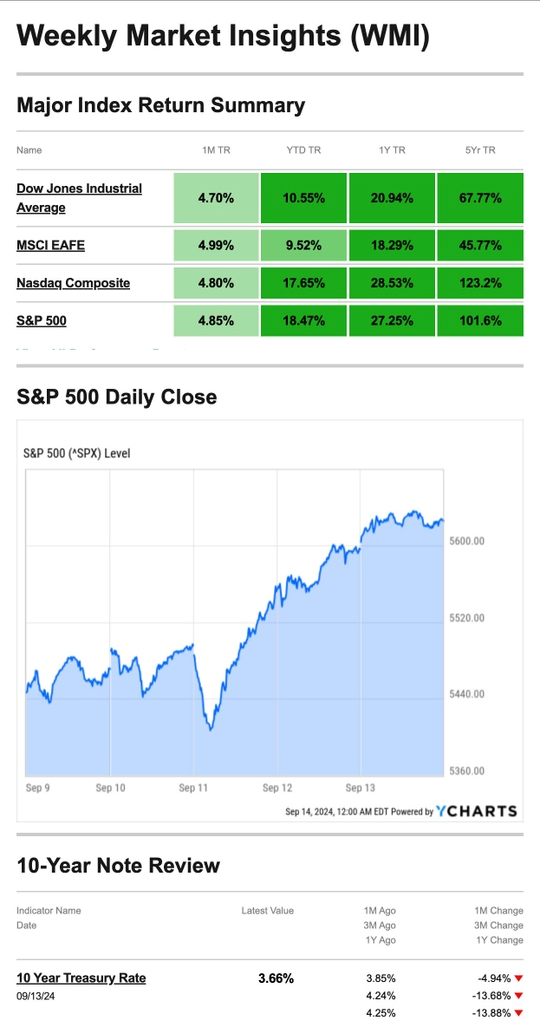

Stocks rallied last week as investors received better-than-expected consumer and producer inflation data.

The Dow Jones Industrial Average rose 2.60 percent, while the Standard & Poor’s 500 Index gained 4.02 percent. The Nasdaq Composite led, picking up 5.95 percent as tech stocks rebounded. The MSCI EAFE Index, which tracks developed overseas stock markets, rose 1.01 percent.1,2

A Wednesday to Remember

Stocks bounced out of the gate at the start of the week as “risk on” investors made moves before the pending release of the twin inflation reports–the Consumer Price Index (CPI) and Producer Price Index (PPI). The three major averages added slightly more than 1 percent in Monday trading.3

On Wednesday, stocks initially dipped following the release of the CPI as traders appeared disappointed by the report. By midday, sentiment changed. The S&P 500, down as much as 1.6 percent in early trading, gained 1.1 percent by the closing bell. More inflation data out Thursday showed wholesale price increases were tempered, which helped stocks move higher through the balance of the week.4,5

Source: YCharts.com, September 14, 2024. Weekly performance is measured from Monday, September 9, to Friday, September 13. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Small Caps Shine

Small-cap stocks, as measured by the Russell 2000 Index, have pushed higher in recent weeks, which is a telling move for some Wall Street observers. The Russell 2000 has outperformed the S&P 500 by more than 4 percent during Q3 so far.6

One reason is that smaller stocks tend to respond when they anticipate interest rates will trend lower. Investors appear to be positioning themselves in small cap issues, expecting the Fed may adjust rates at its September meeting as it looks to guide the economy to a soft landing.7

Check Your Withholding Status Online

The Withholding Calculator can help you determine whether you should submit a new W-4 to your employer, and you also can use the results to adjust your income tax withholding. If you have a more complex tax situation, you may need to use Publication 505, Tax Withholding and Estimated Tax form. This form can help you determine your self-employment tax, alternative minimum tax, or tax on unearned income by dependents. Publication 505 also can help if you receive non-wage income, including capital gains, royalties, dividends, and more.

Checking your withholding is essential to deducting the right amount of taxes; these handy tools can help.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov8

Footnotes and Sources

1. The Wall Street Journal, September 13, 2024

2. Investing.com, September 13, 2024

3. The Wall Street Journal, September 10, 2024

4. The Wall Street Journal, September 11, 2024

5. CNBC.com, September 12, 2024

6. The Wall Street Journal, September 13, 2024

7. MarketWatch.com, September 12, 2024

8. IRS.gov, May 8. 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, SEPT 16 | |

| 8:30 AM | Empire State manufacturing survey |

| TUESDAY, SEPT 17 | |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Business inventories |

| 10:00 AM | Home builder confidence index |

| WEDNESDAY, SEPT 18 | |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 2:00 PM | FOMC interest-rate decision |

| 2:30 PM | Fed Chair Powell press conference |

| THURSDAY, SEPT 19 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 10:00 AM | Existing home sales |

| 10:00 AM | U.S. leading economic indicators |

| FRIDAY, SEPT 20 | |

| None scheduled |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: September 9th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.