Forefront’s Market Notes:

November 4th, 2024

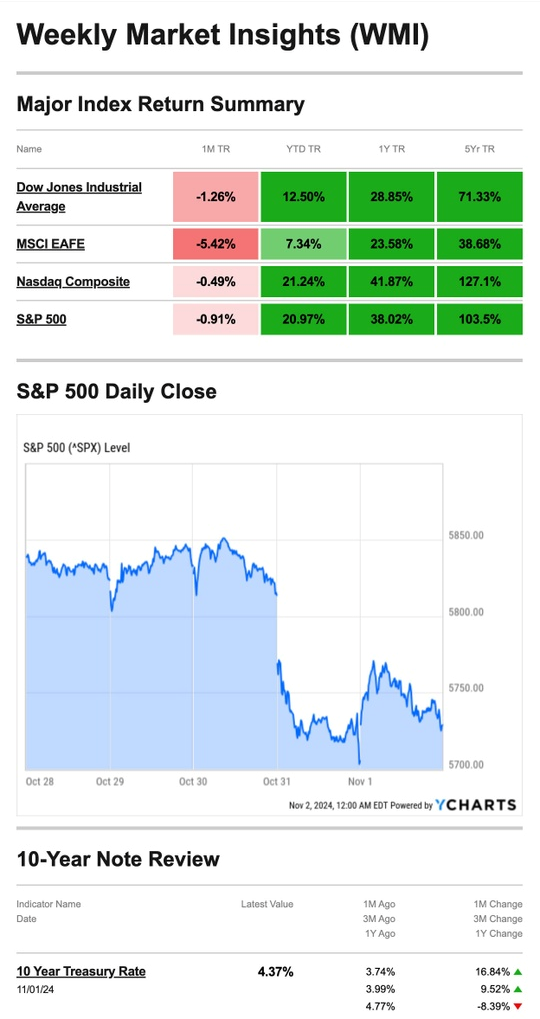

Stocks slid last week as mixed economic data and strong-but-not-spectacular Q3 corporate reports failed to inspire investors.

The Standard & Poor’s 500 Index fell 1.36 percent, while the Nasdaq Composite Index declined 1.50 percent. The Dow Jones Industrial Average edged down 0.15 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, slid 0.96 percent.1,2

Q3 Reports Uninspired

Stocks rallied early Wednesday after the gross domestic product report showed a strong economy that appeared on the path to a soft landing. However, stocks moved lower throughout the day as investors digested mixed Q3 reports from a few mega-cap tech names.3,4

Stocks were under more pressure Thursday as disappointing outlooks for some key tech companies pulled the market down. A softer-than-expected jobs report on Friday unsettled investors, but stocks picked up as the day progressed, and attention shifted to how the Fed may interpret the jobs data.5

By Friday, the Nasdaq’s eight-week winning streak had ended, and the S&P fell for the second week.

Source: YCharts.com, November 2, 2024. Weekly performance is measured from Monday, October 28, to Friday, November 1. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Fed Back in Focus After Jobs Report

At its most recent meetings, the Fed has made it clear that it needed to balance the risks of both inflation and employment.

So Friday’s jobs report that showed 12,000 jobs created in October caught some by surprise. Economists expected the Labor Department to report 100,000, down from September’s 223,000 jobs.6

Investors parsed the data and determined the strike at a major aircraft manufacturer and two hurricanes caused the jobs report to fall short of estimates. Investors also appeared to believe the jobs report would prompt the Fed to move on rates at its two-day policy meeting, which ends on November 7.

Military Members and Their Families Can Receive Free Tax Advice

The IRS started the Volunteer Income Tax Assistance (VITA) program to provide free tax advice, preparation, return filing help, and other assistance to military members and their families. This also includes specific tax advice for military members on combat zone tax benefits, special extensions, and other special rules. VITA has convenient locations on and off base and even has offices overseas.

These offerings are just one way the IRS strives to make tax information available to all. It also offers other free assistance programs to taxpayers who qualify, including the elderly, through its Tax Counseling for the Elderly (TCE) program.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS7

Footnotes and Sources

1. The Wall Street Journal, November 1, 2024

2. Investing.com, November 1, 2024

3. CNBC.com, October 30, 2024

4. The Wall Street Journal, October 30, 2024

5. The Wall Street Journal, November 1, 2024

6. The Wall Street Journal, November 1, 2024

7. IRS.gov, March 29, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, NOV. 4 | |

| 10:00 AM | Factory orders |

| TUESDAY, NOV. 5 | |

| 8:30 AM | U.S. trade deficit |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| WEDNESDAY, NOV. 6 | |

| THURSDAY, NOV. 7 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. productivity (prelim) |

| 10:00 AM | Wholesale inventories |

| 2:00 PM | FOMC interest-rate decision |

| 2:30 PM | Fed Chair Powell press conference |

| 3:00 PM | Consumer credit |

| FRIDAY, NOV. 8 | |

| 10:00 AM | Consumer sentiment (prelim) |

| 11:00 AM | Fed Governor Michelle Bowman speaks about banking regulation |

| 2:30 PM | St. Louis Fed President Alberto Musalem welcoming remarks |

Most anticipated earnings for this week:

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.