Forefront’s Market Notes: January 16th, 2024

Stocks pushed higher last week, led by big tech names and boosted by December inflation reports that were mixed but positive enough to shore up investor confidence in Fed rate cuts this year.

Stocks Rock and Roll

It was a rocky week that ended on a high note. Stocks rallied Monday after the prior week’s decline. Tech shares led, with the Nasdaq posting its best day since November 14.

On Tuesday, stocks initially tumbled but recovered most of their losses late in the session. Stocks rallied on Wednesday ahead of inflation news the following two trading days. Stocks fell initially on Thursday in response to a hotter-than-expected inflation report, reflecting investor concerns about the certainty, timing, and extent of Fed rate cuts later this year.

On Friday, the start of earnings season brought mixed results from a handful of major banks. By close, stocks had recovered most of their losses, ending the week with solid gains.1,2,3,4,5

Source: YCharts.com, January 13, 2024. Weekly performance is measured from Monday, January 8, to Friday, January 12. ROC 5 = the rate of change in the index for the previous 5 trading days. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

A Tale of Two Inflation Reports

The biggest economic news last week was fresh inflation data. The Consumer Price Index (CPI) rose 0.3 percent in December over the prior month and 3.4 percent compared with a year prior. That number was higher than the 3.2 percent increase economists expected and a few ticks elevated from the 3.1 percent figure in November.6,7

Core CPI for December, which excludes volatile food and energy components, rose 3.9%, a slight decrease from November’s 4.0% gain.

On Friday, the Producer Price Index (PPI), which measures inflation by domestic producers, showed a drop of 0.1% for December, possibly suggesting that the CPI’s uptick may have been an anomaly.6,7,8

Know and Understand Your Correct Filing Status

Taxpayers must know their correct filing status and be familiar with each choice. When preparing and filing a tax return, the filing status affects:

- whether taxpayers are required to file a federal tax return

- whether they should file a return to receive a refund

- their standard deduction amount

- whether they can claim certain credits

- the amount of tax they pay

Here are the five filing statuses:

Single: Normally, this status is for taxpayers who are unmarried, divorced, or legally separated under a divorce or separate maintenance decree governed by state law.

Married filing jointly: Taxpayers who are married can file a joint tax return with their spouse. When a spouse passes away, the widowed spouse can usually file a joint return for that year.

Married filing separately: Married couples can choose to file separate tax returns when doing so results in a smaller tax burden than filing a joint tax return.

Head of household: Unmarried taxpayers may be able to file under this status, but special rules apply. For example, they must have paid more than half the cost of maintaining a home for themselves and a qualifying person living in the home for half the year.

Qualifying widow(er) with dependent child: This status may apply to taxpayers whose spouse died during one of the previous two years and who have a dependent child. Other conditions also apply.

*This information is not intended to substitute for specific individualized tax advice. We suggest you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov9

Footnotes and Sources

1. CNBC.com, January 8, 2024.

2. CNBC.com, January 9, 2024.

3. CNBC.com, January 10, 2024.

4. The Wall Street Journal, January 11, 2024.

5. The Wall Street Journal, January 11, 2024.

6. The Wall Street Journal, January 11, 2024.

7. The Wall Street Journal, January 11, 2024.

8. The Wall Street Journal, January 11, 2024.

9. IRS.gov, May 1, 2023.

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, JAN. 15 | |

| Martin Luther King Jr. holiday, none scheduled | |

| TUESDAY, JAN. 16 | |

| 8:30 AM | Empire State manufacturing survey |

| 11:00 AM | Fed Gov. Christopher Waller speaks |

| WEDNESDAY, JAN. 17 | |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

| 8:30 AM | U.S. retail sales |

| 8:30 AM | Retail sales minus autos |

| 9:00 AM | Fed Vice Chair for Supervision Michael Barr speaks |

| 9:00 AM | Fed Gov. Michelle Bowman speaks |

| 9:15 AM | Industrial production |

| 9:15 AM | Capacity utilization |

| 9:15 AM | Business inventories |

| 2:00 PM | Fed Beige Book |

| 3:00 PM | New York Fed President John Williams delivers opening remarks |

| THURSDAY, JAN. 18 | |

| 7:30 AM | Atlanta Fed President Raphael Bostic speaks |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Philadelphia Fed manufacturing survey |

| 8:30 AM | Housing starts |

| 8:30 AM | Building permits |

| 12:05 PM | Atlanta Fed President Raphael Bostic speaks |

| FRIDAY, JAN. 19 | |

| 10:00 AM | Consumer sentiment (prelim) |

| 10:00 AM | Existing home sales |

| 1:00 PM | Fed Vice Chair for Supervision Michael Barr speaks |

| 4:15 PM | San Francisco Fed President Mary Daly speaks |

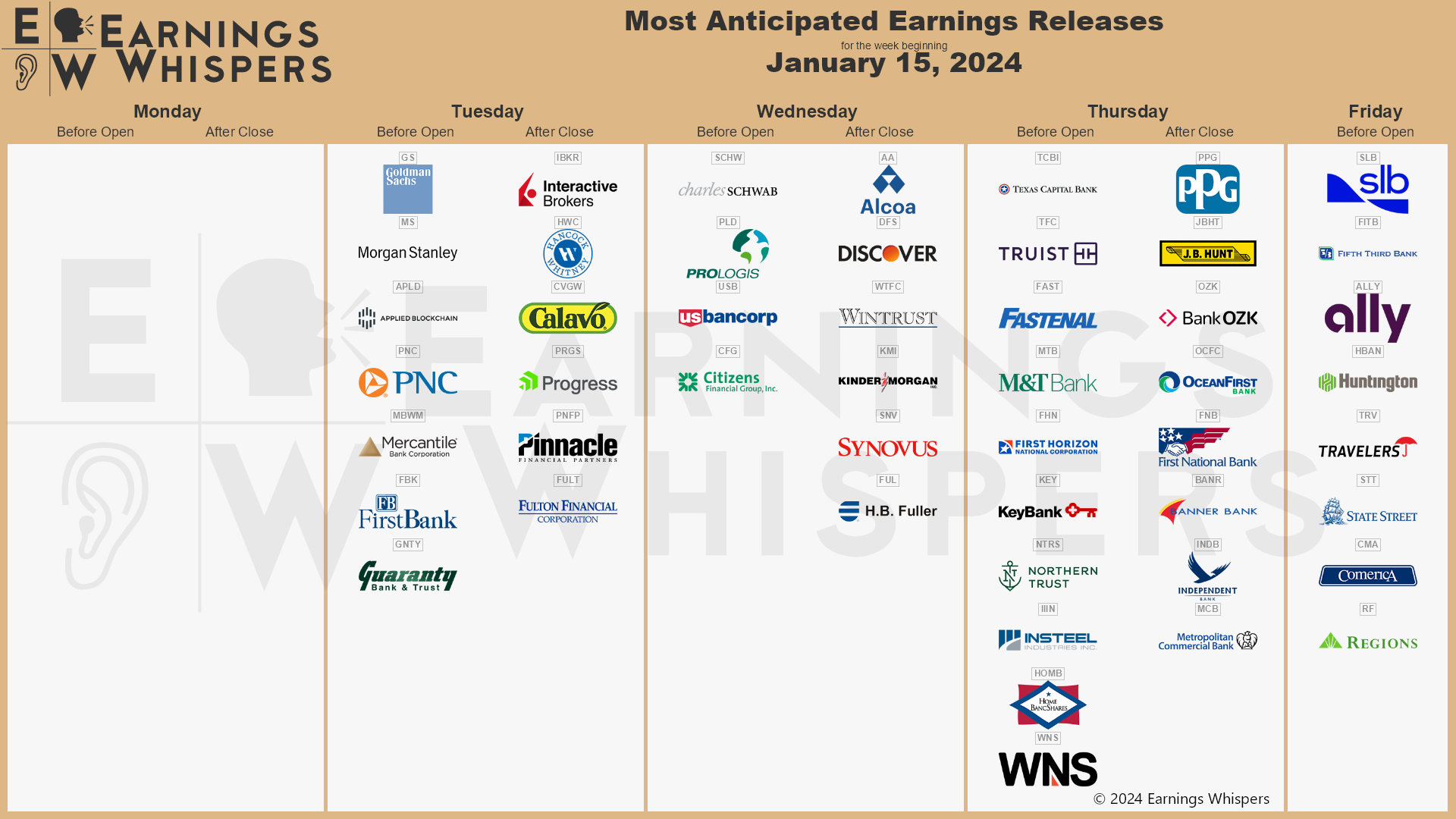

Most anticipated earnings for this week:

Did you miss our blast blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.