Forefront’s Market Notes:

December 9th, 2024

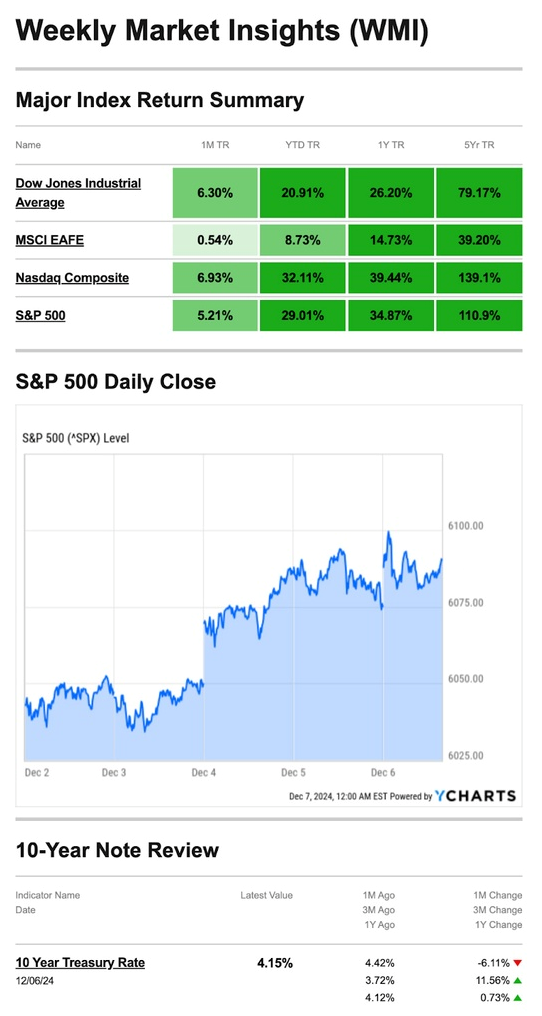

Stocks were mixed during the first trading week of December. Technology stocks led, while the widely followed Dow Jones Industrial Average struggled.

The tech-heavy Nasdaq Composite Index picked up 3.34 percent while the Dow Industrials lost 0.60 percent. The Standard & Poor’s 500 Index added 0.96 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, gained 1.46 percent.1,2

Tech Takes Charge

The S&P and Nasdaq rallied to start the week, closing at record highs Monday and Tuesday. The Dow fell on both days. During a conference speech, Fed governor Christopher Waller said he supports a rate adjustment in December for now, which seemed to add momentum to the S&P’s and Nasdaq’s gains.3,4

Tech shares continued to propel stock gains midweek on the strength of a few better-than-expected Q3 reports.5

On Friday, the S&P and Nasdaq hit new record highs following the November jobs report. Both notched their third consecutive winning week. By contrast, the Dow was down four of the five trading days, ending the week in the red after two back-to-back weekly gains.6,7,8

Source: YCharts.com, December 7, 2024. Weekly performance is measured from Monday, December 2, to Friday, December 6. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Jobs Rebound

After two hurricanes and an aircraft maker strike weighed on the labor market in October, the November jobs report released Friday gave investors what they were looking for: confirmation that the October update was an anomaly.

While November payrolls topped expectations, investors believed the hotter-than-expected report would not influence the Fed’s upcoming decision regarding short-term interest rates. The Fed’s scheduled two-day meeting ends on December 18.9

Beware of the Fake Charity Scam

There are so many scams out there. One of the most heartless is taking advantage of people who want to give money to a legitimate charity, especially after a tragedy or disaster. Scammers can set up fake organizations to take advantage of people’s generosity.

These scams are usually over the phone, and while the organization may sound legitimate, the person on the other end might demand a donation immediately. Remember, a charity will happily receive a donation anytime, so you shouldn’t feel pressured.

You can research charity organizations using the IRS Tax Exempt Organization Search tool—this will help you narrow down a list of legitimate charities. You may even be able to claim a deduction on your tax return.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS10

Footnotes and Sources

1. The Wall Street Journal, December 6, 2024

2. Investing.com, December 6, 2024

3. CNBC.com, December 2, 2024

4. MarketWatch.com, December 3, 2024

5. CNBC.com, December 4, 2024

6. MarketWatch.com, December 5, 2024

7. MarketWatch.com, December 6, 2024

8. The Wall Street Journal, December 6, 2024

9. The Wall Street Journal, December 6, 2024

10. IRS.gov, April 4, 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, DEC. 9 | |

| 10:00 AM | Wholesale inventories |

| TUESDAY, DEC. 10 | |

| 6:00 AM | NFIB optimism index |

| 8:30 AM | U.S. productivity (revision) |

| WEDNESDAY, DEC. 11 | |

| 8:30 AM | Consumer price index |

| 8:30 AM | CPI year over year |

| 8:30 AM | Core CPI |

| 8:30 AM | Core CPI year over year |

| 2:00 PM | Monthly U.S. federal budget |

| THURSDAY, DEC. 12 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Producer price index |

| 8:30 AM | Core PPI |

| 8:30 AM | PPI year over year |

| 8:30 AM | Core PPI year over year |

| FRIDAY, DEC. 13 | |

| 8:30 AM | Import price index |

| 8:30 AM | Import price index minus fuel |

Most anticipated earnings for this week:

Did you miss our last blog?

Forefront Market Notes: December 2nd

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.