Forefront’s Market Notes:

August 26, 2024

Stocks notched a solid gain as dovish comments from Federal Reserve officials boosted the market’s recovery from early August lows.

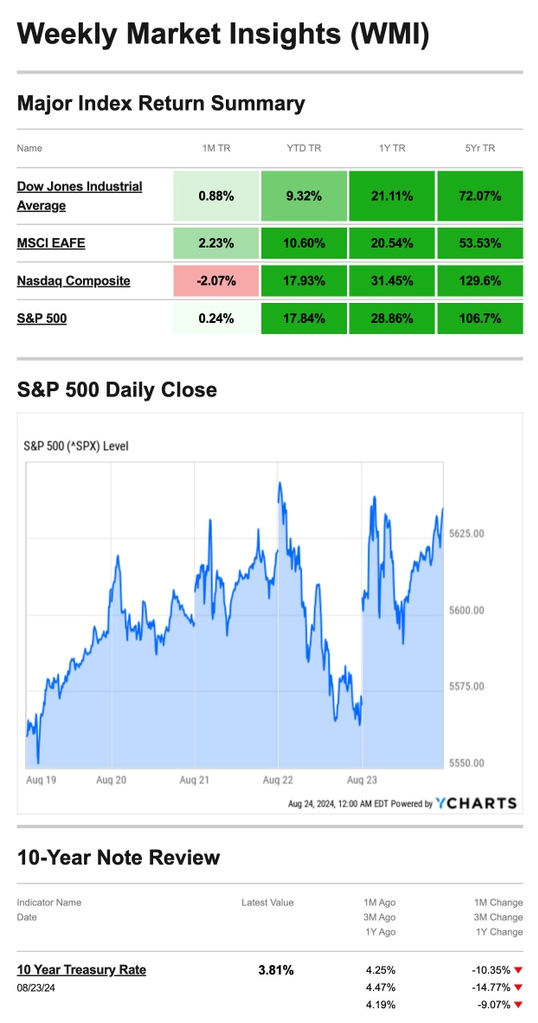

The Standard & Poor’s 500 Index rose 1.45 percent, while the Nasdaq Composite added 1.40 percent. The Dow Jones Industrial Average picked up 1.27 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, gained 2.98 percent.1,2

Dovish Week

Stocks started the week strong, rallying after Wall Street welcomed dovish comments from Minneapolis Fed President Neel Kashkari. The S&P 500 and Nasdaq each posted gains on Monday–the 8th consecutive winning session. The Dow rose for the 5th session in a row.3,4

From there, markets traded in a narrow band until Wednesday afternoon when minutes released from the July 30-31 FOMC Meeting revealed more dovish comments. On Thursday, stocks dipped ahead of Fed Chair Jerome Powell’s annual Jackson Hole, Wyoming, speech.5,6

Well-received comments from Powell on Friday boosted markets, with all three averages closing higher.7

Source: YCharts.com, August 24, 2024. Weekly performance is measured from Monday, August 19, to Friday, August 23. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

“The Time has Come”

The Fed’s annual symposium for global central bankers started Friday morning with Fed Chair Powell’s much-anticipated speech. Citing the risk of the labor market cooling even further, he said, “the time has come for policy to adjust.”

Investors responded favorably, with the remaining question being how significant a rate cut might be. Powell kept that door open, adding that “the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”8

Gig Economy Tax Tips

There are some essential tips to remember if you work as a gig worker, someone who takes temporary work through one or more employers:

- All income from these sources is taxable, regardless of whether you receive information returns; this includes both full-time and part-time work and if you’re paid in cash.

- As a gig worker, you must be correctly classified as an employee or an independent contractor; this can depend on where you live, even for the same services

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov9

Footnotes and Sources

1. The Wall Street Journal, August 23, 2024

2. Investing.com, August 23, 2024

3. The Wall Street Journal, August 23, 2024

4. The Wall Street Journal, August 19, 2024

5. MarketWatch.com, August 22, 2024

6. Reuters.com, August 22, 2024

7. The Wall Street Journal, August 23, 2024

8. The Wall Street Journal, August 23, 2024

9. IRS.gov, May 8. 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, Aug. 26 | |

| 8:30 AM | Durable-goods orders |

| 8:30 AM | Durable-goods minus transportation |

| 2:00 PM | San Francisco Fed President Daly TV interview |

| TUESDAY, Aug. 27 | |

| 9:00 AM | S&P Case-Shiller home price index (20 cities) |

| 10:00 AM | Consumer confidence |

| WEDNESDAY, Aug. 28 | |

| 6:00 PM | Atlanta Fed President Raphael Bostic speech |

| THURSDAY, Aug. 29 | |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | Advanced U.S. trade balance in goods |

| 8:30 AM | Advanced retail inventories |

| 8:30 AM | Advanced wholesale inventories |

| 8:30 AM | GDP (2nd revision) |

| 10:00 AM | Pending home sales |

| 3:30 PM | Atlanta Fed President Raphael Bostic speech |

| FRIDAY, Aug. 30 | |

| 8:30 AM | Personal income (nominal) |

| 8:30 AM | Personal spending (nominal) |

| 8:30 AM | PCE index] |

| 8:30 AM | PCE (year-over-year) |

| 8:30 AM | Core PCE index |

| 8:30 AM | Core PCE (year-over-year) |

| 9:45 AM | Chicago Business Barometer (PMI) |

| 10:00 AM | Consumer sentiment (final) |

Most anticipated earnings for this week:

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.