Forefront’s Market Notes:

May 13th, 2024

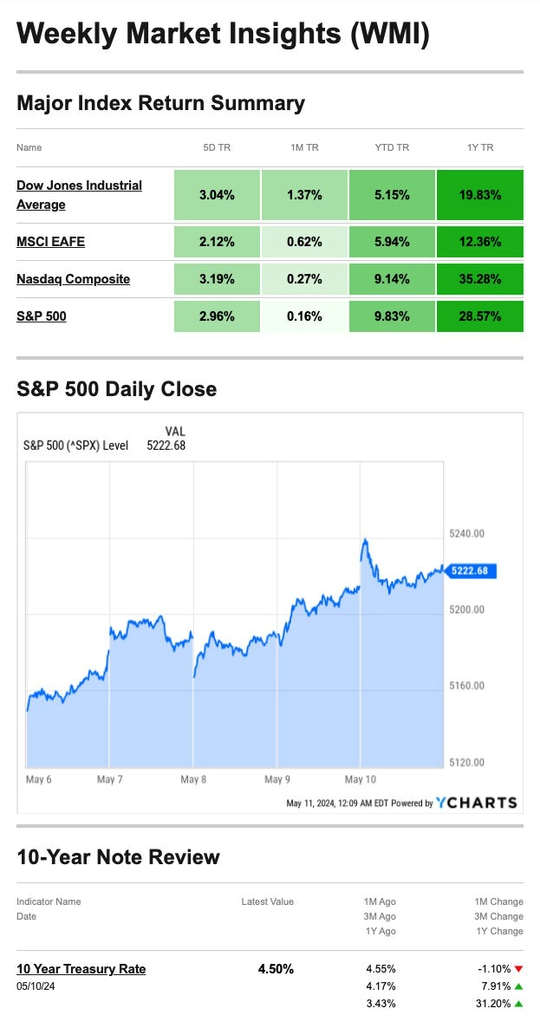

Stocks notched a solid gain last week as rate-cut expectations paced the rally as the Q1 earnings season wound down.

Stocks Climb Steadily

Monday opened with stocks picking up where they left off the prior Friday. Stocks were still basking in the afterglow of fresh jobs data, which eased investor concerns of an overheating economy. That and reports of a possible Middle East ceasefire fueled Monday’s rally.1

Stocks hung out in a narrow trading band Tuesday and Wednesday, yawning at the sparse economic news and a handful of negative earnings results. By contrast, the Nasdaq edged lower over those two days.2,3

On Thursday, the S&P 500 closed above 5,200 for the first time since early April. The next day, stocks rallied, and the Dow clinched its eighth consecutive day of gains, the longest winning streak since December and its best weekly performance this year. Fresh data showed consumers continue to have inflation concerns for the year ahead, which was unsettling.4,5

Source: YCharts.com, May 11, 2024. Weekly performance is measured from Monday, May 6, to Friday, May 10.

ROC 5 = the rate of change in the index for the previous 5 trading days.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Jobs Market Shows a “Goldilocks” Outlook

Jobs data from the past few months have shown unemployment levels remain low while job growth stays strong—but not too hot.

And last week’s Conference Board’s employment trends index for April projected slower jobs growth in the second half. The markets all year have responded well when the “Goldilocks” outlook suggests that economic indicators are “just right.”6

Are Social Security Benefits Taxable?

If you receive Social Security benefits, you may have to pay federal income tax on some of these benefits. Your payment will depend on your specific income and filing status.

To find out whether your Social Security benefits are taxable, if you are single, take half of the Social Security money you received throughout the year and add it to your other income, including pensions, wages, interest, dividends, and capital gains. If the total for an individual exceeds $25,000, part of your benefits may be taxable.

If you are married filing jointly, take half of the Social Security money you received throughout the year plus half of your spouse’s Social Security benefits; add both amounts to your combined household income. If the total is over $32,000, part of your benefits may be taxable.

The IRS’s website delineates the taxable percentage of benefits based on the above calculation. These percentages vary between 50% to 85% and depend on your filing status and income levels. For example, if you are filing as a single person with $25,000 to $34,000 income, 50% of your Social Security benefits may be taxable.

The Interactive Tax Assistant on IRS.gov can help you determine whether your Social Security benefits are taxable and, if so, by how much.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov7

Footnotes and Sources

1. The Wall Street Journal, May 10, 2024

2. The Wall Street Journal, May 7, 2024

3. The Wall Street Journal, May 8, 2024

4. CNBC.com, May 9, 2024

5. The Wall Street Journal, May 10, 2024

6. The Wall Street Journal, May 10, 2024

7. IRS.gov, December 5, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, MAY 13 | |

| 9:00 AM | Fed Vice Chair Philip Jefferson and Cleveland Fed President Loretta Mester together on panel |

| TUESDAY, MAY 14 | |

| 8:30 AM | Producer price index |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI |

| 8:30 AM | Core PPI year over year |

| 9:10 AM | Fed Gov Lisa Cook speaks |

| 10:00 AM | Fed Chair Jerome Powell speaks |

| WEDNESDAY, MAY 15 | |

| 8:30 AM | Consumer price index |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI |

| 8:30 AM | Core CPI year over year |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 8:30 AM | Empire State manufacturing survey |

| 10:00 AM | Home builder confidence index |

| 10:00 AM | Business inventories |

| 12:00 PM | Minneapolis Fed President Neel Kashkari speaks |

| 3:20 PM | Fed Gov. Michelle Bowman speaks |

| THURSDAY, MAY 16 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 1:00 PM | New York Fed President Williams speaks |

| 10:00 AM | Fed Vice Chair for Supervision Michael Barr testifies |

| 12:00 PM | Cleveland Fed President Loretta Mester speaks |

| 3:50 PM | Atlanta Fed President Raphael Bostic speaks |

| FRIDAY, MAY 17 | |

| 10:00 AM | U.S. leading economic indicators |

| 10:15 AM | Fed Governor Christopher Waller speaks |

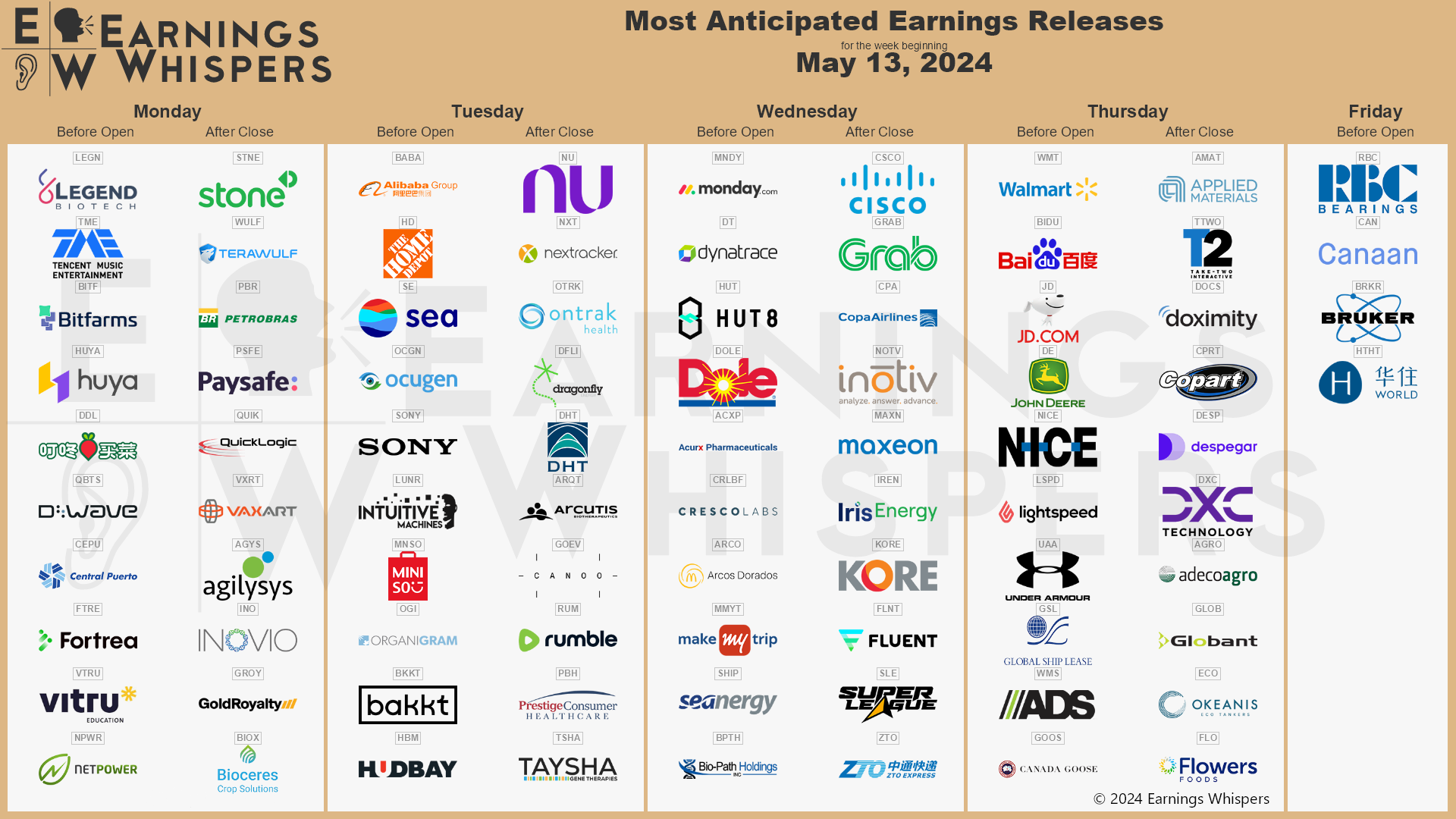

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: May 6th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.