Forefront’s Market Notes:

September 3rd, 2024

There were mixed results for stocks last week as upbeat economic data and a critical Q2 corporate report shaped the week.

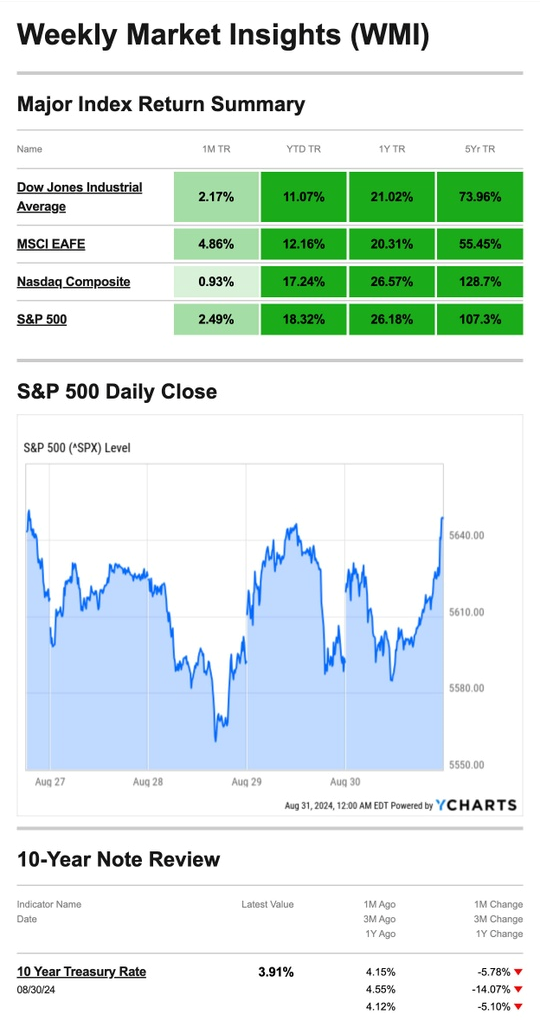

The Dow Jones Industrial Average rose 0.94 percent, while the Standard & Poor’s 500 Index increased 0.24 percent. The Nasdaq Composite lagged, falling 0.92 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, gained 0.35 percent.1,2

Key Economic Data

Markets began the week quiet as investors awaited Q2 earnings from Nvidia, the world’s most influential name in artificial intelligence.

The chipmaker–the second largest stock in the S&P 500 by market capitalization–dipped on the news, putting pressure on the Nasdaq and S&P 500. (The Nasdaq and S&P 500 are market-weighted averages, so larger companies have an outsized impact.)3

Nvidia is mentioned to show its influence on the overall stock market. It should not be considered a solicitation for the purchase or sale of the company.

On Thursday, an upward revision in Gross Domestic Product (GDP) data boosted markets, although stocks fell later in the day. Friday’s Personal Consumption and Expenditures (PCE) data seemed to confirm that inflation remained tame, welcome news for investors who are anticipating the Fed may adjust rates in September.4

Source: YCharts.com, August 31, 2024. Weekly performance is measured from Tuesday, August 27, to Friday, August 30. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Softer Landing in Focus?

Several pieces of data helped build a narrative that the economy may be coming in for a soft landing.

Second-quarter GDP growth was revised upward, from 2.8 percent to 3.0 percent. That’s an improvement from Q1 GDP, which rose 1.4 percent. Some market watchers were concerned about the Q2 revision after pending home sales in July hit its lowest monthly level in 23 years.5

Meanwhile, the Federal Reserve’s preferred measure of inflation, the PCE Index, came in 0.2 percent higher in July–in line with expectations. Core PCE inflation, which the Fed tracks closely, edged up 0.2 percent–also in line with forecasts.6

Reporting Cash Payments

Individuals, companies, corporations, partnerships, associations, trusts, and estates must report cash transactions of more than $10,000. These cash payments can include jewelry sales, a gift from a family member, an overseas purchase, or any other cash transaction. You also need to report cash payments received in one lump sum, in two or more related payments within 24 hours, or as part of a single transaction or two or more transactions in the previous year.

All you need to do is file Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. The form requires information about the giver and receiver of the cash, a description of the transaction, and information about any other parties involved

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov7

Footnotes and Sources

1. The Wall Street Journal, August 30, 2024

2. Investing.com, August 30, 2024

3. CNBC.com, August 28, 2024

4. The Wall Street Journal, August 30, 2024

5. The Wall Street Journal, August 29, 2024

6. CNBC.com, August 30, 2024

7. IRS.gov, May 8. 2024

Stock market calendar this week:

| Time (ET) | Report |

| MONDAY, SEPT. 2 | |

| Labor Day holiday, none scheduled | |

| TUESDAY, SEPT. 3 | |

| 9:45 AM | S&P final U.S. manufacturing PMI |

| 10:00 AM | Construction spending |

| 10:00 AM | ISM manufacturing |

| WEDNESDAY, SEPT. 4 | |

| 8:30 AM | U.S. trade deficit |

| 10:00 AM | Job openings |

| 10:00 AM | Factory orders |

| 2:00 PM | Fed Beige Book |

| TBA | Auto sales |

| THURSDAY, SEPT. 5 | |

| 8:15 AM | ADP employment |

| 8:30 AM | Initial jobless claims |

| 8:30 AM | U.S. productivity (revision) |

| 9:45 AM | S&P final U.S. services PMI |

| 10:00 AM | ISM services |

| FRIDAY, SEPT. 6 | |

| 8:30 AM | U.S. employment report |

| 8:30 AM | U.S. unemployment rate |

| 8:30 AM | U.S. hourly wages |

| 8:30 AM | Hourly wages year over year |

| 8:45 AM | New York Fed President Williams speaks |

| 11:00 AM | Fed Gov. Christopher Waller speaks |

Most anticipated earnings for this week:

Did you miss our last blog?

About Amit: I am a first generation American, the son of a working-class Indian family, and I lived through my parents’ struggle to find their place in this country, to put down roots that would sustain them as well as their children in a new land. As they encouraged me to excel in school and fostered my hobbies and interests, I was keenly aware of the dynamic between them. I understood that there was a difference between where they came from individually and where we were now. They worked hard in their individual capacities, but they weren’t always on the same page about financial issues – and that can make or break a family’s future. I didn’t know it at the time, but this laid the groundwork for my passion towards financial services and helping families succeed.