Forefront’s Market Notes

February 24th, 2025

Stocks fell last week as concerns about sticky inflation and the pace of economic growth rattled investors.

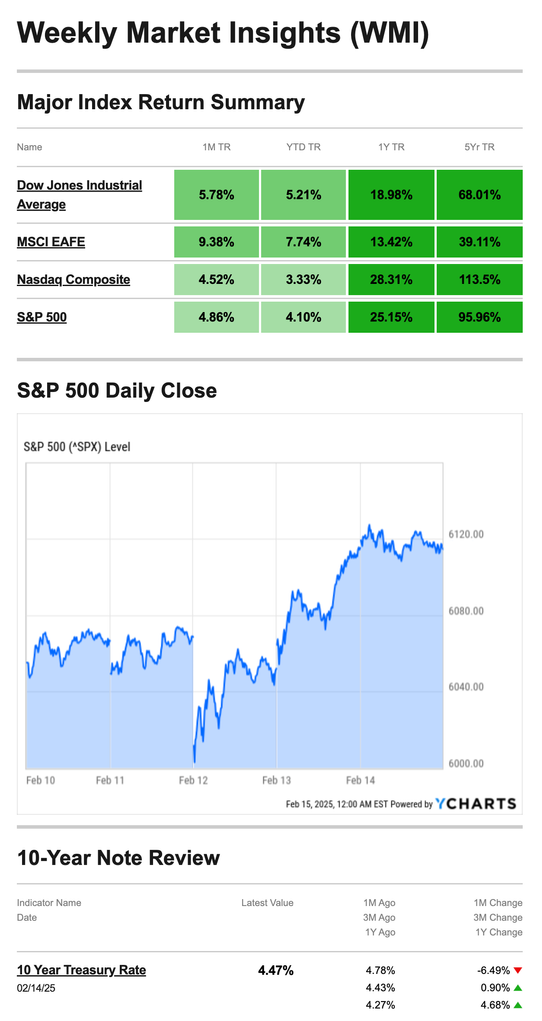

The Standard & Poor’s 500 Index declined 1.66 percent, while the Nasdaq Composite Index dropped 2.51 percent. The Dow Jones Industrial Average also fell 2.51 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, was essentially flat (+0.04 percent).1,2

S&P 500 Hits New High, Then Slips

Following the Presidents’ Day holiday, stock prices were largely range-bound on Tuesday despite some intraday volatility. Then stocks edged higher, shaking off some new tariff talk and disappointing housing starts data. The S&P 500 marked its third record close of the year on Wednesday.3,4

On Thursday, stocks were under pressure from the start of trading after a weaker-than-expected outlook from a mega-retailer. The update reinforced some concerns that the economy may be slowing. The selling accelerated on Friday after a consumer sentiment survey showed investors are unsettled about the inflation outlook.

Friday’s decline was the worst of the young year.5

Source: YCharts.com, February 22, 2025. Weekly performance is measured from Friday, February 14, to Friday, February 21. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Economic Jitters

Investors were forced to navigate a week of disappointing news about the economy and inflation.

First, traders were surprised to hear about slowing demand at the country’s biggest retailer, which soured the outlook for the consumer and the economy. Then, the University of Michigan Consumer Confidence survey fell by 10 percent in February as consumers expressed concerns about higher inflation ahead of possible new tariffs.6

This combination prompted investors to move into a “risk-off” position before the weekend.

Receive Your Tax Return Quicker With Direct Deposit

Want to receive your tax return quickly? The IRS recommends filing your return online and providing your direct deposit information. In addition to receiving your refund quicker, using direct deposit has a few other benefits.

Direct deposit is also fast, secure, and accessible. You must provide your bank account and routing number to sign up for direct deposit. Taxpayers should have this information available when ready to file because the IRS can’t accept it after filing a return.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS7

Footnotes and Sources

1. The Wall Street Journal, February 21, 2025

2. Investing.com, February 21, 2025

3. CNBC.com, February 18, 2025

4. The Wall Street Journal, February 19, 2025

5. CNBC.com, February 21, 2025

6. The Wall Street Journal, February 21, 2025

7. IRS.gov, April 11, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, FEB. 24 | |

| None scheduled | |

| TUESDAY, FEB. 25 | |

| 4:20 AM | Dallas Fed President Lorie Logan speaks in London |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 10:00 AM | Consumer confidence |

| 11:45 AM | Fed Vice Chair for Supervision Michael Barr speaks |

| 1:00 PM | Richmond Fed President Tom Barkin speaks |

| WEDNESDAY, FEB. 26 | |

| 10:00 AM | New home sales |

| 12:00 PM | Atlanta Fed President Raphael Bostic speaks |

| THURSDAY, FEB. 27 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Durable-goods minus transportation |

| 8:30 AM | GDP (second reading) |

| 9:15 AM | Kansas City Fed President Jeff Schmid speaks |

| 10:00 AM | Pending home sales |

| 10:00 AM | Federal Reserve Vice Chair for Supervision Michael Barr speaks |

| 11:45 AM | Fed Governor Michelle Bowman speaks |

| 1:15 PM | Cleveland Fed President Beth Hammack speaks |

| 3:15 PM | Philadelphia Fed President Patrick Harker speaks |

| FRIDAY, FEB. 28 | |

| 8:30 AM | Personal income |

| 8:30 AM | Personal spending |

| 8:30 AM | PCE index |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE index |

| 8:30 AM | Core PCE (year-over-year) |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 8:30 AM | Richmond Fed President Tom Barkin speaks |

| 9:45 AM | Chicago Business Barometer (PMI) |

| 10:15 PM | Chicago Fed President Austan Goolsbee speaks |

Most anticipated earnings for this week

Did you miss our last blog?

Forefront Market Notes: February 18th

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.