Forefront’s Market Notes:

June 17th, 2024

Stocks notched a solid gain last week, driven by the Fed’s decision, May’s inflation report, and Apple’s AI-related news.

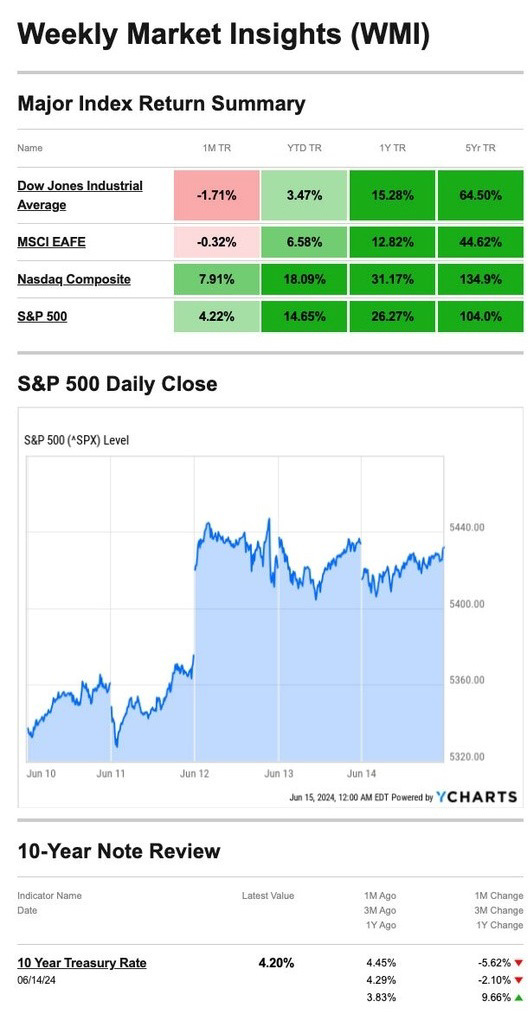

The Standard & Poor’s 500 Index rose 1.58 percent, while the Nasdaq Composite picked up 3.24 percent. The Dow Jones Industrial Average, which has lagged most of the year, slid 0.54 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, fell 1.44 percent for the week through Thursday’s close.1

S&P 500, Nasdaq Lead; Dow Lags

Market leadership took a familiar form. The tech-heavy Nasdaq led while the Dow trailed for the second week (and four out of the past six weeks).2

Stocks trended higher at the start of the week as investors cheered an artificial intelligence update from Apple.3,4

By midweek, the market had split, with the Nasdaq and S&P 500 moving higher while the Dow lagged. Investors were upbeat after learning that consumer prices rose less than expected in May and that the Fed decided to keep rates steady. However, some investors were unsettled after learning Fed officials had shifted their outlook and now only penciled in a single rate cut between now and year-end. A few months ago, the Fed had indicated as many as three cuts were possible.5

Source: YCharts.com, June 15, 2024. Weekly performance is measured from Monday, June 10, to Friday, June 14.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Busy Week for News

Last week was chock full of market-moving events. Between Apple’s AI update, inflation, and the Fed, it was a toss-up which one influenced sentiment the most.

AI’s outsized role in driving market momentum continued last week. OpenAI’s deal with Apple arrived at the start of last week, and the news followed OpenAI’s deal earlier this year with Microsoft. (These companies are mentioned for illustrative purposes only; it is not a recommendation to buy, sell, or hold this or any security.)6

Wednesday morning, the Consumer Price Index (CPI) was announced. A few hours later, the Federal Open Market Committee updated its monetary policy. Those pieces of news have only arrived together 13 times since 2008.

The FOMC kept rates steady at the current 5.25-5.50 percent target range, a widely expected decision. However, the tame CPI report caused some volatility as investors grappled with how the report may influence Fed policy.7,8

Your Plans This Summer May be Eligible for Itemized Deductions

These activities can be itemized as deductions if you have plans to sell or buy a home this summer or to donate some old items. Here are some examples:

If you are refinancing your home this summer, you can deduct some of your mortgage interest. However, there are some limits to these deductions.

According to the IRS, the deduction is limited to interest paid on a loan secured by the taxpayer’s main or second home. When refinancing, you must use the loan to buy, build, or substantially improve your main or second home.

If you buy a new home this summer, you can deduct mortgage insurance if you pay $750,000 in qualifying debt for a first and second home or $375,000 when married and filing separately.

Summer is a great time to sift through your things and donate old clothes, furniture, or home goods you no longer need. If you itemize the deductions and provide proof of the donations, these donations may qualify for a tax deduction.

In addition to donating items, you can deduct mileage on your vehicle for services performed for a qualifying charity.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov9

Footnotes and Sources

1. The Wall Street Journal, June 14, 2024

2. The Wall Street Journal, June 14, 2024

3. The Wall Street Journal, June 10, 2024

4. CNBC.com, June 12, 2024

5. The Wall Street Journal, June 10, 2024

6. The Wall Street Journal, June 10, 2024

7. The Wall Street Journal, June 10, 2024

8. MarketWatch.com, June 10, 2024

9. IRS.gov, April 5, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, JUNE 17 | |

| 8:30 AM | Empire State manufacturing survey |

| 1:00 PM | Philadelphia Fed President Patrick Harker speech |

| 9:00 PM | Fed Governor Lisa Cook speech |

| TUESDAY, JUNE 18 | |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 10:00 AM | Business inventories |

| 10:00 AM | Richmond Fed President Tom Barkin podcast interview |

| 1:00 PM | Fed Governor Adriana Kugler speech |

| 1:00 PM | Dallas Fed President Laurie Logan speech |

| 1:20 PM | St. Louis Fed President Alberto Musalem speech |

| 2:00 PM | Chicago Fed President Austan Goolsbee speech |

| WEDNESDAY, JUNE 19 | |

| Juneteenth Day holiday | |

| 10:00 AM | Home builder confidence index |

| THURSDAY, JUNE 20 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. current account |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| FRIDAY, JUNE 21 | |

| 9:45 AM | S&P flash U.S. services PMI |

| 9:45 AM | S&P flash U.S. manufacturing PMI |

| 10:00 AM | Existing home sales |

| 10:00 AM | U.S. leading economic indicators |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: June 3rd

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.