Forefront’s Market Notes: January 8th, 2024

Stocks retreated in the first trading week of 2024, struggling a bit after a celebratory end to last year as investors second-guessed Fed signals and fretted over lingering inflation concerns.

New Year Blues

Stocks got off to a rough first week of the new year, with tech names leading the week’s decline. Several market observers called it the “reverse Goldilocks” effect, where the market decided investors were getting a little too excited over the prospect of a Fed rate cut.

Stocks bounced up and down each of the four trading days but ended each one down—except Friday, when the Dow Industrials, Nasdaq Composite, and S&P 500 all ended the day in the green when jobs data helped soften the week’s slide.1,2

All About the Fed

On Wednesday, manufacturing news came in better than expected, lifting markets until the December Federal Open Market Committee meeting minutes were released, revealing that the Fed members had discussed rate cuts for 2024 but in no specific terms.

Jobs and services sector news painted a better picture of the economy on Thursday, but as the 10-year Treasury hit 4%, stock prices responded negatively.

Source: YCharts.com, January 6, 2024. Weekly performance is measured from the close of trading on Friday, December 29, to Friday, January 5, close. Treasury note yield is expressed in basis points.

Jobs Data in Focus

Finally, employment data helped buffer the week on Friday, as employers added 216,000 new jobs in December, besting estimates from economists and surpassing the 173,000 jobs added in November. News of unemployment remaining steady at 3.7% also helped sentiment.3,4

Errors to Avoid When Filing Your Extended Tax Return

If you file an extension of your tax return, it’s essential to avoid the common errors described below to submit a complete and accurate tax return:

- Missing or inaccurate Social Security number (SSN): Make sure your return has your correct SSN, matching what is on your Social Security card.

- Misspelled names: This may be a simple matter to look for, but mistakes happen. If you go by a name other than the one printed on your Social Security card, make sure you use the name on the card.

- Filing status: Claiming the wrong filing status can invalidate your return. Choose the correct option (electronic filing software can prevent mistakes). The interactive tax assistant tool can also help to determine your filing status and any relevant credits you should (or should not) claim.

- Math errors: Simple addition and subtraction mistakes can delay your return. Consider using electronic filing software that does the math automatically to avoid mistakes.

- Incorrect bank account information: If you opt to receive your refund via direct deposit, provide the correct bank account information. Giving an incorrect account number can delay your refund even further.

- Unsigned forms: Lastly, you should double-check that all sections of your forms are signed. Missing signatures can delay your return.

*This information is not intended to substitute for specific individualized tax advice. We suggest you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov5

Footnotes and Sources

1. The Wall Street Journal, January 5, 2024

2. The Wall Street Journal, January 5, 2024

3. The Wall Street Journal, January 5, 2024

4. The Wall Street Journal, January 5, 2024

5. IRS.gov, September 6, 2023

Stock market calendar this week:

| TIME (ET) | REPORT |

| MONDAY, JAN. 8 | |

| 3:00 PM | Consumer credit |

| TUESDAY, JAN. 9 | |

| 8:30 AM | Trade deficit |

| WEDNESDAY, JAN. 10 | |

| 10:00 AM | Wholesale inventories |

| 3:15 PM | New York Fed President John Williams speaks |

| THURSDAY, JAN.11 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | CPI |

| 8:30 AM | Core CPI |

| 8:30 AM | CPI (year-over-year) |

| 8:30 AM | Core CPI (year-over-year) |

| 2:00 PM | Budget statement |

| FRIDAY, JAN. 12 | |

| 8:30 AM | PPI |

| 8:30 AM | Core PPI (year-over-year) |

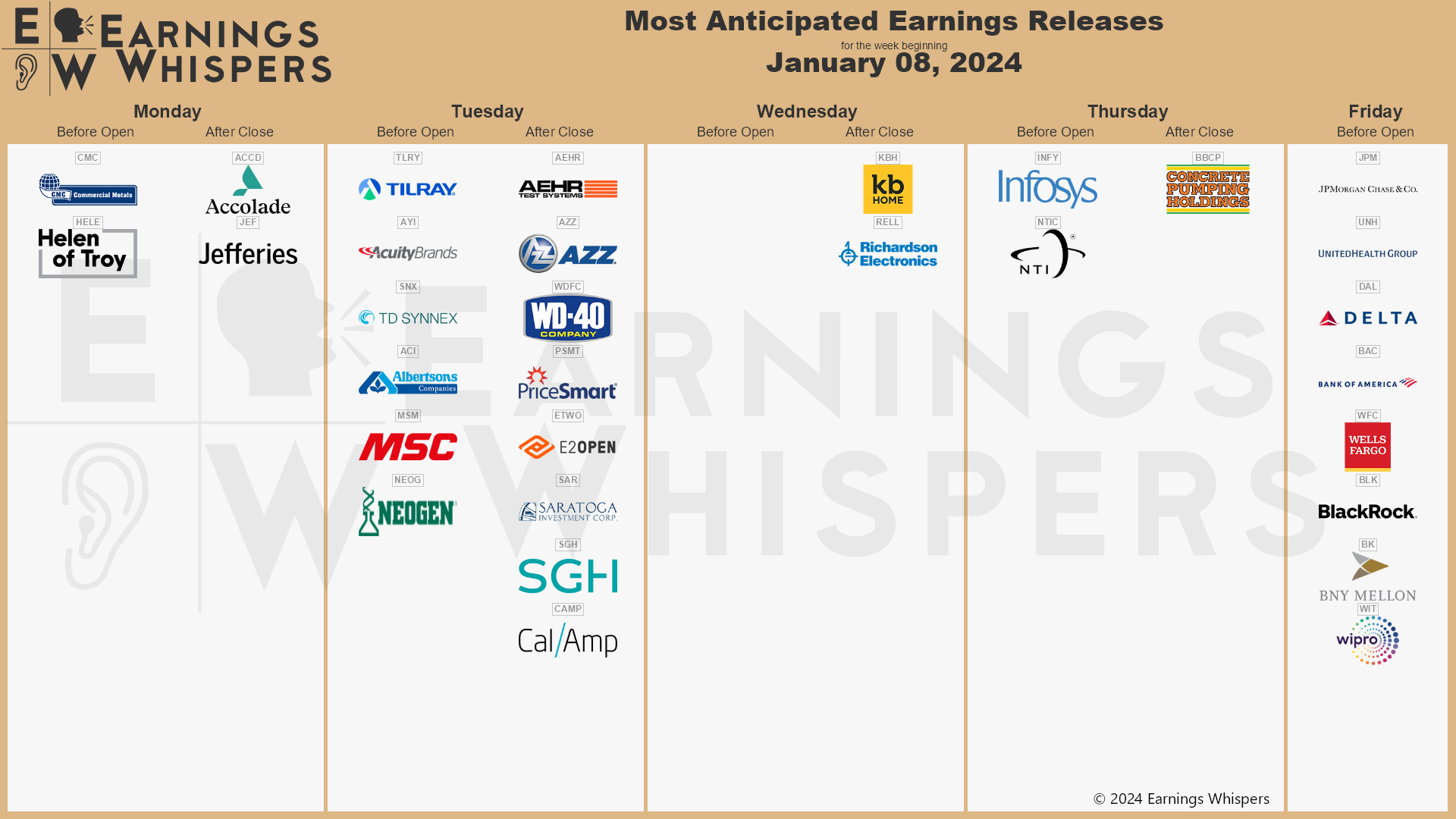

Most anticipated earnings for this week:

Did you miss our blast blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.