Forefront’s Market Notes:

October 28th, 2024

Stocks were mixed last week as fresh economic data points and election-related uncertainty slowed market momentum.

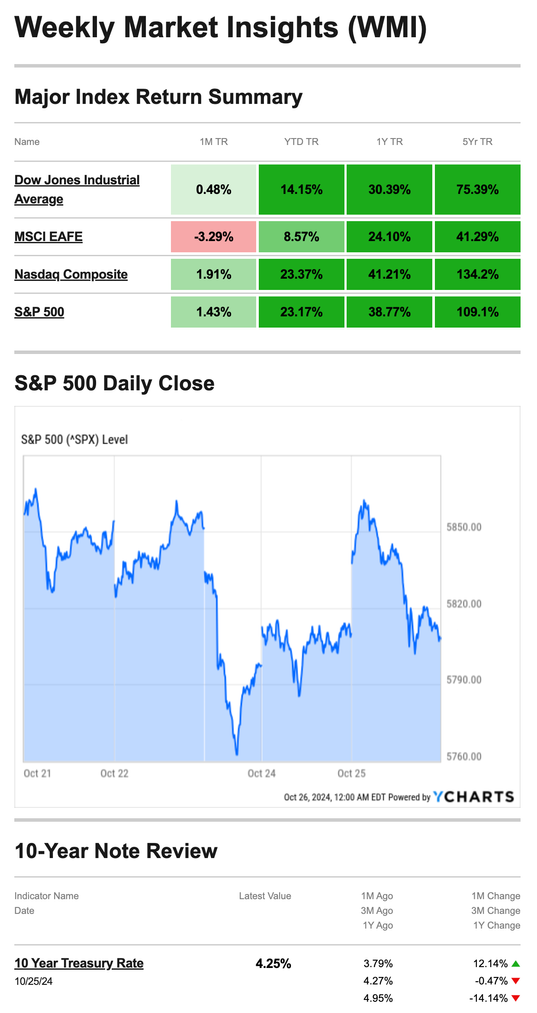

The Standard & Poor’s 500 Index fell 0.96 percent, while the Nasdaq Composite Index rose 0.16 percent. The Dow Jones Industrial Average dropped 2.68 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, slid 2.30 percent.1,2

Nasdaq Leads

Stocks were mixed for the first half of the week as investors geared up for a steady stream of Q3 reports. The 10-year Treasury yield continued to trend higher, which caught the attention of some traders

Markets fell Wednesday morning with news that existing home sales fell to a 14-year low in October; still slowed by higher interest rates, sales are on track for their worst year since 1995. Also, pre-election jitters remained an undertow with traders.3,4,5

News that durable goods orders rose in September buoyed sentiment a bit. At Friday’s close, the Nasdaq, fueled by technology names, marked its seventh consecutive week of gains but the S&P 500 broke its 6-week winning streak.6,7

Source: YCharts.com, October 26, 2024. Weekly performance is measured from Monday, October 21, to Friday, October 25. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Election Focus

With the election cycle in full swing, some traders appear to be preparing for an uptick in volatility in the coming weeks.

In late August, nearly 90 percent of stock traded above their 20-day moving average. However, that momentum has slowed. On Tuesday, Standard & Poor’s reported that the number of stocks above their 20-day moving average fell to nearly 50 percent. Traders may be moving to more of a “risk off” position ahead of November 5.8

Is Your Office in a Historic Building? You May Be Eligible for a Tax Credit

To protect heritage sites and other history, the IRS implemented its rehabilitation tax credit, which offers an incentive to renovate and restore old or historic buildings. Here are some of the highlights to help you determine whether your building is eligible:

- The credit may pay 20 percent of the qualifying costs of rehabilitating a historic building.

- This 20 percent needs to be spread out over five years.

- The credit doesn’t apply to the purchase of the building.

- Taxpayers use Form 3468, Investment Credit, to claim the rehabilitation tax credit.

Although this credit might not significantly improve many situations, it’s still a step toward preserving our country’s history.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS9

Footnotes and Sources

1. The Wall Street Journal, October 25, 2024

2. Investing.com, October 25, 2024

3. MarketWatch.com, October 23, 2024

4. The Wall Street Journal, October 23, 2024

5. The Wall Street Journal, October 23, 2024

6. ABA Banking Journal, October 25, 2024

7. CNBC.com, October 25, 2024

8. The Wall Street Journal, October 25, 2024

9. IRS.gov, April 30, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, OCT. 28 | |

| None scheduled | |

| TUESDAY, OCT. 29 | |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 10:00 AM | Consumer confidence |

| 10:00 AM | Job openings |

| WEDNESDAY, OCT.30 | |

| 8:15 AM | ADP employment |

| 8:30 AM | GDP |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 10:00 AM | Pending home sales |

| THURSDAY, OCT. 31 | |

| 8:30 AM | Personal income |

| 8:30 AM | Personal spending |

| 8:30 AM | PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE index |

| 8:30 AM | Core PCE (year-over-year) |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. employment cost index |

| 9:45 AM | Chicago PMI |

| FRIDAY, NOV. 1 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

| 9:45 AM | S&P final U.S. manufacturing PMI |

| 10:00 AM | Construction spending |

| 10:00 AM | ISM manufacturing |

| TBA | Auto sales |

Most anticipated earnings for this week:

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.